Answered step by step

Verified Expert Solution

Question

1 Approved Answer

business homework** please fill out both tables and answer all questions Jerome's Financial Statement Assessments Students will: (1) analyze financial transactions for its effect on

business homework**

please fill out both tables and answer all questions

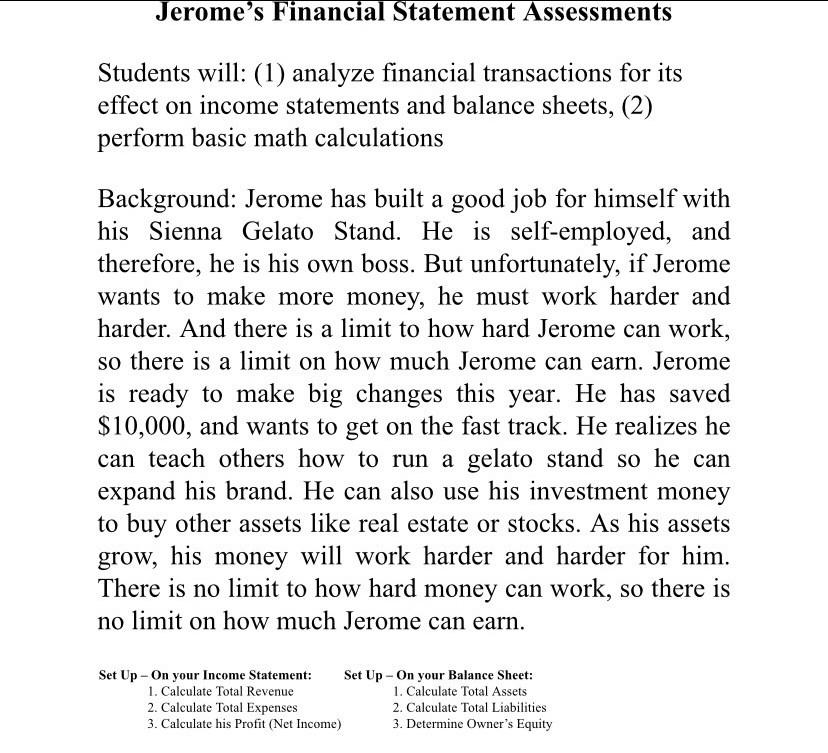

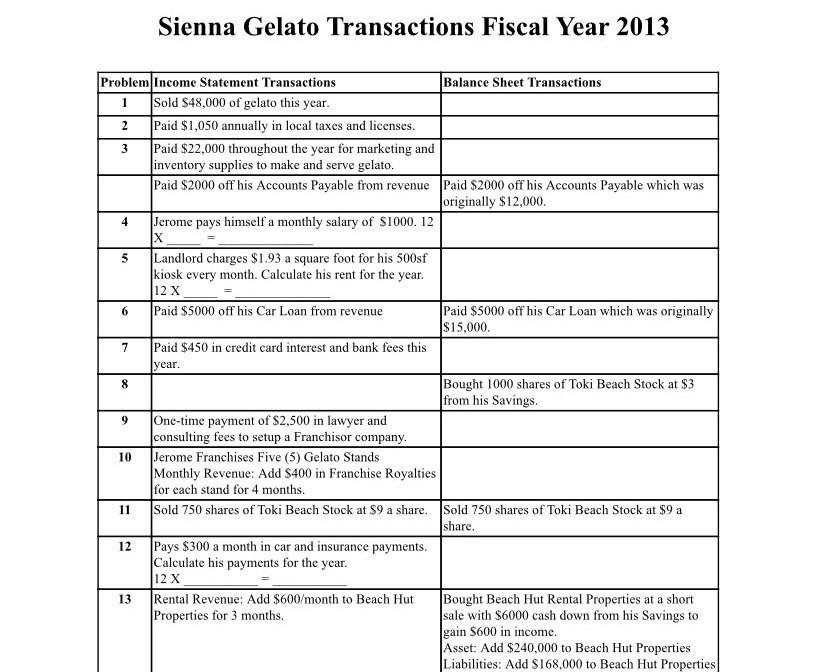

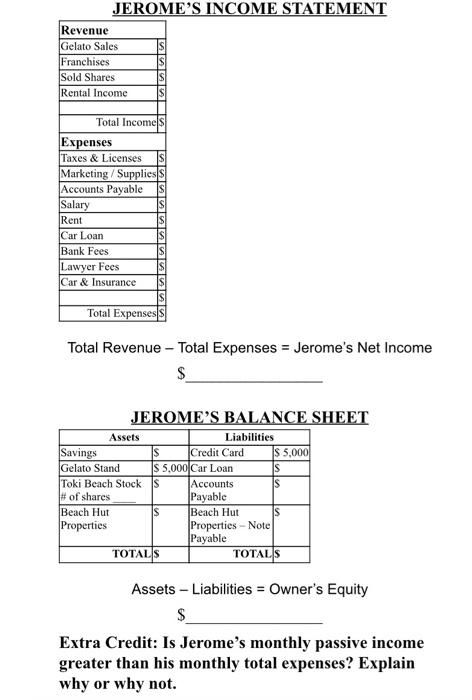

Jerome's Financial Statement Assessments Students will: (1) analyze financial transactions for its effect on income statements and balance sheets, (2) perform basic math calculations Background: Jerome has built a good job for himself with his Sienna Gelato Stand. He is self-employed, and therefore, he is his own boss. But unfortunately, if Jerome wants to make more money, he must work harder and harder. And there is a limit to how hard Jerome can work, so there is a limit on how much Jerome can earn. Jerome is ready to make big changes this year. He has saved $10,000, and wants to get on the fast track. He realizes he can teach others how to run a gelato stand so he can expand his brand. He can also use his investment money to buy other assets like real estate or stocks. As his assets grow, his money will work harder and harder for him. There is no limit to how hard money can work, so there is no limit on how much Jerome can earn. Set Up-On your Income Statement: Set Up-On your Balance Sheet: 1. Calculate Total Revenue 1. Calculate Total Assets 2. Calculate Total Expenses 2. Calculate Total Liabilities 3. Calculate his Profit (Net Income) 3. Determine Owner's Equity Sienna Gelato Transactions Fiscal Year 2013 Problem Income Statement Transactions Balance Sheet Transactions 1 Sold $48,000 of gelato this year. 2 Paid $1,050 annually in local taxes and licenses. 