Question

Business Consultation: Talking GAAP A good friend of yours inherited the family business (a local grocery store) and just received a set of financial statements

Business Consultation: Talking GAAP A good friend of yours inherited the family business (a local grocery store) and just received a set of financial statements (Balance Sheet and Income statement). These were prepared by the same accountant who has done the accounting for years. Your friend has forwarded the statements to you along with a note expressing her concerns about certain items on the statements. Shes asking you to go to the accountant and find out whats wrong with the books. Directions: 1. Read through the letter from Jill. 2. Using the statements provided explain to Jill why the reports are properly prepared under US GAAP. Include the accounting assumption, principle, or constraint as applicable in your answer.

Dear Jack,

It was good talking to you yesterday. Can you believe the summer is over? Here are the copies of reports on my familys grocery store I just received from the accountant. I sure need your help because I can never understand what those bean counters are trying to say.

Ive put together a list of some issues my brothers have with what the accountant is doing. We think there may be some BIG problems with the books. Could you please talk to him and find out what is happening?

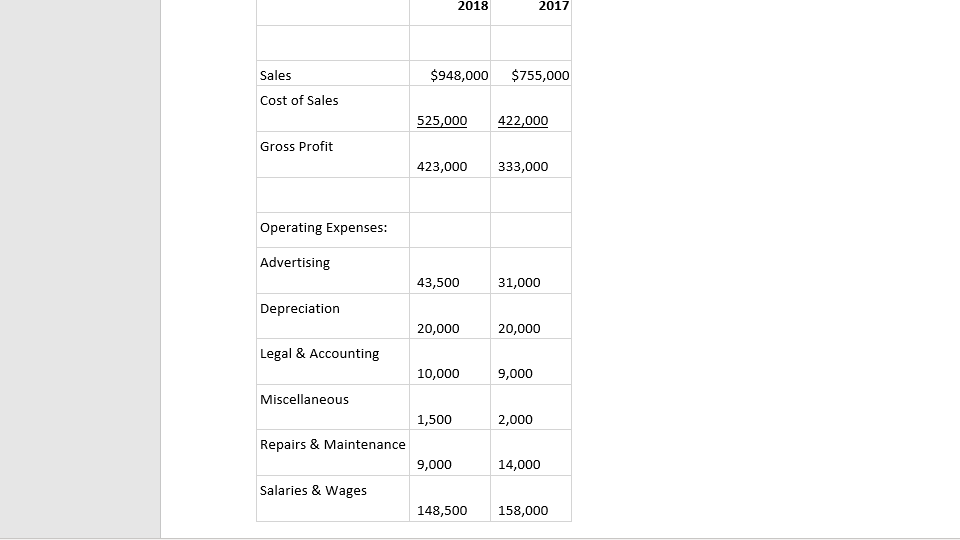

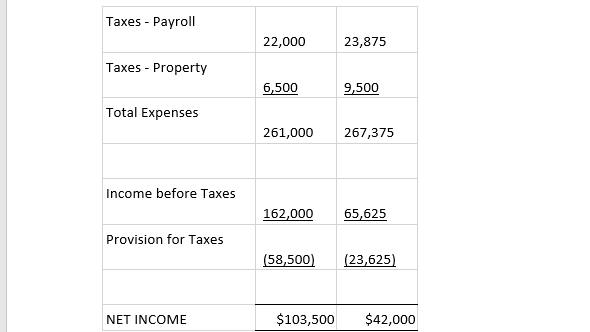

- What happened to the cash? How can we have net income and yet have the cash decrease? Is someone pocketing our cash?

- What about all the investments my father owned? I know he bought a variety of stocks with money he made from the business. Why dont any investments show up on these reports? 3. I also know our store is located on very valuable property. The land was appraised at over $500,000 just six months ago. Why does the accountant only show it at $50,000? Did he just drop a 0?

- One of the large expenses on the income statement is for depreciation, but we never authorized a check for that amount. And all our equipment is paid for, so this really looks bad.

- What about the mortgage owed to the bank? We make monthly payments of $750 and there are 10 years left to pay. The amount on the report is lower than the total remaining payments, so this needs correcting.

I have some other minor questions, but if you can get the accountant to fix these big mistakes (and find out if he even knows what hes doing), that would be a big help! Call me if you want to go over any of these in more detail. Again, thanks for being the go-between. (You were always so good at accounting!) Your friend,

Jill

income statement

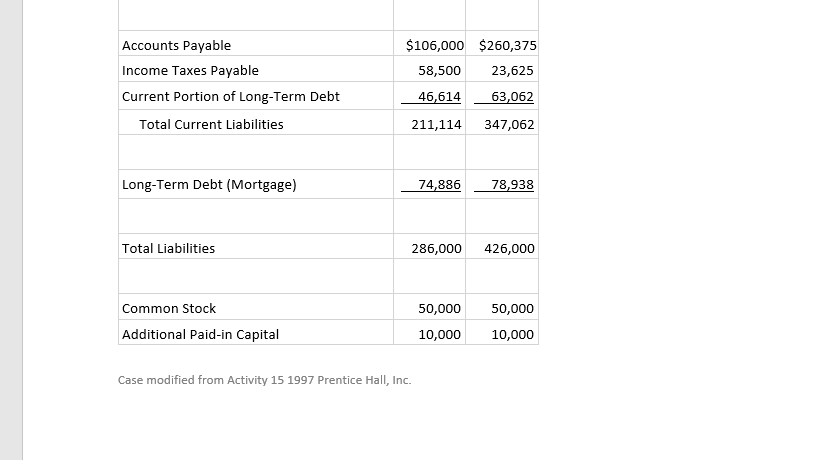

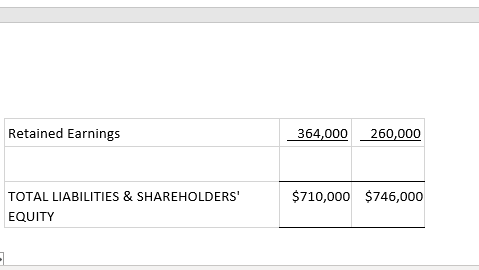

balance statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started