Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BUSINESS FINANCE - RETIREMENT INCOME PROBLEM Retirement income problem. I have a tax client who retired recently and just reached 70.5 years of age (during

BUSINESS FINANCE - RETIREMENT INCOME PROBLEM

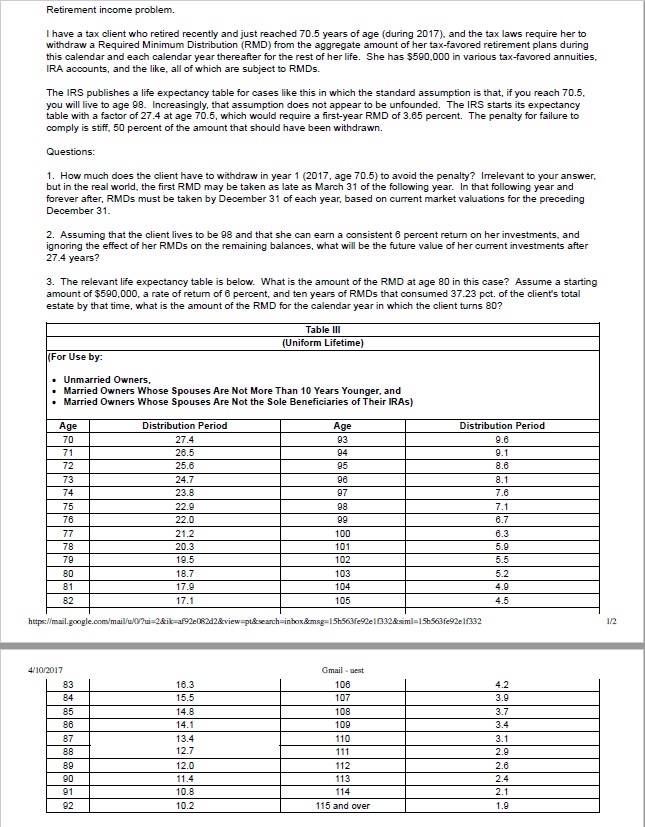

Retirement income problem. I have a tax client who retired recently and just reached 70.5 years of age (during 2017), and the tax laws require her to withdraw a Required Minimum Distribution (RMD) from the aggregate amount of her tax-favored retirement plans during this calendar and each calendar year thereafter for the rest of her life. She has $590.000 in various tax-favored annuities. IRA accounts, and the like, all of which are subject to RMDs. The IRS publishes a life expectancy table for cases like this in which the standard assumption is that, if you reach 70.5, you will live to age 98. Increasingly, that assumption does not appear to be unfounded. The IRS starts its expectancy table with a factor of 27.4 at age 70.5, which would require a first-year RMD of 3.65 percent. The penalty for failure to comply is stiff, 50 percent of the amount that should have been withdrawn. 1. How much does the client have to withdraw in year 1 (2017, age 70.5) to avoid the penalty? irrelevant to your answer, but in the re al world, the first RMD may be taken as late as March 31 of the following year. In that following year and forever after, RMDs must be taken by December 31 of each year, based on current market valuations for the preceding December 31. Assuming that the client lives to be 98 and that she can earn a consistent 8 percent return on her investments, and ignoring the effect of her RMDs on the remaining balances, what will be the future value of her current investments after 27.4 years? The relevant life expectancy table is below. What is the amount of the RMD at age 80 in this case? Assume a starting amount of $590.000, a rate of return of 6 percent, and ten years of RMDs at consumed 37.23 pct. of the client's total estate by that time, what is the amount of the RMD for the calendar year in which the client turns 80? (For Use by: Unmarried owners. Married owners Whose Spouses Are Not More Than 10 Years Younger, and Married owners Whose spouses Are Not the Sole Beneficiaries of Their IRAs)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started