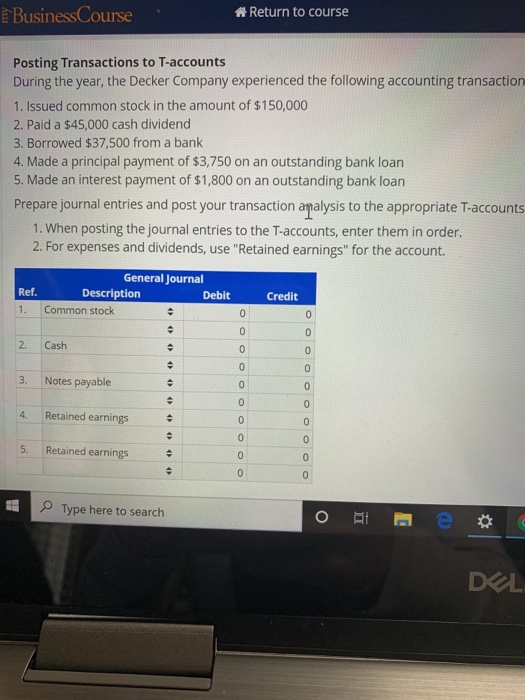

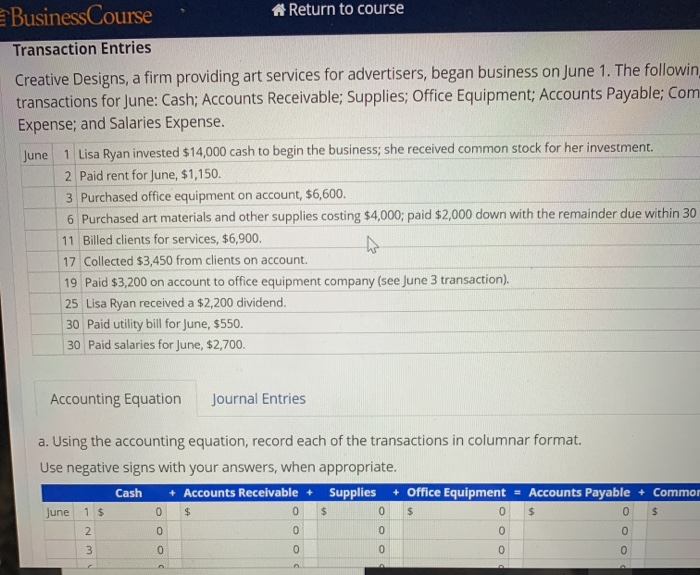

Business Course Return to course Posting Transactions to T-accounts During the year, the Decker Company experienced the following accounting transaction 1. Issued common stock in the amount of $150,000 2. Paid a $45,000 cash dividend 3. Borrowed $37,500 from a bank 4. Made a principal payment of $3,750 on an outstanding bank loan 5. Made an interest payment of $1,800 on an outstanding bank loan Prepare journal entries and post your transaction analysis to the appropriate T-accounts 1. When posting the journal entries to the T-accounts, enter them in order. 2. For expenses and dividends, use "Retained earnings" for the account. General Journal Description Debit Credit Ref. 1 Common stock 0 0 2. Cash OOOO 0 3. Notes payable 0 OOOO 0 4. Retained earnings 0 5. Retained earnings OOOO 0 0 Type here to search e DEL Business Course Return to course Transaction Entries Creative Designs, a firm providing art services for advertisers, began business on June 1. The followin transactions for June: Cash; Accounts Receivable; Supplies; Office Equipment; Accounts Payable; Com Expense; and Salaries Expense. June 1 Lisa Ryan invested $14,000 cash to begin the business; she received common stock for her investment. 2 Paid rent for June, $1,150. 3 Purchased office equipment on account, $6,600. 6 Purchased art materials and other supplies costing $4,000; paid $2,000 down with the remainder due within 30 11 Billed clients for services, $6,900. 17 Collected $3,450 from clients on account. 19 Paid $3,200 on account to office equipment company (see June 3 transaction). 25 Lisa Ryan received a $2,200 dividend. 30 Paid utility bill for June, $550. 30 Paid salaries for June, $2,700. Accounting Equation Journal Entries a. Using the accounting equation, record each of the transactions in columnar format. Use negative signs with your answers, when appropriate. Cash + Accounts Receivable + Supplies + Office Equipment = Accounts Payable + Commor June 0 $ 0 2 1 $ 0 $ $ 0 $ 0 $ OO 0 0 0 0 3 0 0 0 0 0 Business Course Return to course Posting Transactions to T-accounts During the year, the Decker Company experienced the following accounting transaction 1. Issued common stock in the amount of $150,000 2. Paid a $45,000 cash dividend 3. Borrowed $37,500 from a bank 4. Made a principal payment of $3,750 on an outstanding bank loan 5. Made an interest payment of $1,800 on an outstanding bank loan Prepare journal entries and post your transaction analysis to the appropriate T-accounts 1. When posting the journal entries to the T-accounts, enter them in order. 2. For expenses and dividends, use "Retained earnings" for the account. General Journal Description Debit Credit Ref. 1 Common stock 0 0 2. Cash OOOO 0 3. Notes payable 0 OOOO 0 4. Retained earnings 0 5. Retained earnings OOOO 0 0 Type here to search e DEL Business Course Return to course Transaction Entries Creative Designs, a firm providing art services for advertisers, began business on June 1. The followin transactions for June: Cash; Accounts Receivable; Supplies; Office Equipment; Accounts Payable; Com Expense; and Salaries Expense. June 1 Lisa Ryan invested $14,000 cash to begin the business; she received common stock for her investment. 2 Paid rent for June, $1,150. 3 Purchased office equipment on account, $6,600. 6 Purchased art materials and other supplies costing $4,000; paid $2,000 down with the remainder due within 30 11 Billed clients for services, $6,900. 17 Collected $3,450 from clients on account. 19 Paid $3,200 on account to office equipment company (see June 3 transaction). 25 Lisa Ryan received a $2,200 dividend. 30 Paid utility bill for June, $550. 30 Paid salaries for June, $2,700. Accounting Equation Journal Entries a. Using the accounting equation, record each of the transactions in columnar format. Use negative signs with your answers, when appropriate. Cash + Accounts Receivable + Supplies + Office Equipment = Accounts Payable + Commor June 0 $ 0 2 1 $ 0 $ $ 0 $ 0 $ OO 0 0 0 0 3 0 0 0 0 0