Answered step by step

Verified Expert Solution

Question

1 Approved Answer

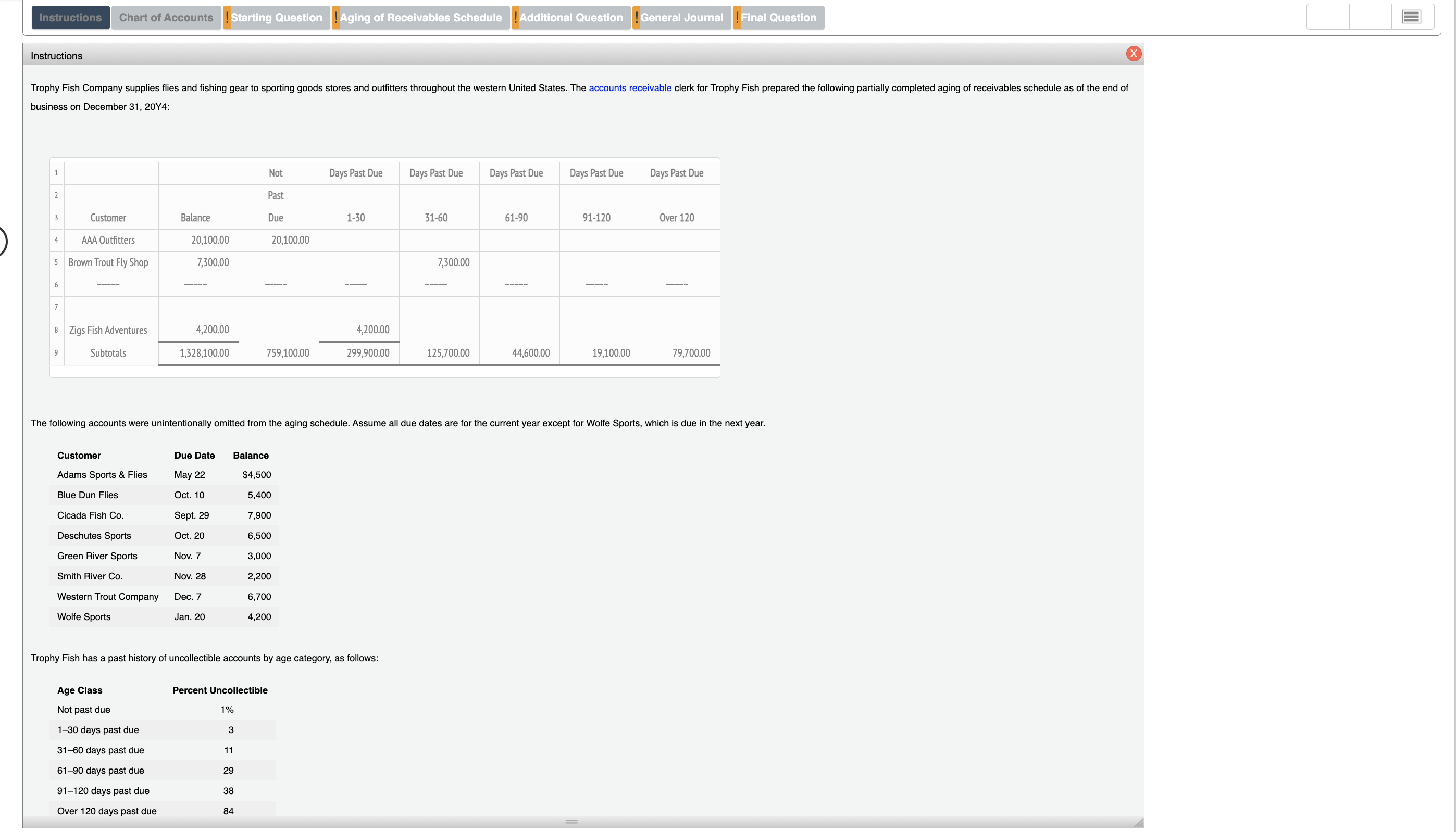

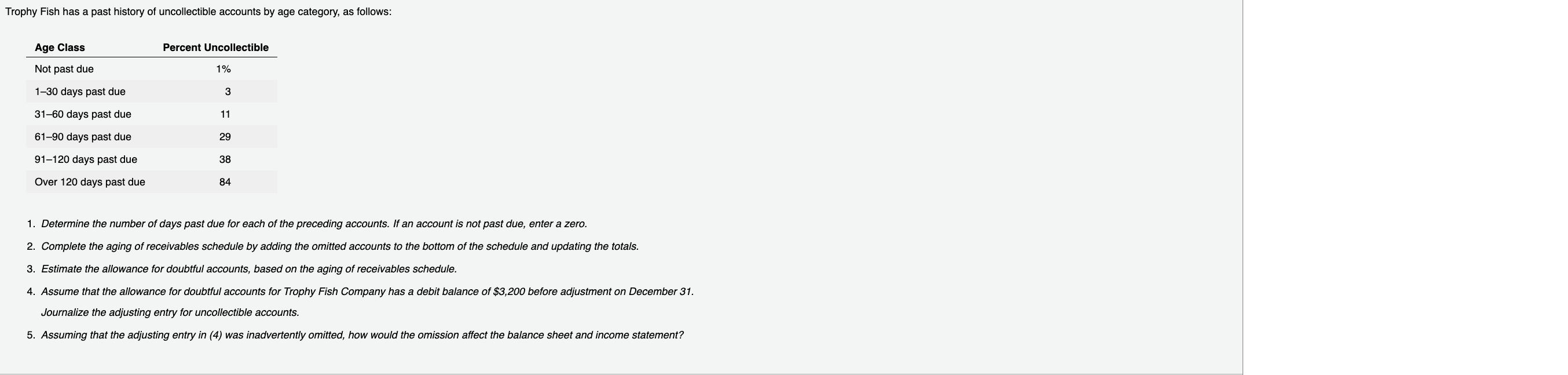

business on December 31,20Y4 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for

