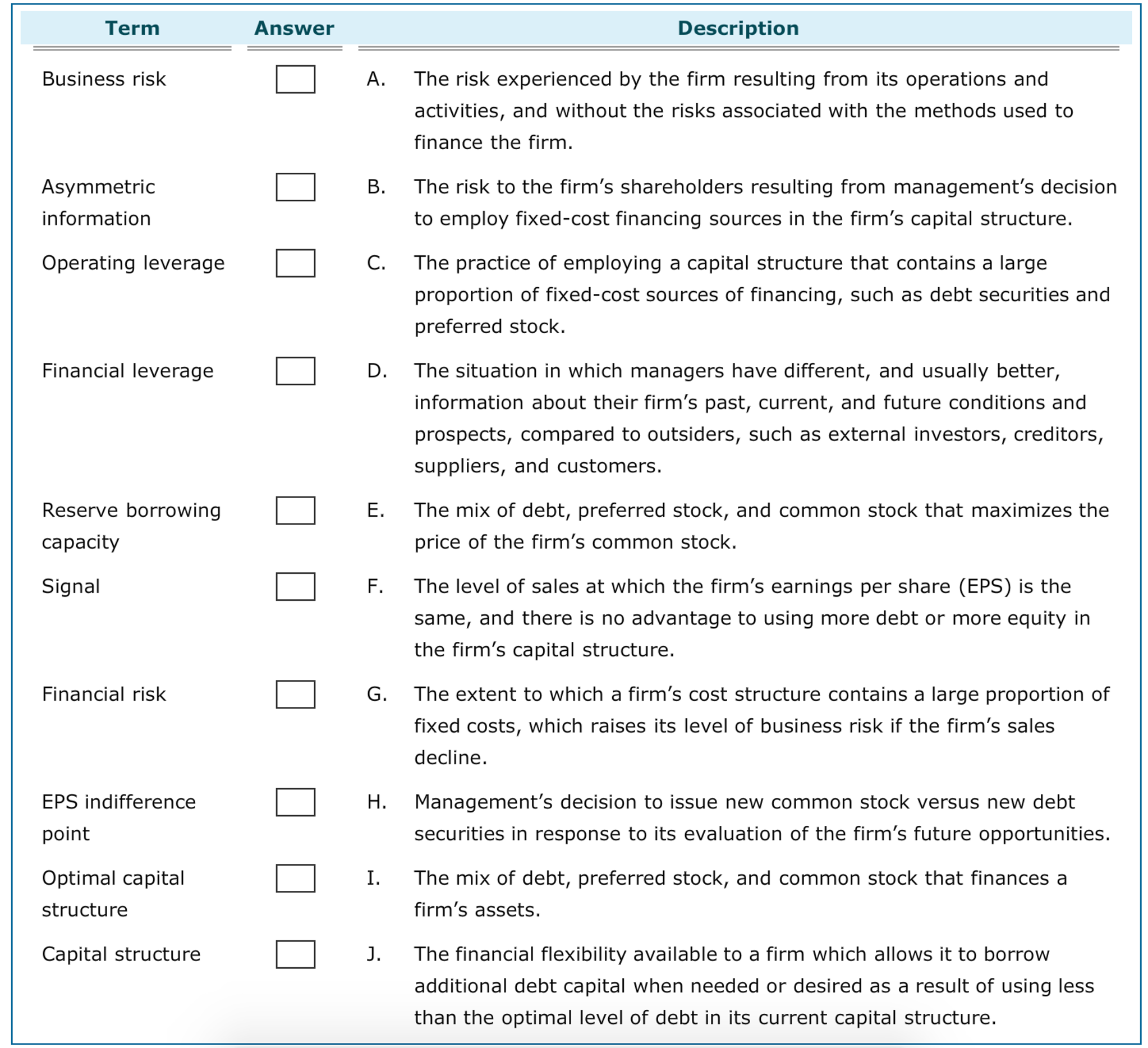

