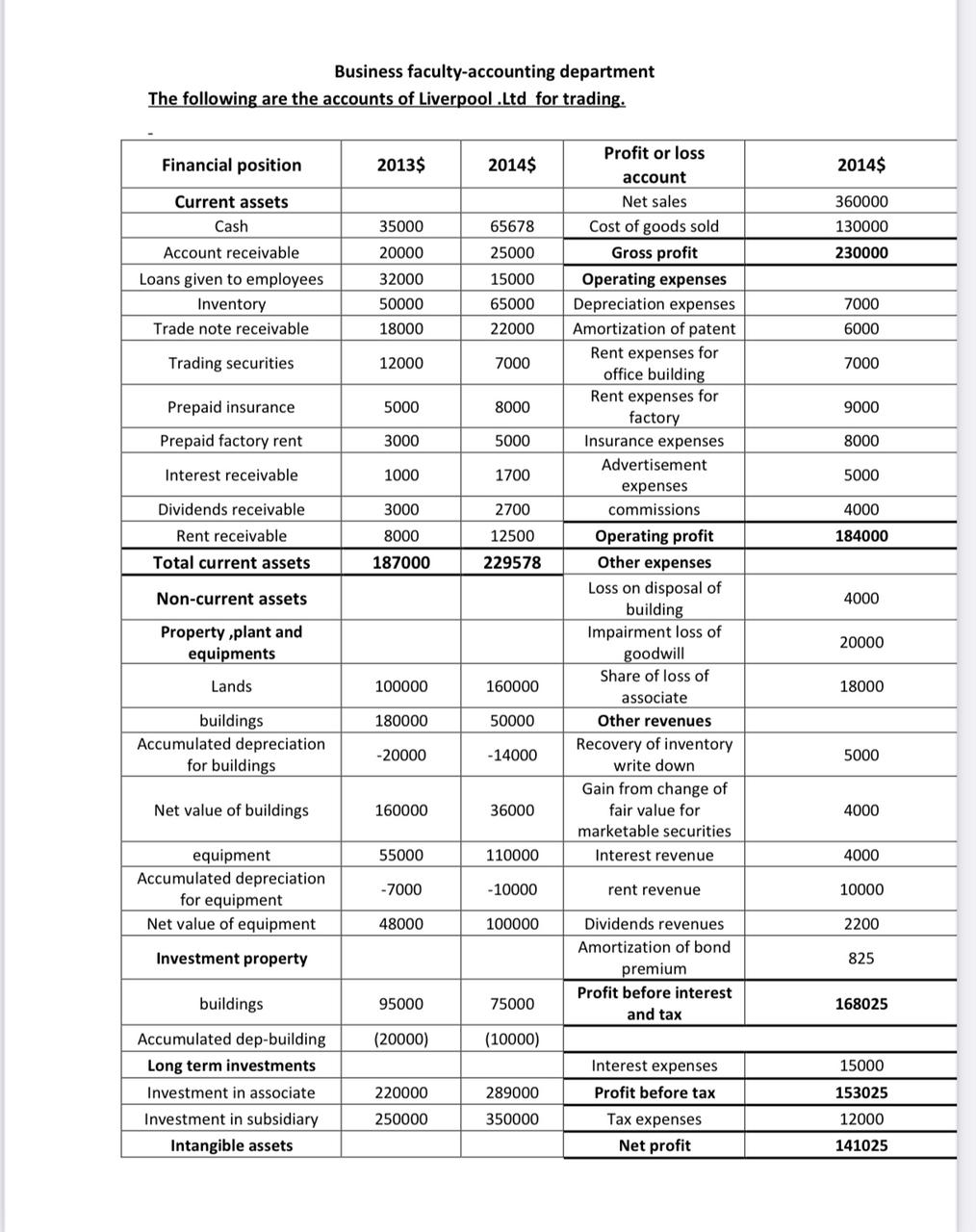

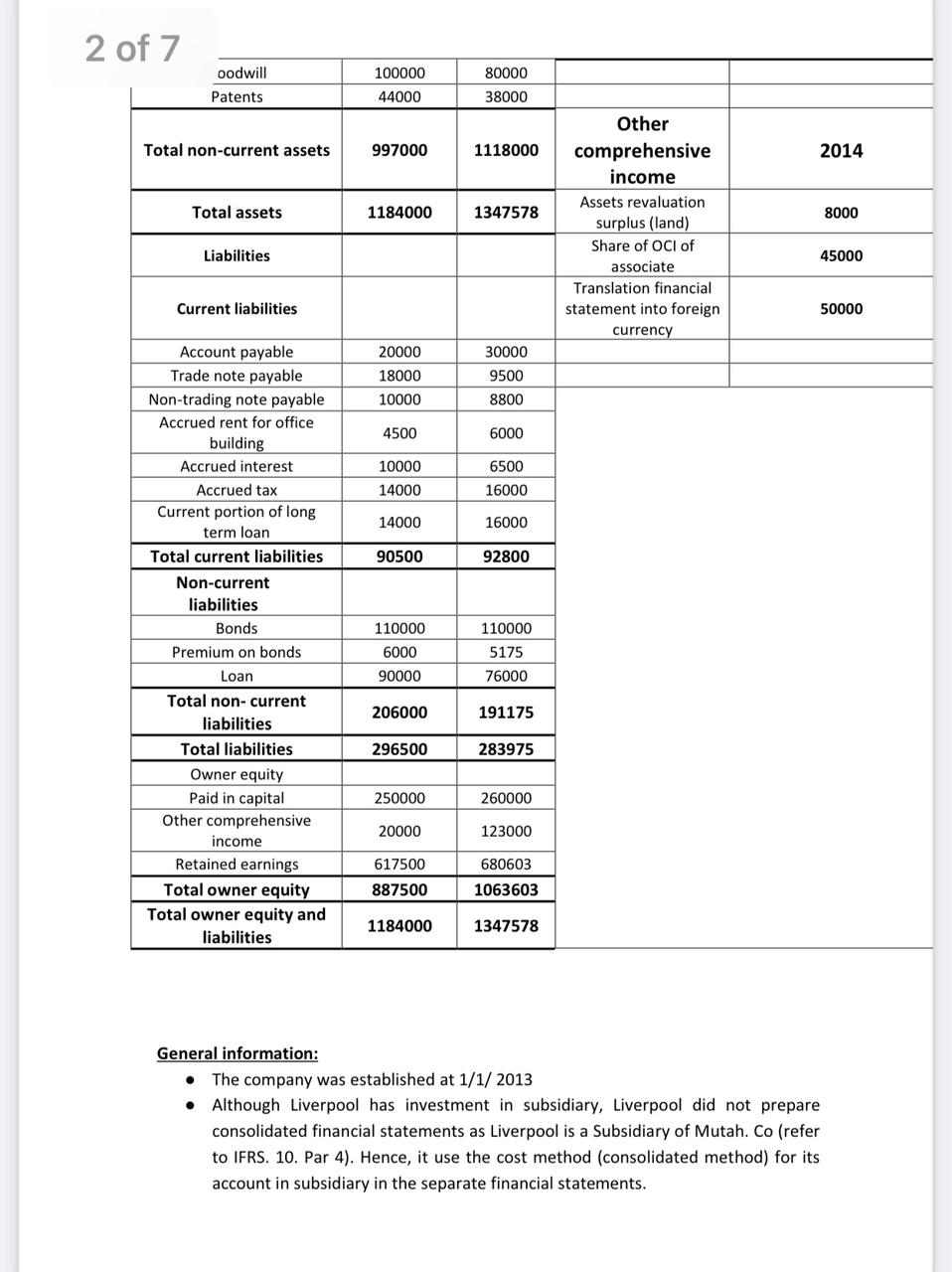

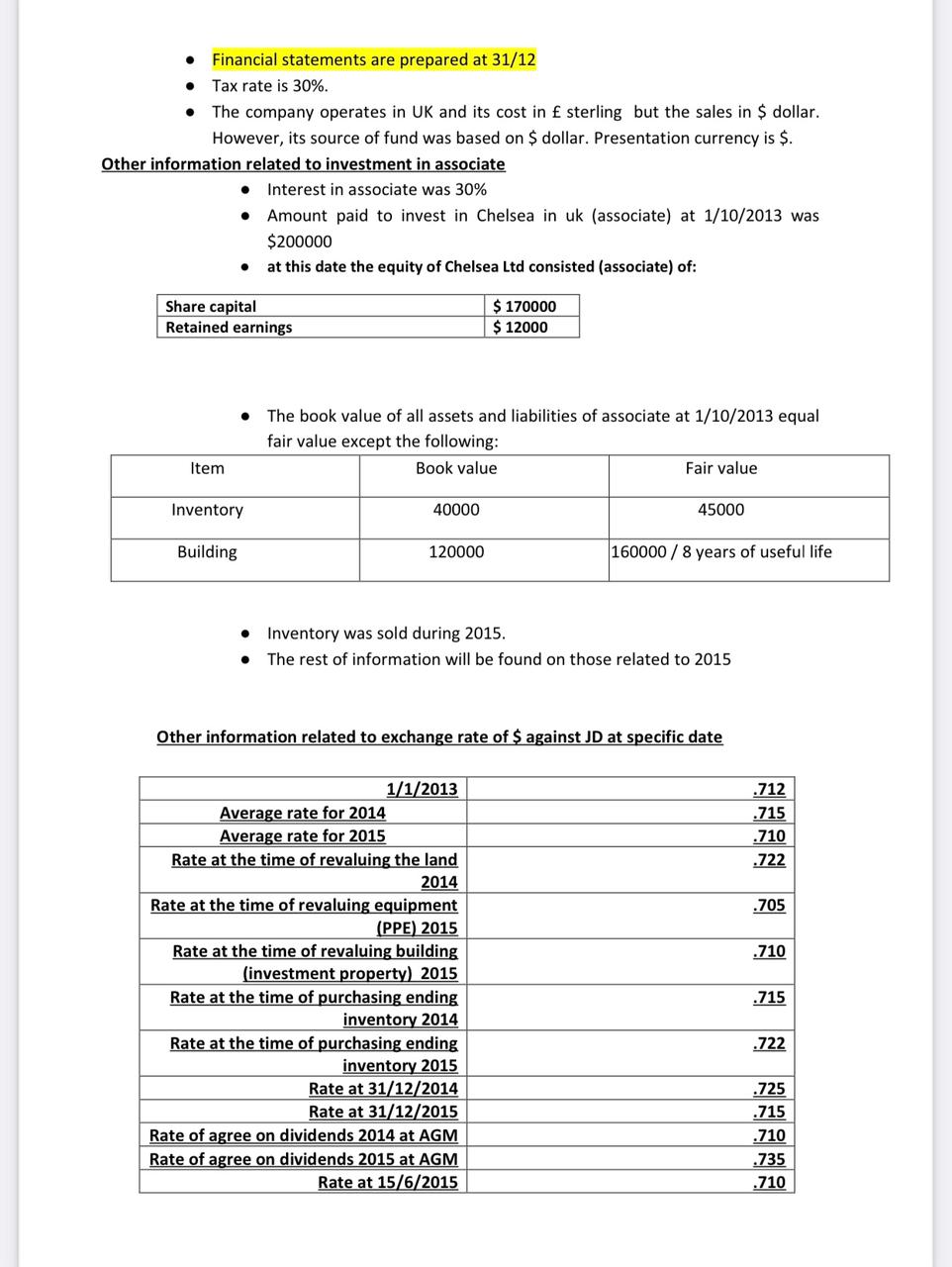

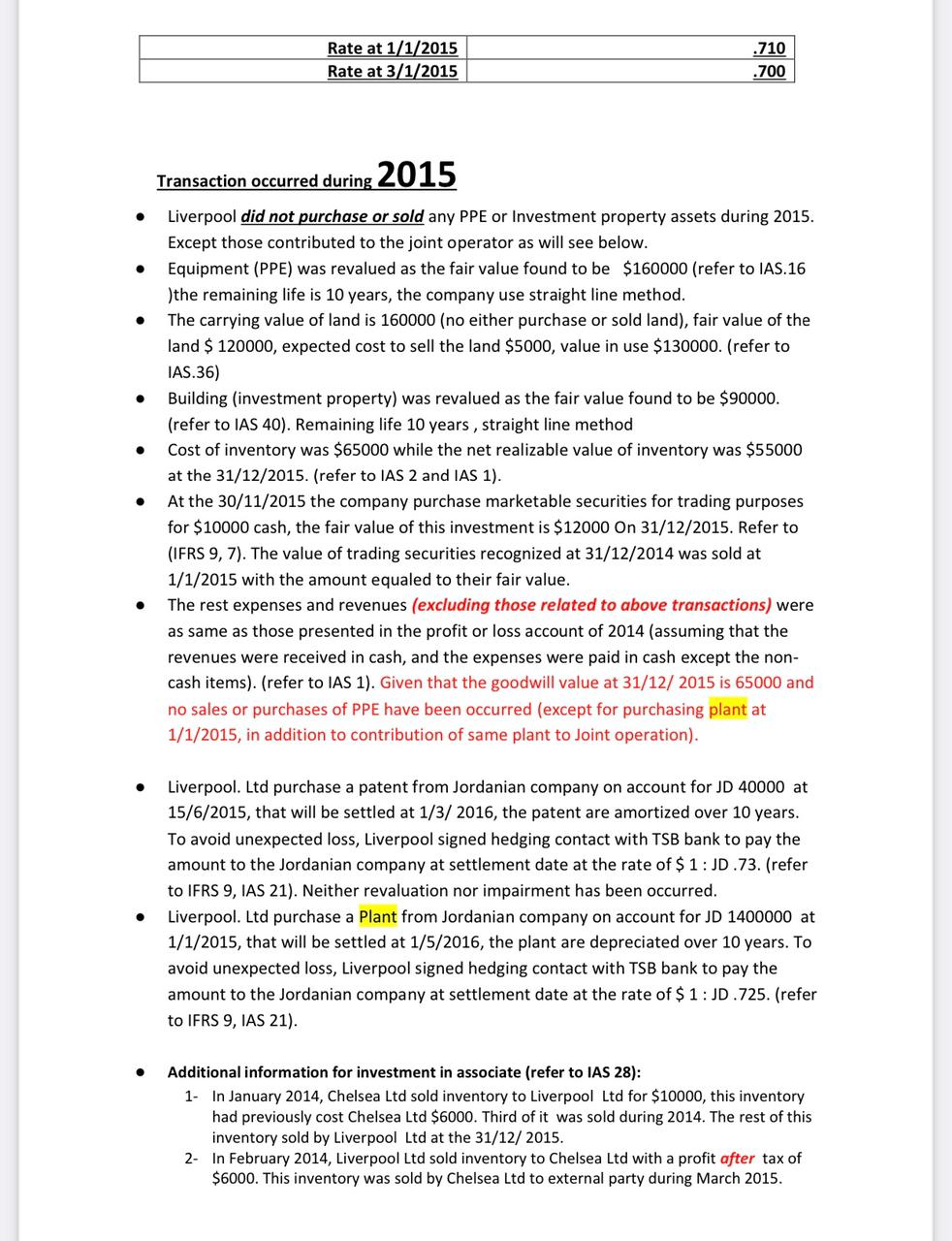

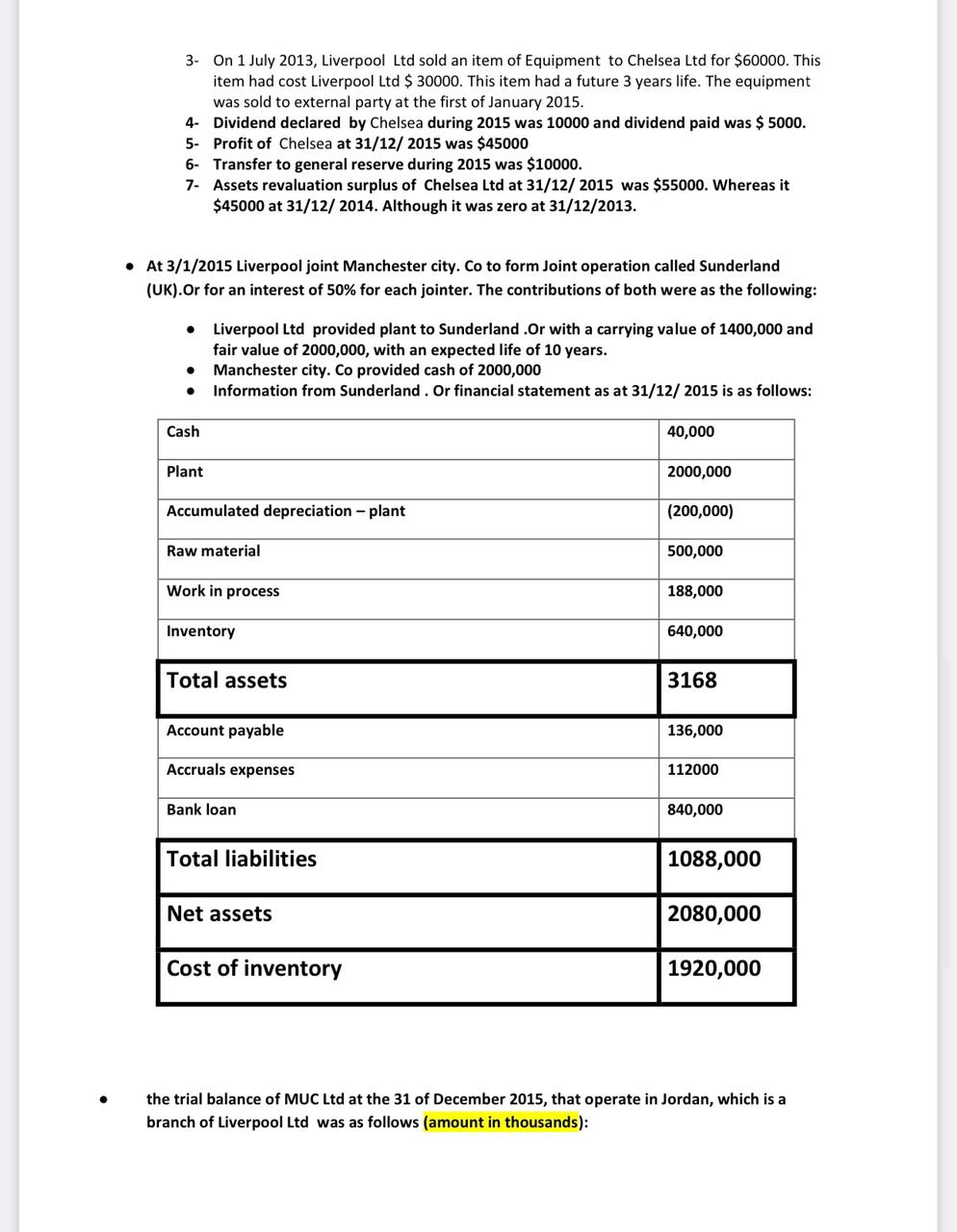

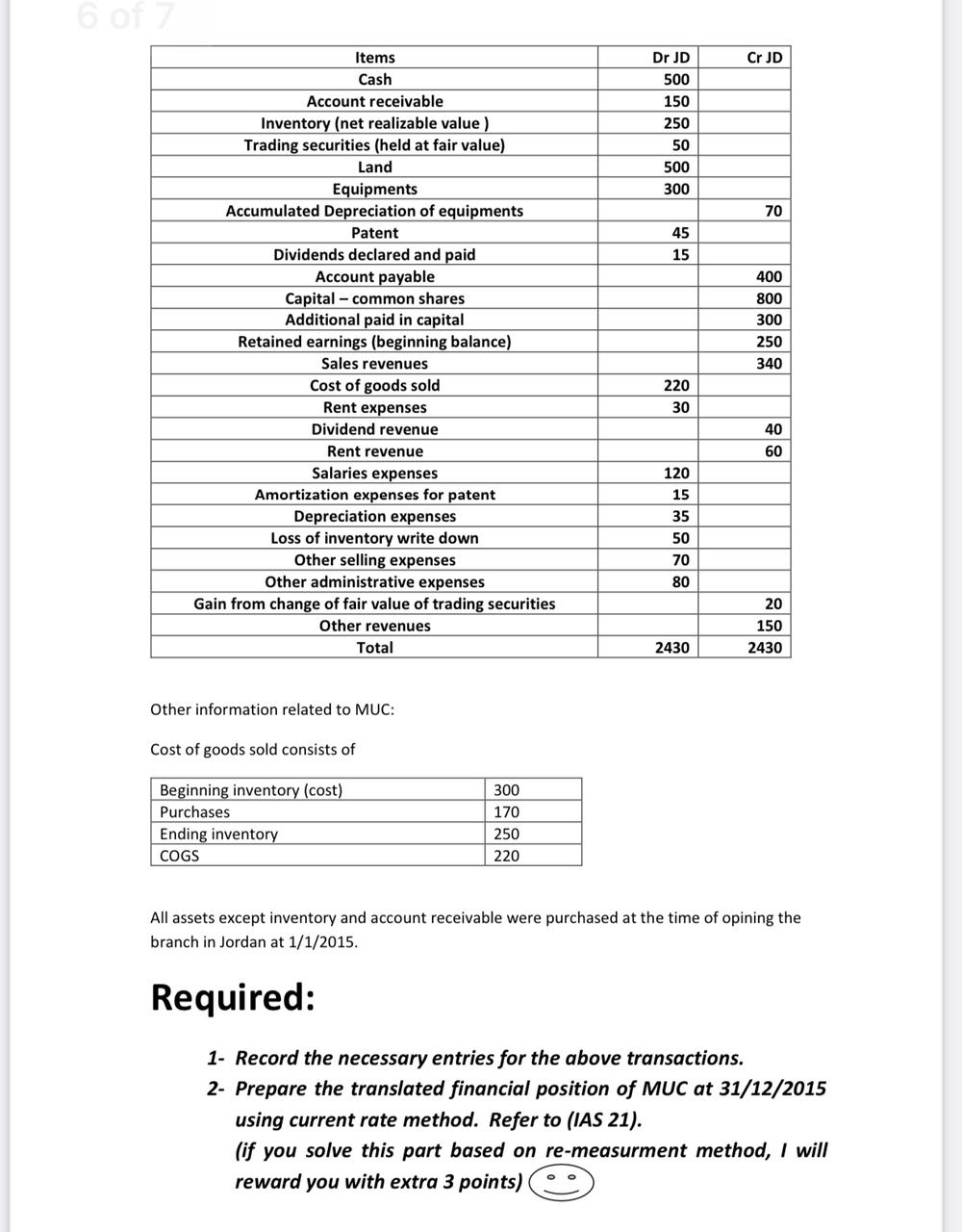

Business faculty-accounting department The following are the accounts of Liverpool .Ltd for trading. Profit or loss Financial position 2013$ 2014$ 2014$ account Current assets Net sales 360000 Cash 35000 65678 Cost of goods sold 130000 Account receivable 20000 25000 Gross profit 230000 Loans given to employees 32000 15000 Operating expenses Inventory 50000 65000 Depreciation expenses 7000 Trade note receivable 18000 22000 Amortization of patent 6000 Rent expenses for Trading securities 12000 7000 7000 office building Rent expenses for Prepaid insurance 5000 8000 9000 actory Prepaid factory rent 3000 5000 Insurance expenses 8000 Interest receivable 1700 Advertisement 1000 5000 expenses Dividends receivable 3000 2700 commissions 4000 Rent receivable 8000 12500 Operating profit 184000 Total current assets 187000 229578 Other expenses Loss on disposal of Non-current assets 4000 building Property , plant and Impairment loss of 20000 equipments goodwill Share of loss of Lands 100000 160000 18000 associate buildings 180000 50000 Other revenues Accumulated depreciation