Answered step by step

Verified Expert Solution

Question

1 Approved Answer

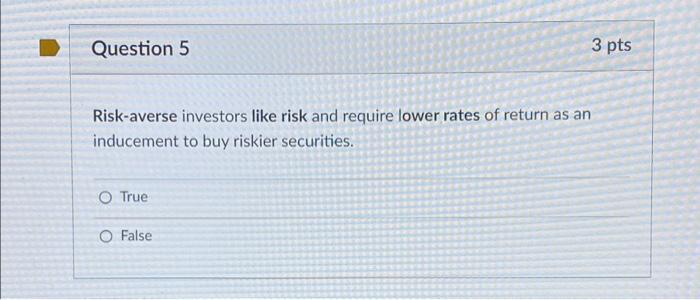

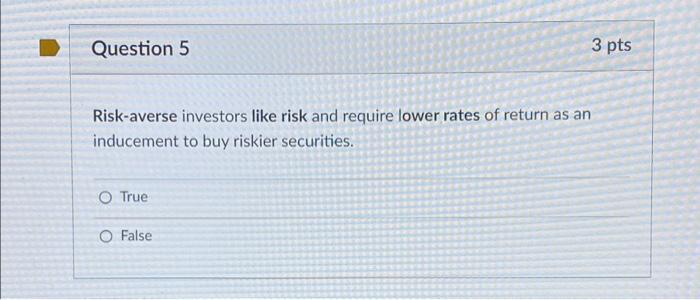

Business Finance Question 5 3 pts Risk-averse investors like risk and require lower rates of return as an inducement to buy riskier securities. O True

