Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Business law please answers those questions If the partnership agreement does not apportion profits, profit are shared in the same proportion as a partner investment

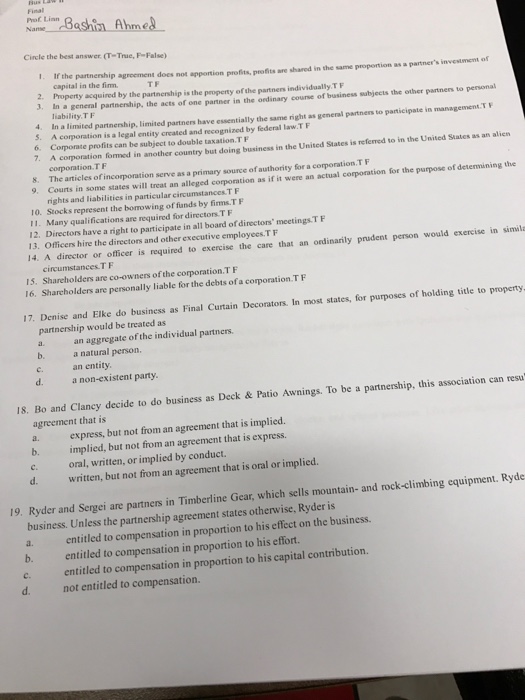

Business law please answers those questions  If the partnership agreement does not apportion profits, profit are shared in the same proportion as a partner investment of capital in the firm. Property acquired by the partnership is the property of the partners individually TF In a general partnership, acts of one partner in the ordinary course of business objects the other partner to personal liability TF In a limned partnership, limited partners have essentially the same right as general partners to participate in management TF A corporation is a legal entity created and recognized by federal law TF Corporate profit a can be subject to double taxation T F A corporation formed in another country but doing business in the United States as an alien corporation TF The articles of incorporation serve as a primary source of authority for a corporation. T F Courts in some states will treat an alleged corporation as if it were as actual corporation for the purpose of determining the rights and liabilities in particular circumstances. T F Stocks represent the borrowing of funds by TF Many qualifications are required for directors T F Directors have a right to participate in all board of directors' meetings-T F Officers hire the directors and other executive employee. T F A director or officer is required to exercise the care that an ordinarily prudent person would exercise in similar circumstances. T F Shareholder! are co-owners of the corporation. T F Shareholders are personally liable for the debts of a corporation T F Denise and Elke do business as Final Curtain Decorators. In most states, for purposes of holding title to property, partnership would be Created as an aggregate of the individual partners. a natural person. an entity. a non-existent party. Bo and Clancy decide to do business as Deck & Patio Awnings. To be a partnership, this association can agreement that it express, but not from an agreement that is implied. implied, but not from an agreement that is express. oral, written, or implied by conduct. written, but not from an agreement that is oral or implied. Ryder and Sergei are partners in Timberline Gear, which sells mountains and rock-climbing equipment. Ryder business. Unless the partnership agreement states otherwise. Ryder is entitled to compensation in proportion to his effect on the business. entitled to compensation in proportion to his effort. entitled to compensation in proportion to his capital contribution. not entitled to compensation

If the partnership agreement does not apportion profits, profit are shared in the same proportion as a partner investment of capital in the firm. Property acquired by the partnership is the property of the partners individually TF In a general partnership, acts of one partner in the ordinary course of business objects the other partner to personal liability TF In a limned partnership, limited partners have essentially the same right as general partners to participate in management TF A corporation is a legal entity created and recognized by federal law TF Corporate profit a can be subject to double taxation T F A corporation formed in another country but doing business in the United States as an alien corporation TF The articles of incorporation serve as a primary source of authority for a corporation. T F Courts in some states will treat an alleged corporation as if it were as actual corporation for the purpose of determining the rights and liabilities in particular circumstances. T F Stocks represent the borrowing of funds by TF Many qualifications are required for directors T F Directors have a right to participate in all board of directors' meetings-T F Officers hire the directors and other executive employee. T F A director or officer is required to exercise the care that an ordinarily prudent person would exercise in similar circumstances. T F Shareholder! are co-owners of the corporation. T F Shareholders are personally liable for the debts of a corporation T F Denise and Elke do business as Final Curtain Decorators. In most states, for purposes of holding title to property, partnership would be Created as an aggregate of the individual partners. a natural person. an entity. a non-existent party. Bo and Clancy decide to do business as Deck & Patio Awnings. To be a partnership, this association can agreement that it express, but not from an agreement that is implied. implied, but not from an agreement that is express. oral, written, or implied by conduct. written, but not from an agreement that is oral or implied. Ryder and Sergei are partners in Timberline Gear, which sells mountains and rock-climbing equipment. Ryder business. Unless the partnership agreement states otherwise. Ryder is entitled to compensation in proportion to his effect on the business. entitled to compensation in proportion to his effort. entitled to compensation in proportion to his capital contribution. not entitled to compensation

Business law please answers those questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started