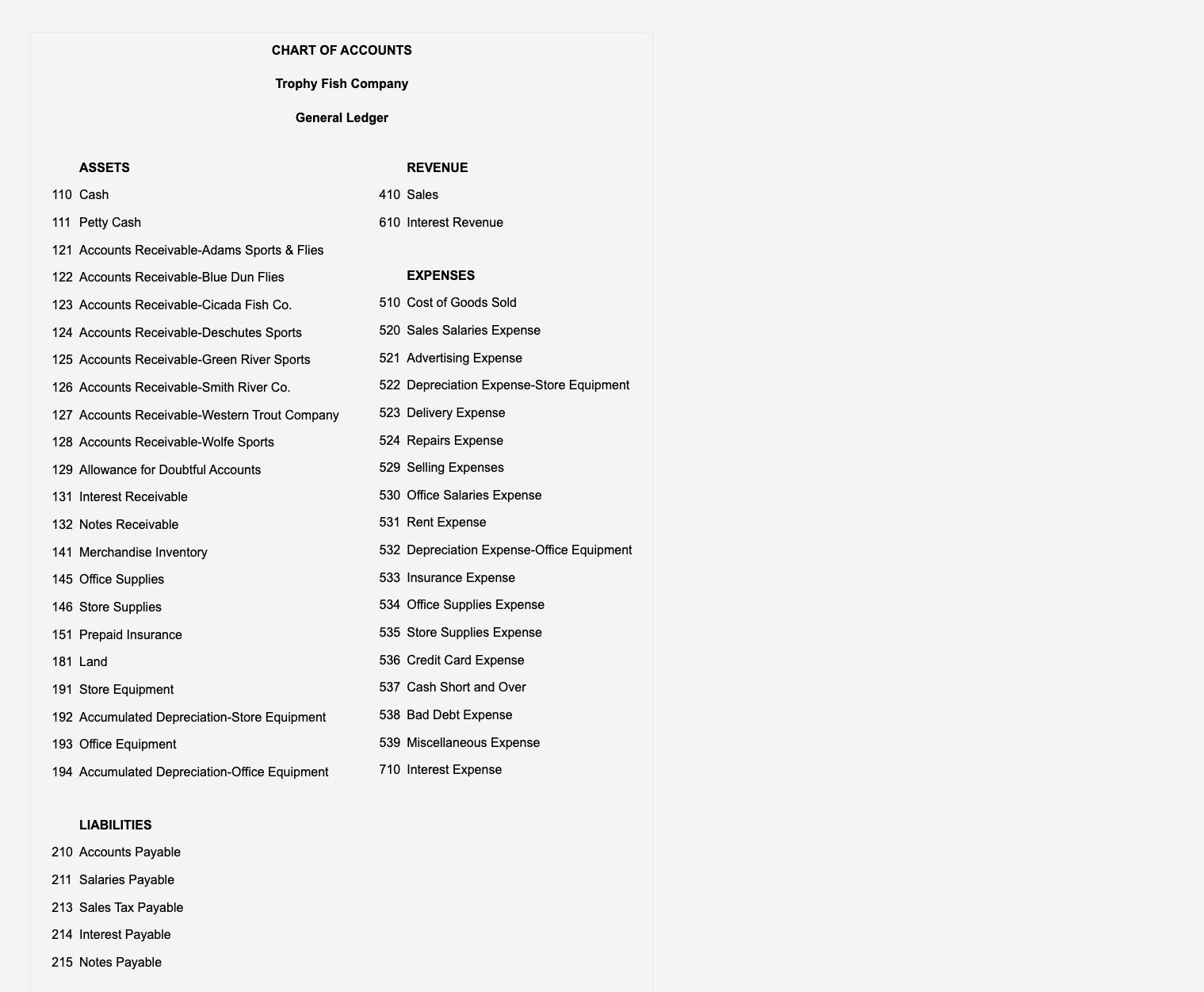

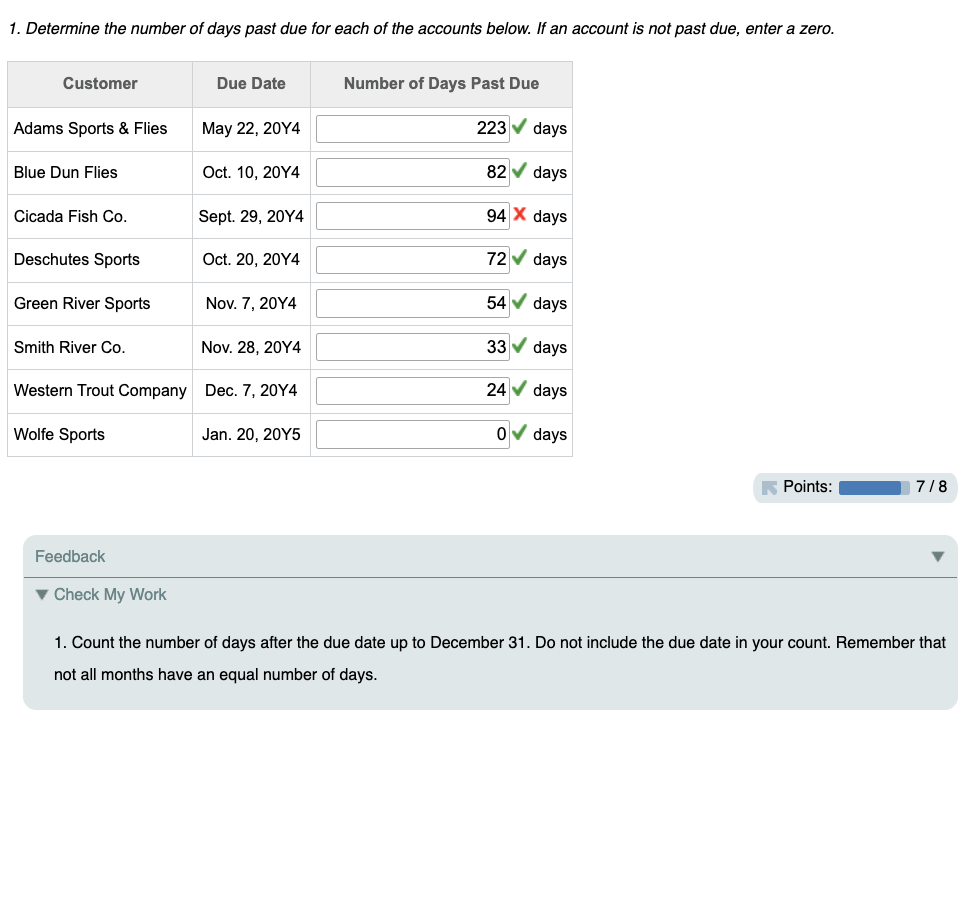

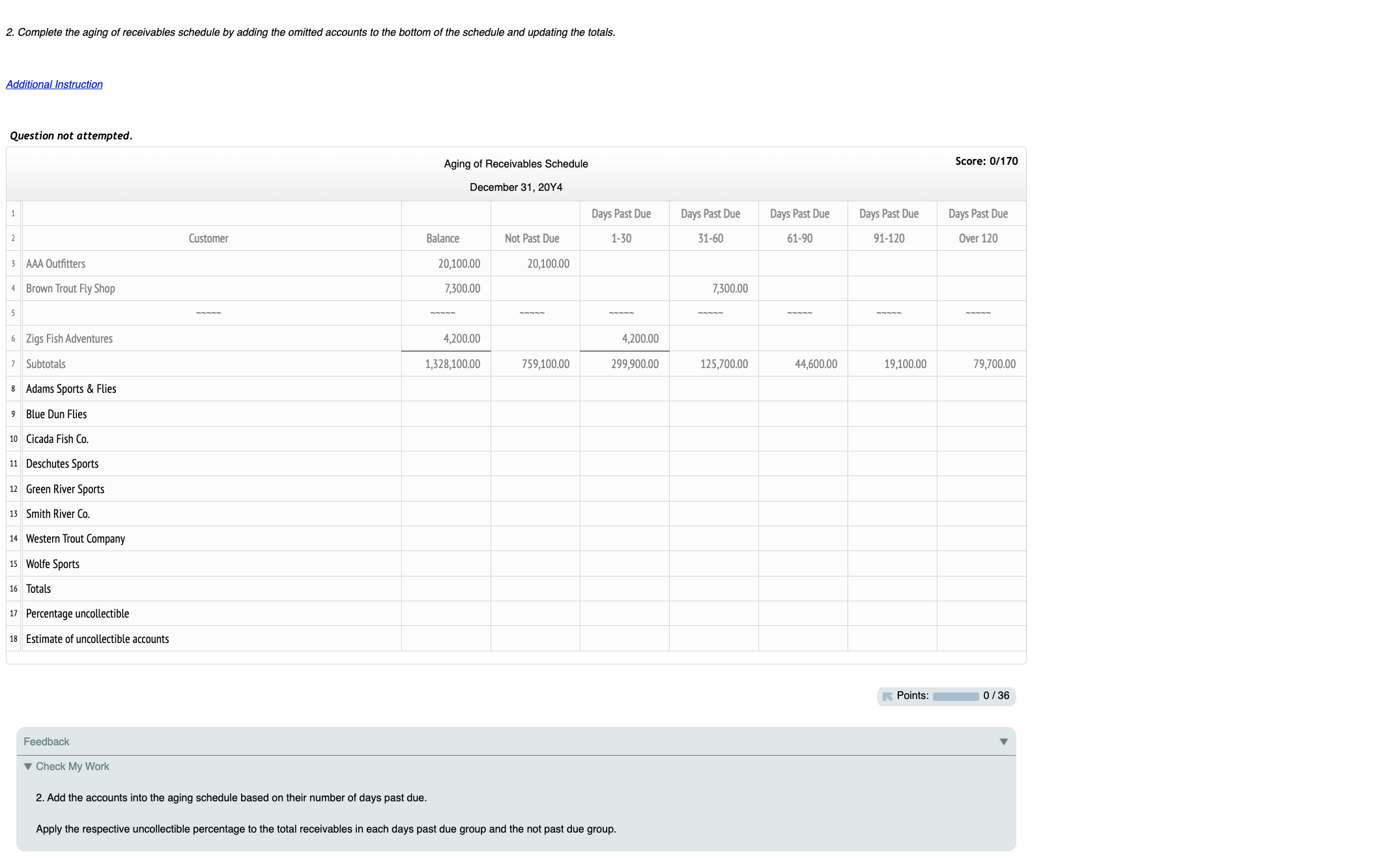

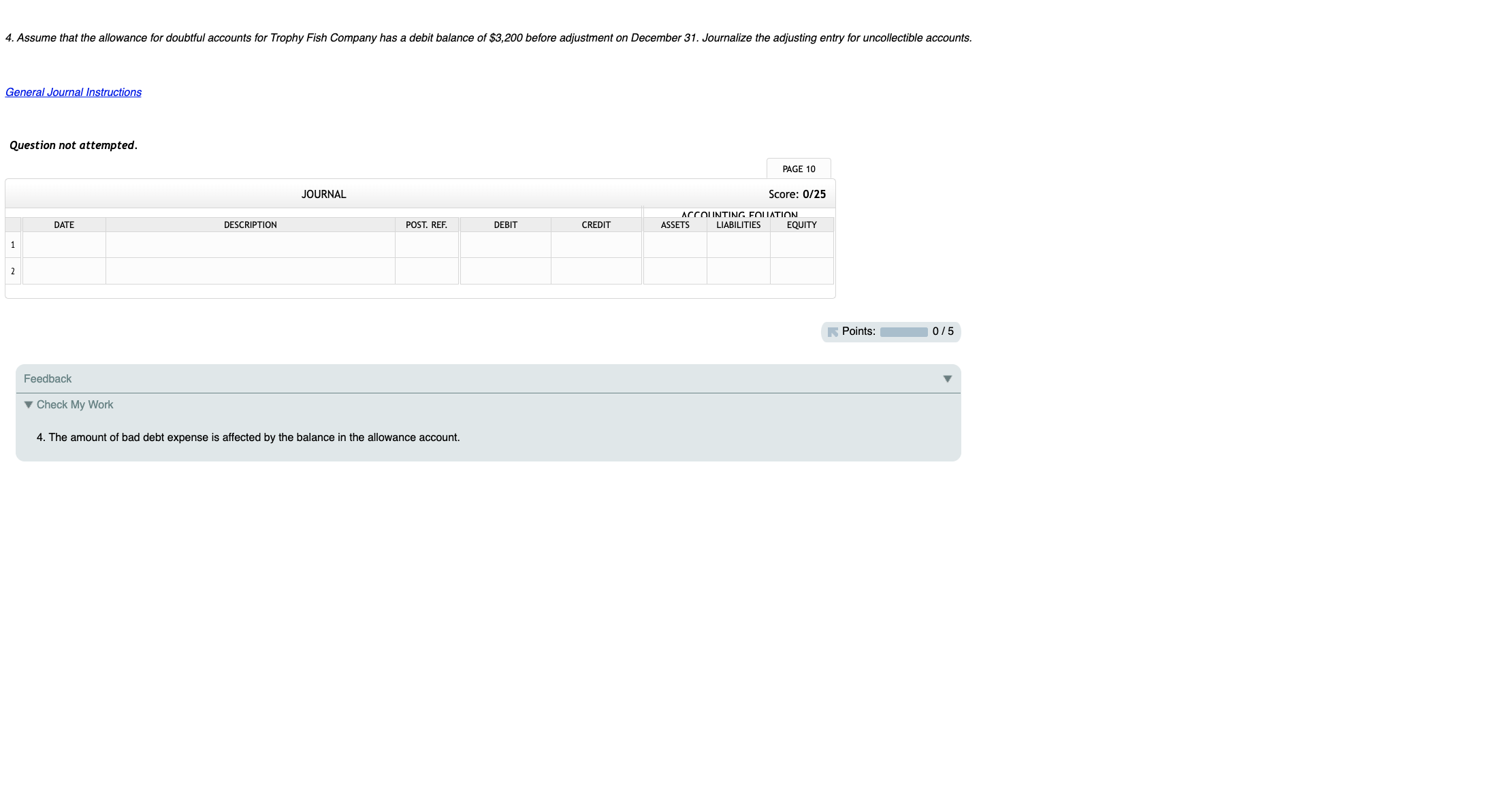

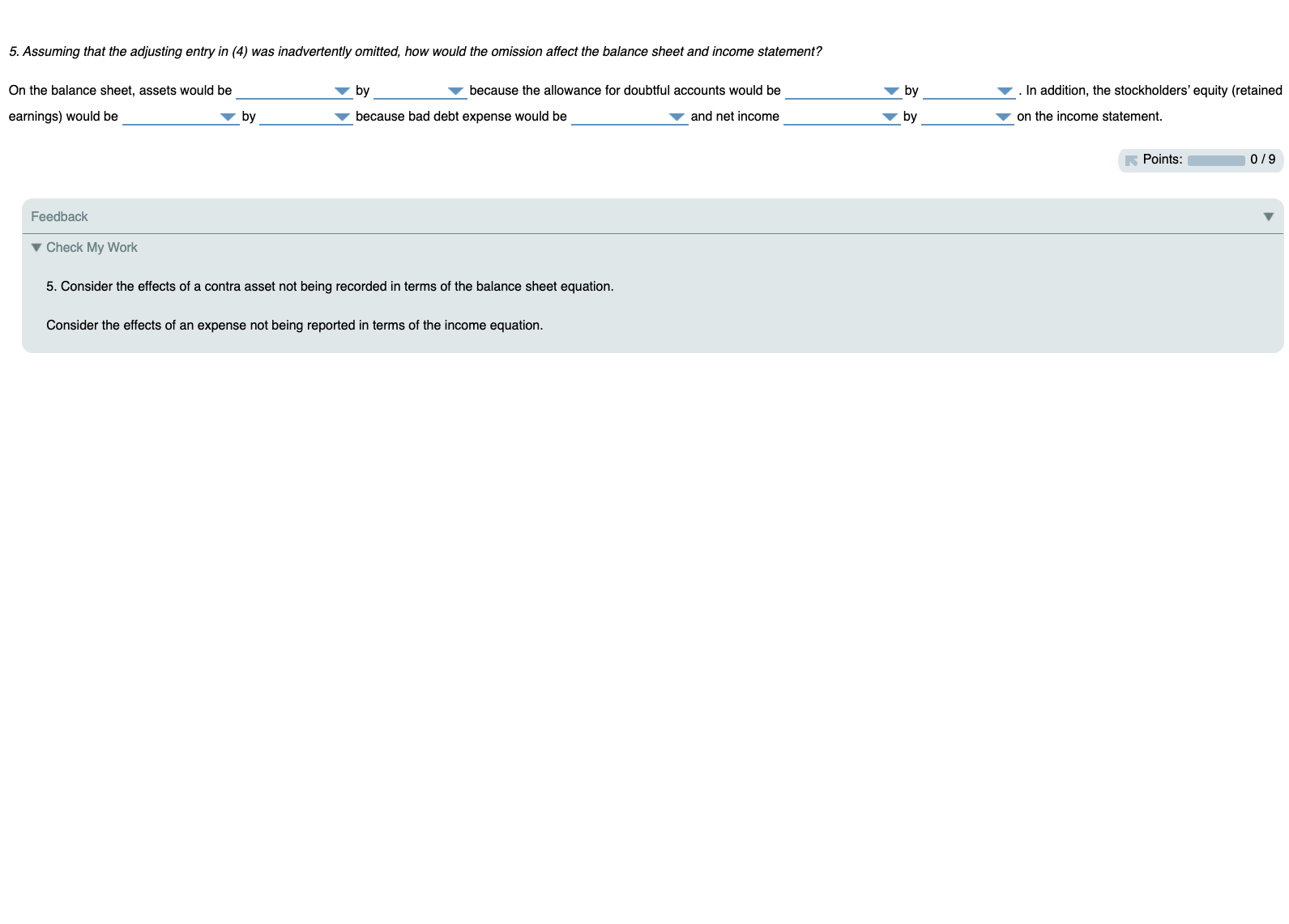

business on December 31,20Y4 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year. Trophy Fish has a past history of uncollectible accounts by age category, as follows: Trophy Fish has a past history of uncollectible accounts by age category, as follows: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the tots 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,200 before adjustment on December 31 . Journalize the adjusting entry for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? CHART OF ACCOUNTS Trophy Fish Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 121 Accounts Receivable-Adams Sports \& Flies 122 Accounts Receivable-Blue Dun Flies EXPENSES 123 Accounts Receivable-Cicada Fish Co. 510 Cost of Goods Sold 124 Accounts Receivable-Deschutes Sports 520 Sales Salaries Expense 125 Accounts Receivable-Green River Sports 521 Advertising Expense 126 Accounts Receivable-Smith River Co. 522 Depreciation Expense-Store Equipment 127 Accounts Receivable-Western