Question

BUSINESS PROBLEM: CREDIT CARD ATTRITION DenizBank currently has 3 different type of credit card, A, B and C, for the Individual customer group. Attrition (customer

BUSINESS PROBLEM: CREDIT CARD ATTRITION

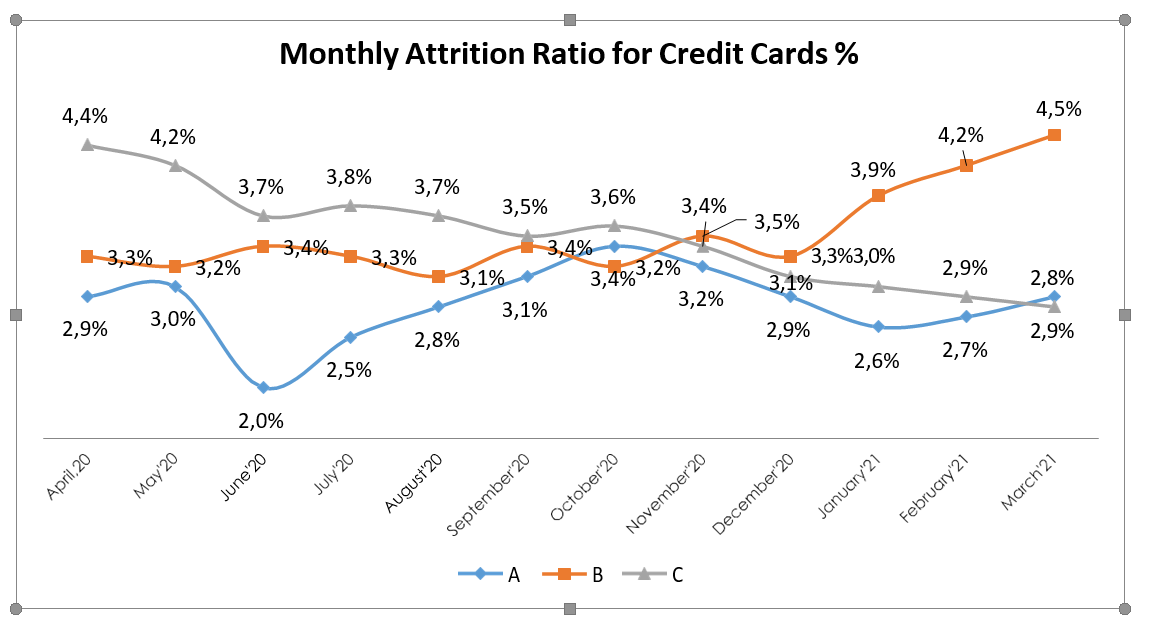

DenizBank currently has 3 different type of credit card, A, B and C, for the Individual customer group.

Attrition (customer stops using the product) rates for the last 12 months of these 3 credit card type are given below. For the B credit card, there has been a significant increase in attrition rates in the last 3 months.

It's necessary to determine the causes of the situation and take different actions for different reasons by using current customer data for preventing this increase as soon as possible.

Accordingly, share your solution approach with 5-6 slides presentation addressing the following topics.

- What could be the reasons for the increase for the B card type attrition rate?

- What analytical models can be created to predict and prevent these causes?

- What are the data fields required to create these analytical models?

- What conclusions can be drawn by applying these analytical models? What are the example marketing actions that can be suggested in line with these results?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started