Recovery of inventory 20000 14000 5000 for buildings write down Gain from change of Net value of buildings 160000 36000 fair value for 4000 marketable securities equipment 55000 110000 Interest revenue 4000 Accumulated depreciation -7000 10000 rent revenue 10000 for equipment Net value of equipment 48000 100000 Dividends revenues 2200 Amortization of bond Investment property 825 premium Profit before interest buildings 95000 75000 168025 and tax Accumulated dep-building (20000) (10000) Long term investments Interest expenses 5000 Investment in associate 220000 289000 Profit before tax 153025 Investment in subsidiary 250000 350000 Tax expenses 12000 Intangible assets Net profit 1410252 of 7 oodwill 100000 80000 Patents 44000 38000 Other Total non-current assets 997000 1118000 comprehensive 2014 income 1184000 1347578 Assets revaluation Total assets 8000 surplus (land) Share of OCI of Liabilities 45000 associate Translation financial Current liabilities statement into foreign 50000 currency Account payable 20000 30000 Trade note payable 18000 950 Non-trading note payable 10000 800 Accrued rent for office 4500 6000 building Accrued interest 10000 6500 Accrued tax 14000 16000 Current portion of long 14000 16000 term loan Total current liabilities 90500 92800 Non-current liabilities Bonds 110000 110000 Premium on