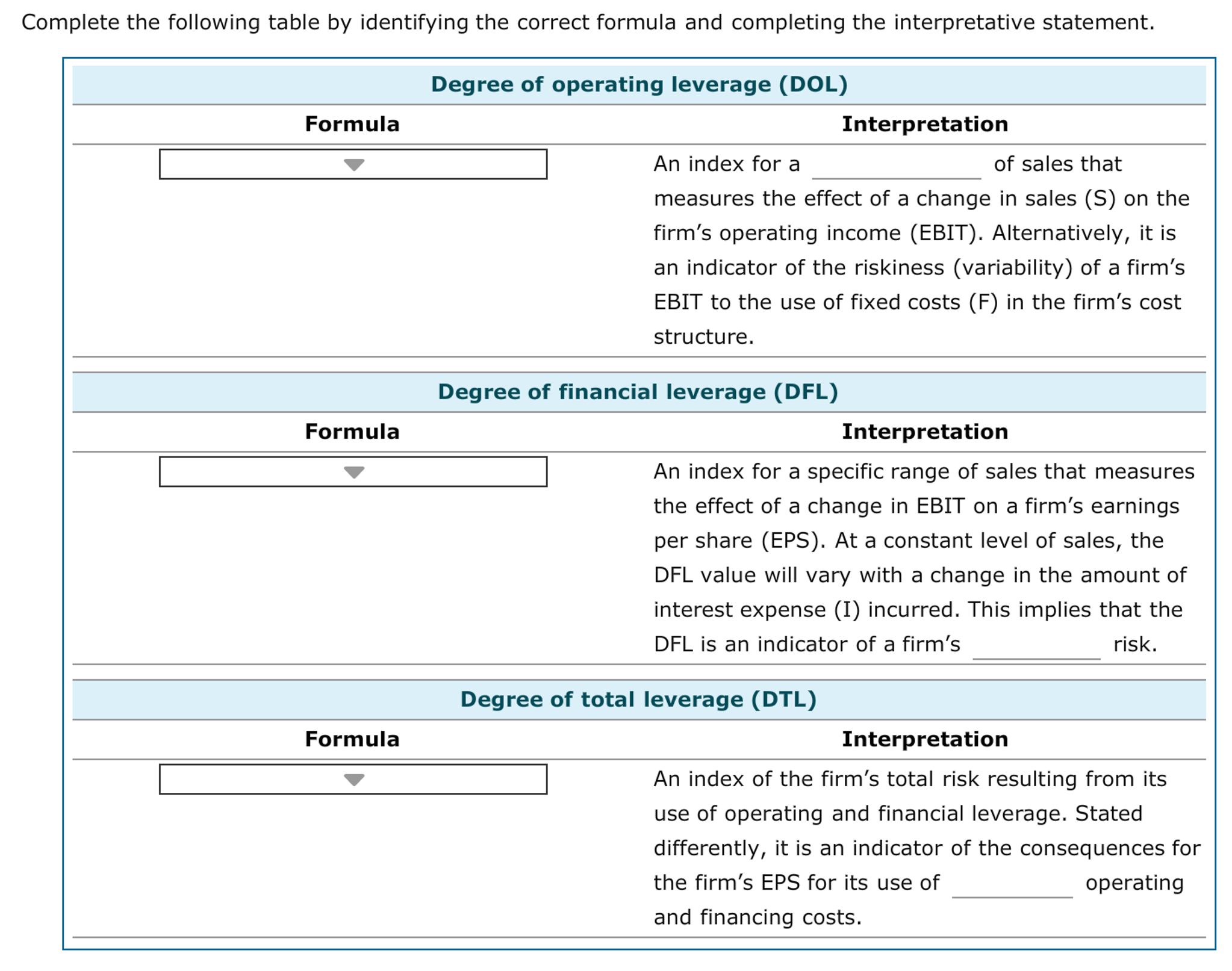