Trout Company 523 Delivery Expense 128 Accounts Receivable-Wolfe Sports 524 Repairs Expense 129 Allowance for Doubtful Accounts 529 Selling Expenses 131 Interest Receivable 530 Office Salaries Expense 132 Notes Receivable 531 Rent Expense 141 Merchandise Inventory 532 Depreciation Expense-Office Equipment 145 Office Supplies 533 Insurance Expense 146 Store Supplies 534 Office Supplies Expense 151 Prepaid Insurance 535 Store Supplies Expense 181 Land 536 Credit Card Expense 191 Store Equipment 537 Cash Short and Over 192 Accumulated Depreciation-Store Equipment 538 Bad Debt Expense 193 Office Equipment 539 Miscellaneous Expense 194 Accumulated Depreciation-Office Equipment 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero. Feedback Check My Work 1. Count the number of days after the due date up to December 31 . Do not include the due date in your count. Remember that not all months have an equal number of days. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. AdditionalInstruction Question not attempted. Feedback Check My Work 2. Add the accounts into the aging schedule based on their number of days past due. Apply the respective uncollectible percentage to the total receivables in each days past due group and the not past due group. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. Feedback Check My Work 3. The analysis of receivables method places more emphasis on the net realizable value of the receivables and, thus, emphasizes the balance sheet. That is, the amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts equal to that estimated by the aging schedule. The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding the less likely that it will be collected. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,200 before adjustment on December 31 . Journalize the adjusting entry for uncollectible accounts. Question not attempted. DAr.F10 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? On the balance sheet, assets would be by because the allowance for doubtful accounts would be by . In addition, the stockholders' equity (retained earnings) would be by because bad debt expense would be and net income by on the income statement. Feedback Check My Work 5. Consider the effects of a contra asset not being recorded in terms of the balance sheet equation. Consider the effects of an expense not being reported in terms of the income equation

