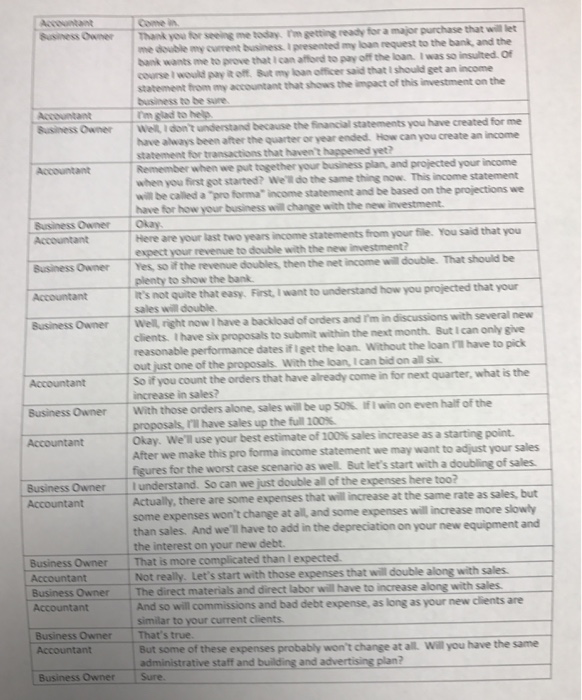

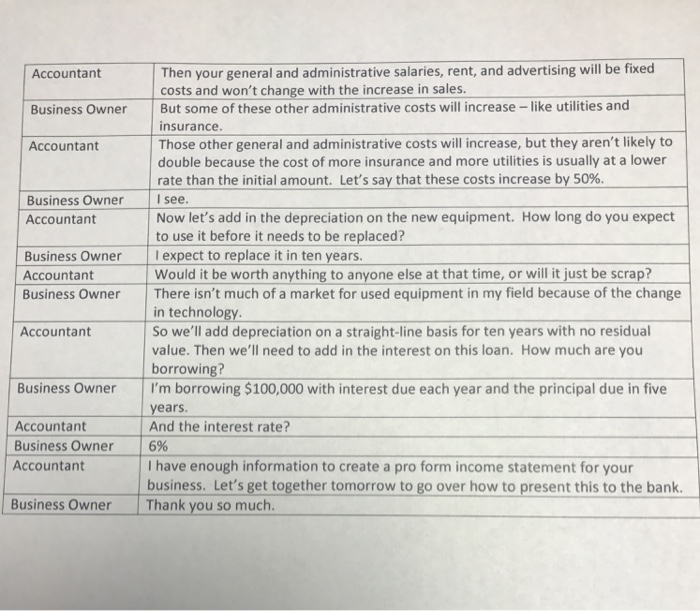

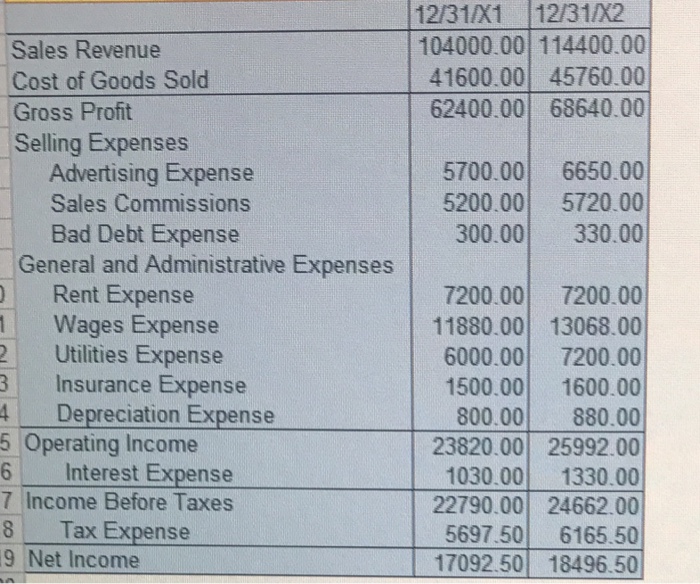

Business owner Thank youtor seeing me today rmgetting ready tora major purchase that willet me doublemy current business presented loan request to the bank, and the wants me to prove that Icar afford to pay off the loan. I was so insulted of course would But my loan officer said that should get an income statement from my accountant thatshows the impact of thisinvestment on the business to be sure Business owner idontunderstand because the financialstatements you have created for me well have always been after the quarter or yearended. How can you create an Remember for transactions that haven't bappened yet? yourincome when we put together your business pian and projected when you first got started? We do the same ting now. This income statement wil be caled a pro forma income statement and be based on the projections we have for how your business w with the new investment. Here are your last two years income statements from your file. You said that you expect your revenue to double with the new investment Business owner Yes, so if the revenue do then the net income wil double. That should be plenty to show the bank. you projected that it's not quite that easy. First iwant to understand how sales will double. discussions with several new owner Wel right now I have a backload of orders and rmin month. But can onlygive clients. have six proposals to submit within the next reasonable performance dates figet the loan. Without the loan m have to pick out just one of the proposals with the loan can bid on all six So if you count the orders that have already come in for next quarter, what is the owner alone, sales wil be up 50 If I win on even half of the With those orders proposals m have sales up the full 100%. sales increase as a starting point. We'i use your best estimate of 100s After we make this pro forma income statement we may want to adjust your sales figures for the worst case scenario as well Butler's start with a Business owner understand. So can we just double a of the expenses here too? as sales, but Actually, there are some expenses that will increase at the same rate some expenses won't change at all, and some expenses wil increase more slowly than sales. And we'll have to add in the depreciation on your new equipment and the interest on your new debt. Business Owner That is more complicated than lexpected. Not really. Let's start with those expenses that wil double along with sales The direct materials and direct labor bave to increase And so will commissions and bad debt expense, as long as your new clients are similar to your current clients. some of these expenses probably won't change at all. Wilyou have the same administrative staff and buading and advertising plan