bonds 5000 5175 Loan 90000 76000 Total non- current 206000 191175 iabilities Total liabilities 296500 283975 Owner equity Paid in capital 250000 260000 Other comprehensive 20000 123000 ncome Retained earnings 617500 80603 Total owner equity 887500 1063603 Total owner equity and 1184000 1347578 liabilities General information: The company was established at 1/1/ 2013 . Although Liverpool has investment in subsidiary, Liverpool did not prepare consolidated financial statements as Liverpool is a Subsidiary of Mutah. Co (refer to IFRS. 10. Par 4). Hence, it use the cost method (consolidated method) for its account in subsidiary in the separate financial statements.Financial statements are prepared at 31/12 Tax rate is 30%. . . The company operates in UK and its cost in f sterling but the sales in $ dollar. However, its source of fund was based on $ dollar. Presentation currency is $. Other information related to investment in associate . Interest in associate was 30% . Amount paid to invest in Chelsea in uk (associate) at 1/10/2013 was $200000 at this date the equity of Chelsea Ltd consisted (associate) of: Share capital $ 170000 Retained earnings $ 12000 . The book value of all assets and liabilities of associate at 1/10/2013 equal fair value except the following: Item Book value Fair value Inventory 40000 45000 Building 120000 160000 / 8 years of useful life Inventory was sold during 2015. . The rest of information will be found on those related to 2015 Other information related to exchange rate of $ against JD at specific date 1/1/2013 .712 Average rate for 2014 .715 Average rate for 2015 .710 Rate at the time of revaluing the land 722 2014 Rate at the time of revaluing equipment .705 (PPE) 2015 Rate at the time of revaluing building 710 (investment property) 2015 Rate at the time of purchasing ending .715 inventory 2014 Rate at the time of purchasing ending 722 inventory 2015 Rate at 31/12/2014 .725 Rate at 31/12/2015 715 Rate of agree on dividends 2014 at AGM 710 Rate of agree on dividends 2015 at AGM 735 Rate at 15/6/2015 .710Rate at 1 2015 m Rate at 3 2015 .700 Transaction occurred during 20 15 Liverpool did not purchase or sold any PPE or investment property assets during 2015. Except those contributed to the joint operator as will see beEow. Equipment (PPE) was revalued as the fair value found to be $160000 [refer to M5516 )the remaining life is 10 years, the company use straight line method. The carrying value of land is 160000 [no either purchase or sold land), fair value of the land 5 120000, expected cost to sell the land $5000, value in use $130000. (refer to MESS) Building {investment property} was revaiued