business on December 31,20Y4 The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year. Trophy Fish has a past history of uncollectible accounts by age category, as follows: Trophy Fish has a past history of uncollectible accounts by age category, as follows: 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the tots 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,200 before adjustment on December 31 . Journalize the adjusting entry for uncollectible accounts. 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? CHART OF ACCOUNTS Trophy Fish Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 121 Accounts Receivable-Adams Sports \& Flies 122 Accounts Receivable-Blue Dun Flies EXPENSES 123 Accounts Receivable-Cicada Fish Co. 510 Cost of Goods Sold 124 Accounts Receivable-Deschutes Sports 520 Sales Salaries Expense 125 Accounts Receivable-Green River Sports 521 Advertising Expense 126 Accounts Receivable-Smith River Co. 522 Depreciation Expense-Store Equipment 127 Accounts Receivable-Western Trout Company 523 Delivery Expense 128 Accounts Receivable-Wolfe Sports 524 Repairs Expense 129 Allowance for Doubtful Accounts 529 Selling Expenses 131 Interest Receivable 530 Office Salaries Expense 132 Notes Receivable 531 Rent Expense 141 Merchandise Inventory 532 Depreciation Expense-Office Equipment 145 Office Supplies 533 Insurance Expense 146 Store Supplies 534 Office Supplies Expense 151 Prepaid Insurance 535 Store Supplies Expense 181 Land 536 Credit Card Expense 191 Store Equipment 537 Cash Short and Over 192 Accumulated Depreciation-Store Equipment 538 Bad Debt Expense 193 Office Equipment 539 Miscellaneous Expense 194 Accumulated Depreciation-Office Equipment 710 Interest Expense LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero. Feedback Check My Work 1. Count the number of days after the due date up to December 31 . Do not include the due date in your count. Remember that not all months have an equal number of days. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. AdditionalInstruction Question not attempted. Feedback Check My Work 2. Add the accounts into the aging schedule based on their number of days past due. Apply the respective uncollectible percentage to the total receivables in each days past due group and the not past due group. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. Feedback Check My Work 3. The analysis of receivables method places more emphasis on the net realizable value of the receivables and, thus, emphasizes the balance sheet. That is, the amount of the adjusting entry is the amount that will yield an adjusted balance for Allowance for Doubtful Accounts equal to that estimated by the aging schedule. The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding the less likely that it will be collected. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,200 before adjustment on December 31 . Journalize the adjusting entry for uncollectible accounts. Question not attempted. DAr.F10 5. Assuming that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? On the balance sheet, assets would be by because the allowance for doubtful accounts would be by . In addition, the stockholders' equity (retained earnings) would be by because bad debt expense would be and net income by on the income statement. Feedback Check My Work 5. Consider the effects of a contra asset not being recorded in terms of the balance sheet equation. Consider the effects of an expense not being reported in terms of the income equation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started