Business Finance

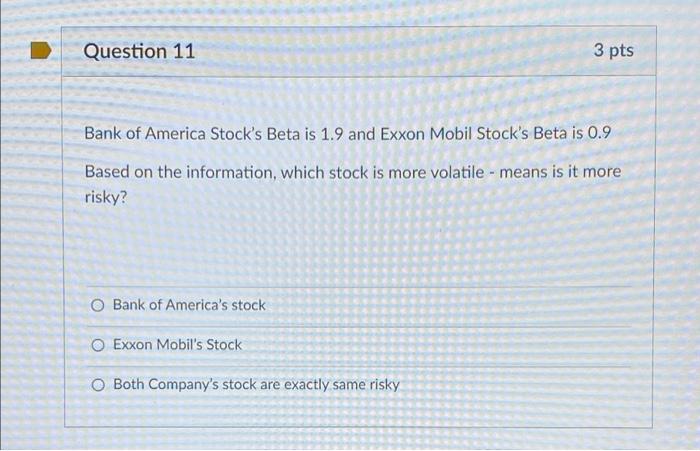

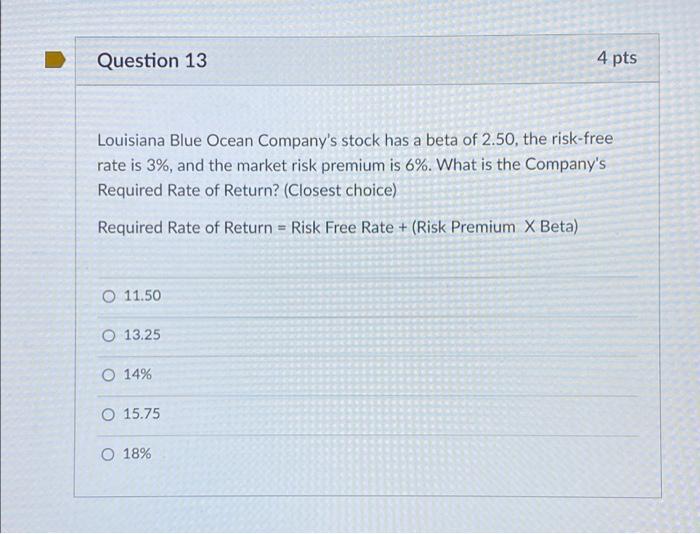

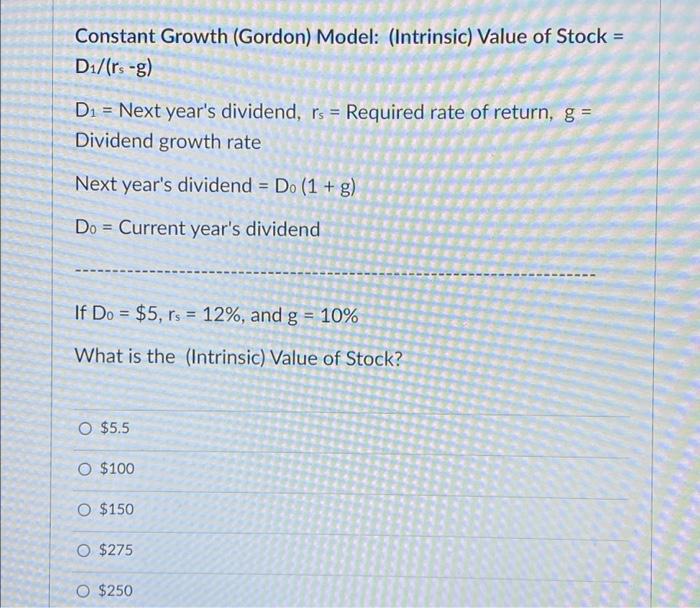

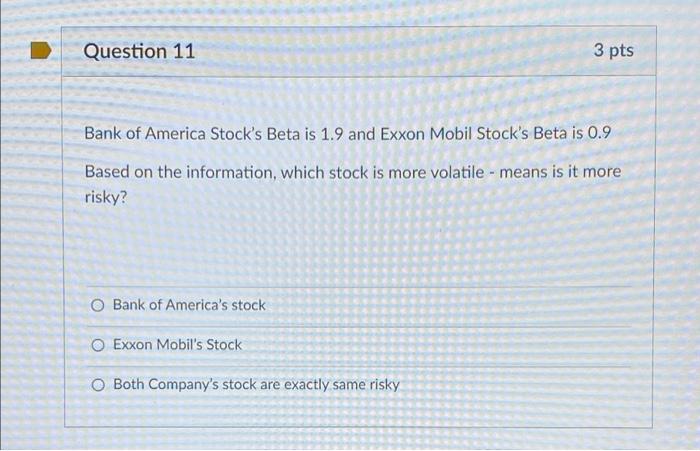

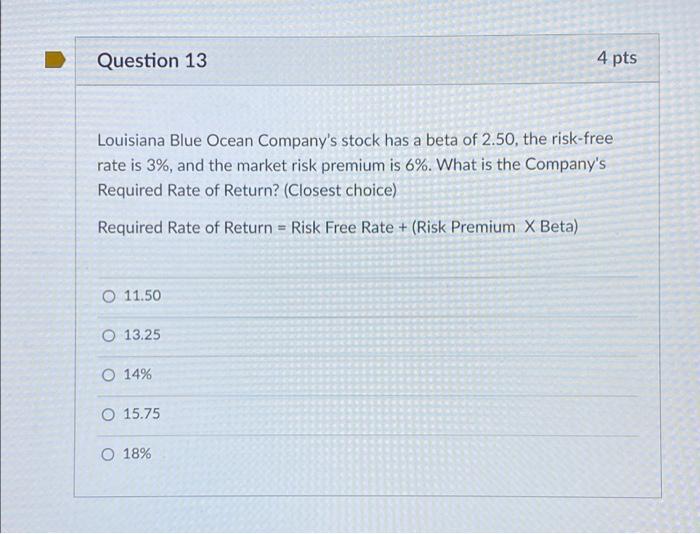

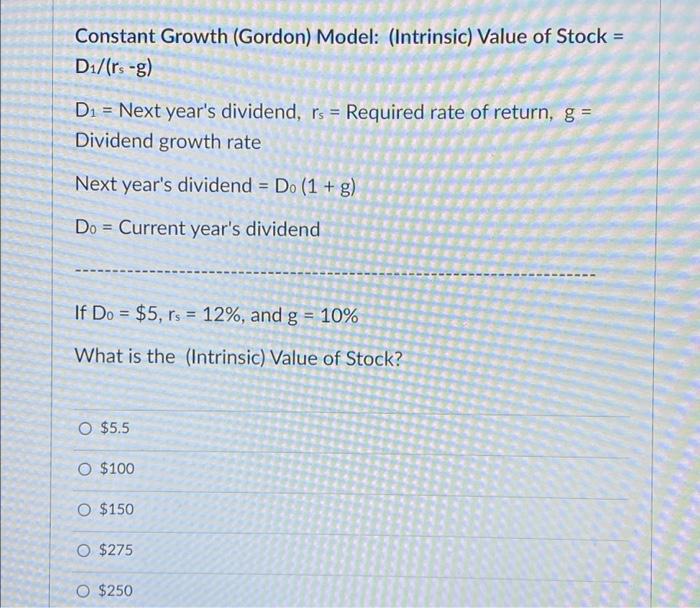

Question 5 3 pts Risk-averse investors like risk and require lower rates of return as an inducement to buy riskier securities. O True O False Question 11 3 pts Bank of America Stock's Beta is 1.9 and Exxon Mobil Stock's Beta is 0.9 Based on the information, which stock is more volatile - means is it more risky? O Bank of America's stock O Exxon Mobil's Stock O Both Company's stock are exactly same risky Question 13 4 pts Louisiana Blue Ocean Company's stock has a beta of 2.50, the risk-free rate is 3%, and the market risk premium is 6%. What is the Company's Required Rate of Return? (Closest choice) Required Rate of Return = Risk Free Rate + (Risk Premium X Beta) O 11.50 O 13.25 O 14% O 15.75 O 18% Constant Growth (Gordon) Model: (Intrinsic) Value of Stock = D/(rs-g) D1 = Next year's dividend, rs = Required rate of return, g = Dividend growth rate Next year's dividend = D. (1 + g) - Do = Current year's dividend If Do = $5, rs = 12%, and g = 10% - What is the (Intrinsic) Value of Stock? O $5.5 O $100 O $150 O $275 O $250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started