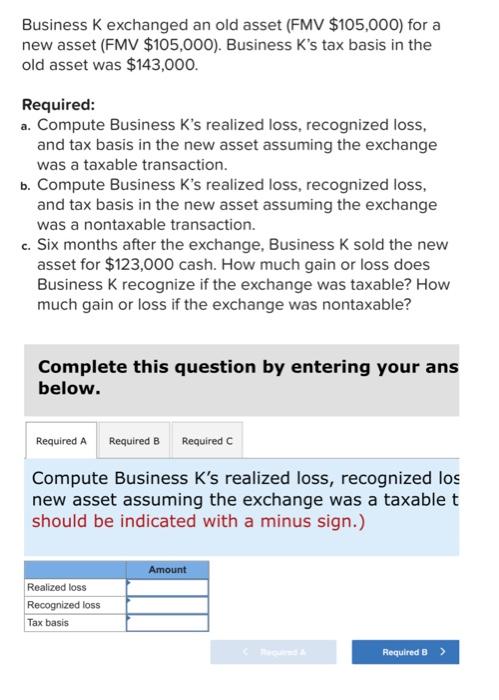

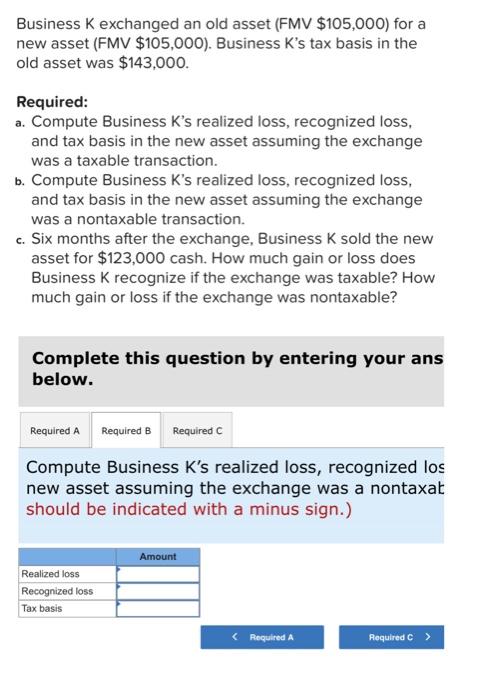

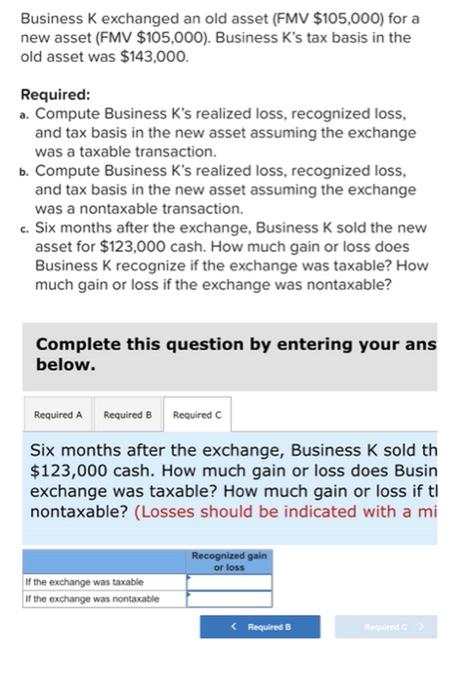

Business k exchanged an old asset (FMV $105,000) for a new asset (FMV $105,000). Business K's tax basis in the old asset was $143,000. Required: a. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a taxable transaction. b. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a nontaxable transaction. c. Six months after the exchange, Business k sold the new asset for $123,000 cash. How much gain or loss does Business K recognize if the exchange was taxable? How much gain or loss if the exchange was nontaxable? Complete this question by entering your ans below. Required A Required B Required Compute Business K's realized loss, recognized los new asset assuming the exchange was a taxable t should be indicated with a minus sign.) Amount Realized loss Recognized loss Tax basis Required B > Business k exchanged an old asset (FMV $105,000) for a new asset (FMV $105,000). Business K's tax basis in the old asset was $143,000. Required: a. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a taxable transaction. b. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a nontaxable transaction. c. Six months after the exchange, Business k sold the new asset for $123,000 cash. How much gain or loss does Business K recognize if the exchange was taxable? How much gain or loss if the exchange was nontaxable? Complete this question by entering your ans below. Required A Required B Required Compute Business K's realized loss, recognized los new asset assuming the exchange was a nontaxat should be indicated with a minus sign.) Amount Realized loss Recognized loss Tax basis Business k exchanged an old asset (FMV $105,000) for a new asset (FMV $105,000). Business K's tax basis in the old asset was $143,000. Required: a. Compute Business K's realized loss, recognized loss. and tax basis in the new asset assuming the exchange was a taxable transaction. b. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a nontaxable transaction. c. Six months after the exchange, Business K sold the new asset for $123,000 cash. How much gain or loss does Business K recognize if the exchange was taxable? How much gain or loss if the exchange was nontaxable? Complete this question by entering your ans below. Required A Required B Required Six months after the exchange, Business K sold th $123,000 cash. How much gain or loss does Busin exchange was taxable? How much gain or loss if t1 nontaxable? (Losses should be indicated with a mi Recognized gain or loss of the exchange was taxable of the exchange was nontaxable