Answered step by step

Verified Expert Solution

Question

1 Approved Answer

business policy 4. Are you impressed by the strategy Elon Musk has crafted... What is your assessment of Tesla's financial performance as shown in case

business policy

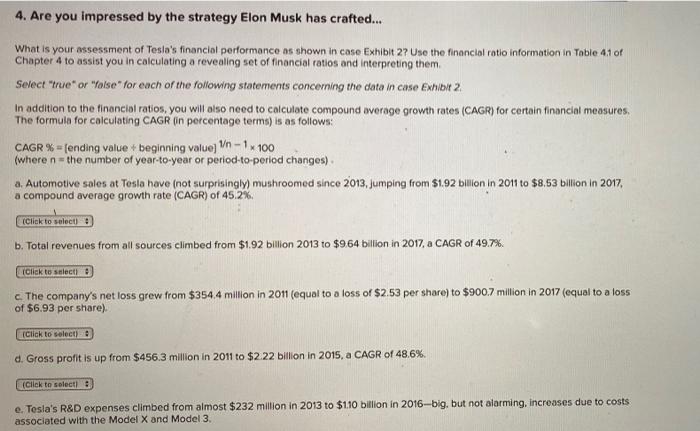

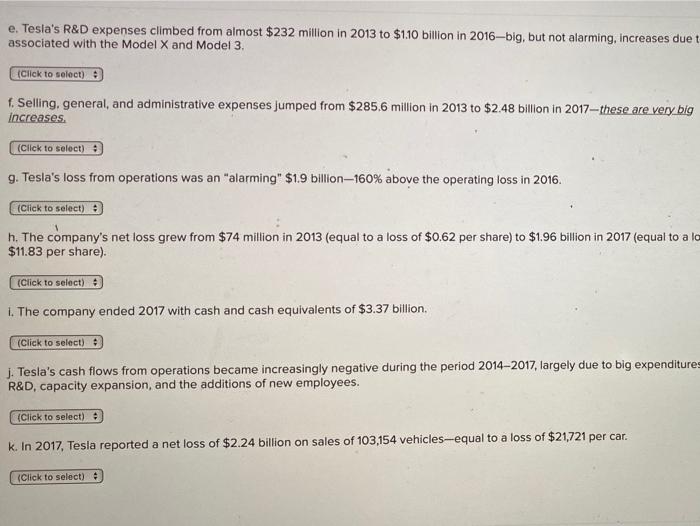

4. Are you impressed by the strategy Elon Musk has crafted... What is your assessment of Tesla's financial performance as shown in case Exhibit 2? Use the financial rotio information in Table 41 of Chapter 4 to assist you in calculating a revealing set of financial ratios and interpreting them Select "true" or "alse" for each of the following statements concerning the data in case Exhibit 2. In addition to the financial ratios, you will also need to calculate compound average growth rates (CAGR) for certain financial measures The formula for calculating CAGR in percentage terms) is as follows: CAGR % - fending value beginning value] Vn - 1 x 100 (where n = the number of year-to-year or period-to-period changes) a. Automotive sales at Tesla have not surprisingly) mushroomed since 2013, jumping from $1.92 billion in 2011 to $8,53 billion in 2017, a compound average growth rate (CAGR) of 45.2%. Click to select 3 b. Total revenues from all sources climbed from $1.92 billion 2013 to $9.64 billion in 2017, a CAGR of 49.7%. Click to select c. The company's net loss grew from $354,4 million in 2011 (equal to a loss of $2.53 per share) to $900.7 million in 2017 (equal to a loss of $6.93 per share) (Click to select) d. Gross profit is up from $456.3 million in 2011 to $2 22 billion in 2015, a CAGR of 48.6% (Click to select : e. Tesla's R&D expenses climbed from almost $232 million in 2013 to $110 billion in 2016-big, but not alarming, increases due to costs associated with the Model X and Model 3 e. Tesla's R&D expenses climbed from almost $232 million in 2013 to $110 billion in 2016-big, but not alarming, increases due t associated with the Model X and Model 3. (Click to select) f. Selling, general, and administrative expenses Jumped from $285.6 million in 2013 to $2.48 billion in 2017 - these are very big increases. (Click to select) 9. Tesla's loss from operations was an "alarming" $1.9 billion-160% above the operating loss in 2016. (Click to select) h. The company's net loss grew from $74 million in 2013 (equal to a loss of $0.62 per share) to $1.96 billion in 2017 (equal to a lo $11.83 per share). (Click to select) 1. The company ended 2017 with cash and cash equivalents of $3.37 billion. (Click to select) J. Tesla's cash flows from operations became increasingly negative during the period 2014-2017, largely due to big expenditures R&D, capacity expansion, and the additions of new employees. (Click to select) k. In 2017, Tesla reported a net loss of $2.24 billion on sales of 103,154 vehicles-equal to a loss of $21,721 per car. (Click to select) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started