3 Paid $22,000 throughout the year for marketing and inventory supplies to make and serve gelato. Paid $2000 off his Accounts Payable from revenue Paid $2000 off his Accounts Payable which was originally $12,000. 4 Jerome pays himself a monthly salary of S1000. 12 X Landlord charges $1.93 a square foot for his 500sf kiosk every month. Calculate his rent for the year. 12 X Paid $5000 off his Car Loan from revenue Paid $5000 off his Car Loan which was originally $15,000. 7 Paid $450 in credit card interest and bank fees this 5 6 year. 8 9 10 11 Bought 1000 shares of Toki Beach Stock at $3 from his Savings. One-time payment of $2,500 in lawyer and consulting fees to setup a Franchisor company. Jerome Franchises Five (5) Gelato Stands Monthly Revenue: Add S400 in Franchise Royalties for each stand for 4 months. Sold 750 shares of Toki Beach Stock at $9 a share. Sold 750 shares of Toki Beach Stock at $9 a share. Pays $300 a month in car and insurance payments. Calculate his payments for the year. 12 X Rental Revenue: Add $600/month to Beach Hut Bought Beach Hut Rental Properties at a short Properties for 3 months. sale with $6000 cash down from his Savings to gain 5600 in income. Asset: Add $240,000 to Beach Hut Properties Liabilities: Add S168,000 to Beach Hut Properties 12 13 JEROME'S INCOME STATEMENT Revenue Gelato Sales S Franchises Sold Shares Rental Income Total Incomes Expenses Taxes & Licenses Is Marketing / Supplies Accounts Payable Salary Rent Car Loan Bank Fees Lawyer Fees Car & Insurance Total Expenses Total Revenue - Total Expenses = Jerome's Net Income $ JEROME'S BALANCE SHEET Assets Liabilities Savings IS Credit Card S 5,000 Gelato Stand $ 5.000 Car Loan S Toki Beach Stock S Accounts IS # of shares Payable Beach Hut IS Beach Hut is Properties Properties - Note Payable TOTALS TOTALS Assets - Liabilities = Owner's Equity $ Extra Credit: Is Jerome's monthly passive income greater than his monthly total expenses? Explain why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started