as the fair value found to be $90000. (refer to IAS 40). Remaining life 10 years , straight line method Cost of inventory was $65000 while the net realizabie value of inventory was $55000 at the 31/12/'2015. {refer to IAS 2 and MS 1). At the 30/11f2015 the company purchase marketable securities for trading purposes for 310000 cash, the fair vaiue of this investment is 512000 On 31/1212015. Refer to (IFRS 9, 7}. The value of trading securities recognized at 31112I2014 was sold at 11112015 with the amount equaled to their fair value. The rest expenses and revenues (excluding those related to above transactions} were as same as those presented in the profit or loss account of 2014 (aSSuming that the revenues were received in cash, and the expenses were paid in cash except the non- cash items). (refer to IAS 1). Given that the goodwill value at 31f12l 2015 is 65000 and no sales or purchases of PPE have been occurred (except for purchasing plant at 1/1f2015, in addition to contribution of same plant to Joint operation]. Liverpool. Ltd purchase a patent from Jordanian company on account for JD 40000 at 15f6f2015, that will be settled at 1/3,! 2016, the patent are amortized over 10 years. To avoid unexpected loss, Liverpool signed hedging contact with TSB bank to pay the amount to the Jordanian company at settlement date at the rate of 5 1 : JD .73. [refer to IFRS 9, IAS 21). Neither revaluation nor impairment has been occurred. Liverpool. Ltd purchase a Plant from Jordanian company on account for JD 1400000 at 1f112015, that will be settled at 1l5l2016, the plant are depreciated over 10 years. To avoid unexpected loss. Liverpool signed hedging contact with TSB bank to pay the amount to the Jordanian company at settlement date at the rate of 5 1 : JD .725. (refer to IFRS 9, IAS 21). Additional information for investment in associate [refer to MS 28}: 1- In January 2014, Chelsea Ltd sold inventory to Liverpool Ltd for 510000, this inventory had previously cost Chelsea Ltd $6000. Third of it was soid during 2014. The rest of this inventory sold by Liverpool Ltd at the 31112! 2015. 2- In February 2014, Liverpool Ltd sold inventory to Chelsea Ltd with a prot after tax of $6000. This inventory was sold by Chelsea Ltd to external party during March 2015. 3- On 1 July 2013, Liverpool Lid sold an item of Equipment to Chelsea Lid for $60000. This item had cost Liverpool Ltd $ 30000. This item had a future 3 years life. The equipment was sold to external party at the first of January 2015. 4- Dividend declared by Chelsea during 2015 was 10000 and dividend paid was $ 5000. 5- Profit of Chelsea at 31/12/ 2015 was $45000 6- Transfer to general reserve during 2015 was $10000. 