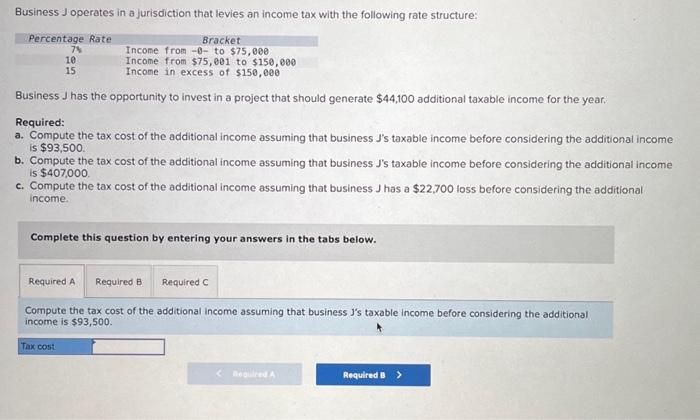

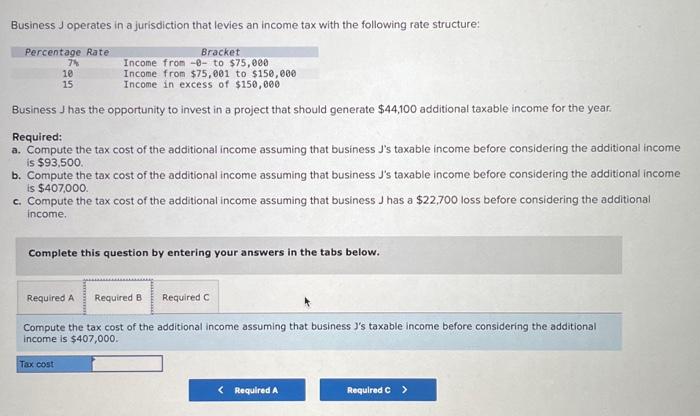

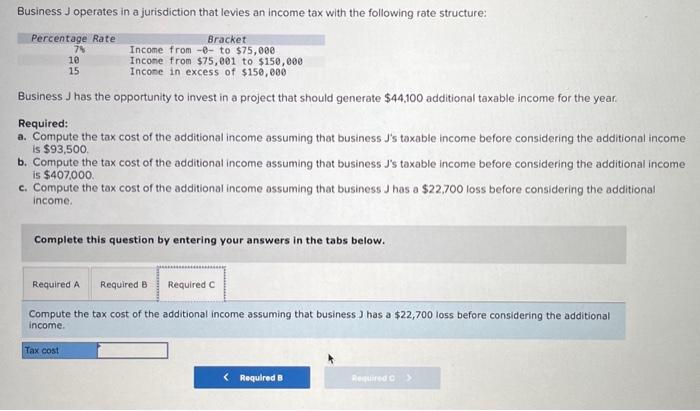

Business J operates in a jurisdiction that levies an income tax with the following rate structure: Business J has the opportunity to invest in a project that should generate $44,100 additional taxable income for the year: Required: a. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. b. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. c. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Complete this question by entering your answers in the tabs below. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. Business J operates in a jurisdiction that levies an income tax with the following rate structure: Business J has the opportunity to invest in a project that should generate $44,100 additional taxable income for the year: Required: a. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. b. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. c. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Complete this question by entering your answers in the tabs below. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. Business J operates in a jurisdiction that levies an income tax with the following rate structure: Business J has the opportunity to invest in a project that should generate $44,100 additional taxable income for the year. Required: a. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. b. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. c. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Complete this question by entering your answers in the tabs below. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Business J operates in a jurisdiction that levies an income tax with the following rate structure: Business J has the opportunity to invest in a project that should generate $44,100 additional taxable income for the year: Required: a. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. b. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. c. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Complete this question by entering your answers in the tabs below. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. Business J operates in a jurisdiction that levies an income tax with the following rate structure: Business J has the opportunity to invest in a project that should generate $44,100 additional taxable income for the year: Required: a. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. b. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. c. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Complete this question by entering your answers in the tabs below. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. Business J operates in a jurisdiction that levies an income tax with the following rate structure: Business J has the opportunity to invest in a project that should generate $44,100 additional taxable income for the year. Required: a. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $93,500. b. Compute the tax cost of the additional income assuming that business J's taxable income before considering the additional income is $407,000. c. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income. Complete this question by entering your answers in the tabs below. Compute the tax cost of the additional income assuming that business J has a $22,700 loss before considering the additional income