7- Assets revaluation surplus of Chelsea Ltd at 31/12/ 2015 was $55000. Whereas it $45000 at 31/12/ 2014. Although it was zero at 31/12/2013. At 3/1/2015 Liverpool joint Manchester city. Co to form Joint operation called Sunderland (UK).Or for an interest of 50% for each jointer. The contributions of both were as the following: . Liverpool Ltd provided plant to Sunderland .Or with a carrying value of 1400,000 and fair value of 2000,000, with an expected life of 10 years. . Manchester city. Co provided cash of 2000,000 . Information from Sunderland . Or financial statement as at 31/12/ 2015 is as follows: Cash 40,000 Plant 2000,000 Accumulated depreciation - plant (200,000) Raw material 500,000 Work in process 188,000 Inventory 640,000 Total assets 3168 Account payable 136,000 Accruals expenses 112000 Bank loan 840,000 Total liabilities 1088,000 Net assets 2080,000 Cost of inventory 1920,000 the trial balance of MUC Ltd at the 31 of December 2015, that operate in Jordan, which is a branch of Liverpool Lid was as follows (amount in thousands):6 of Items Dr JD Cr JD Cash 500 Account receivable 150 Inventory (net realizable value ) 250 Trading securities (held at fair value) 50 Land 500 Equipments 300 Accumulated Depreciation of equipments 70 Patent 45 Dividends declared and paid 15 Account payable 400 Capital - common shares 800 Additional paid in capital 300 Retained earnings (beginning balance) 250 Sales revenues 340 Cost of goods sold 220 Rent expenses 30 Dividend revenue 40 Rent revenue 60 Salaries expenses 120 Amortization expenses for patent 15 Depreciation expenses 35 Loss of inventory write down 50 Other selling expenses 70 Other administrative expenses 80 Gain from change of fair value of trading securities 20 Other revenues 150 Total 2430 2430 Other information related to MUC: Cost of goods sold consists of Beginning inventory (cost) 300 Purchases 170 Ending inventory 250 COGS 220 All assets except inventory and account receivable were purchased at the time of opining the branch in Jordan at 1/1/2015. Required: 1- Record the necessary entries for the above transactions. 2- Prepare the translated financial position of MUC at 31/12/2015 using current rate method. Refer to (IAS 21). (if you solve this part based on re-measurment method, I will reward you with extra 3 points) (- .3- Prepared the financial statements of Liverpool at the 31/12/2015. 4- Translate the financial statements of Liverpool. Ltd into foreign currency using current method as required by Mutah. Co (that is a parent company for Liverpool), Mutah operates in Jordan with functional currency of JD