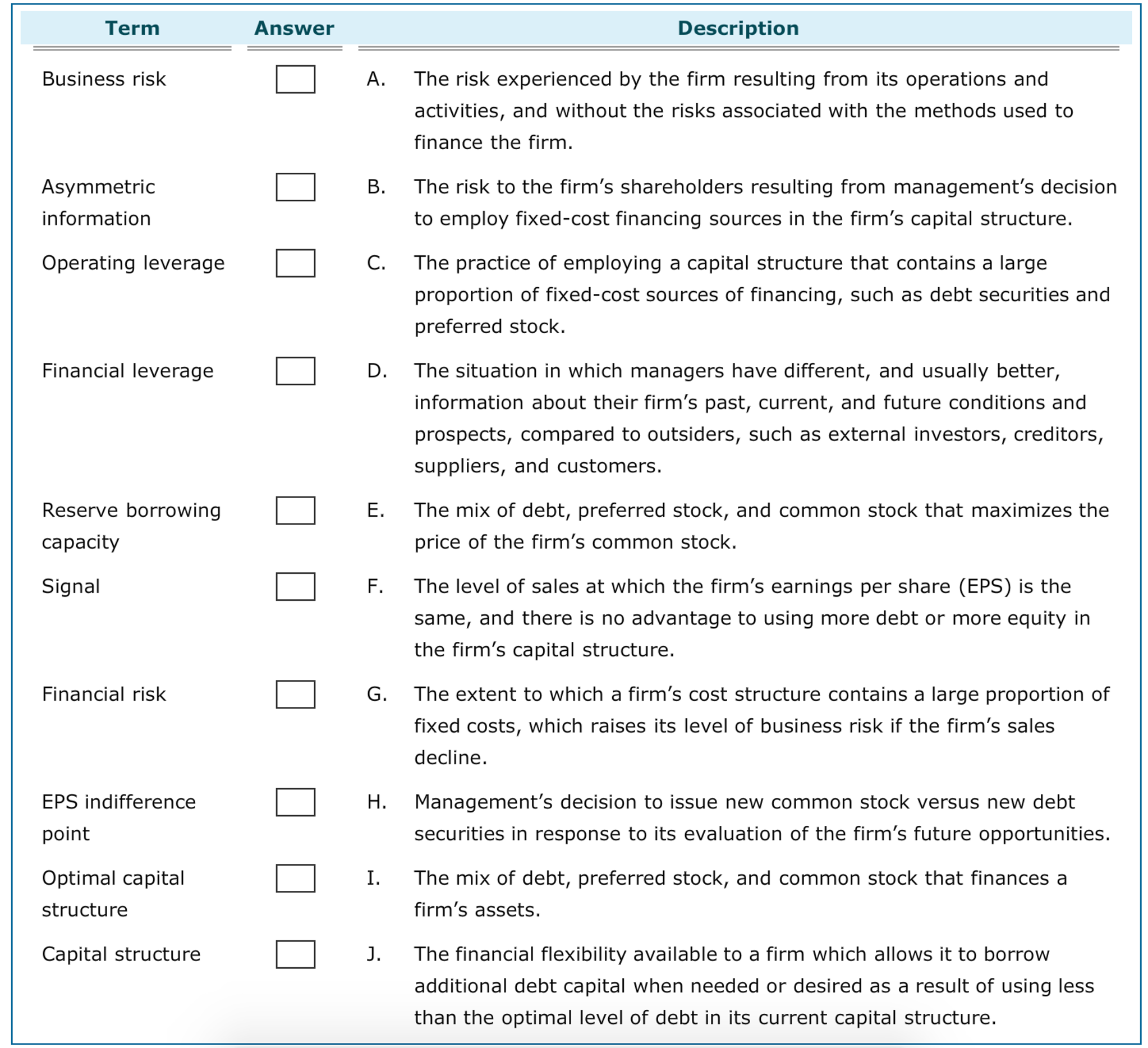

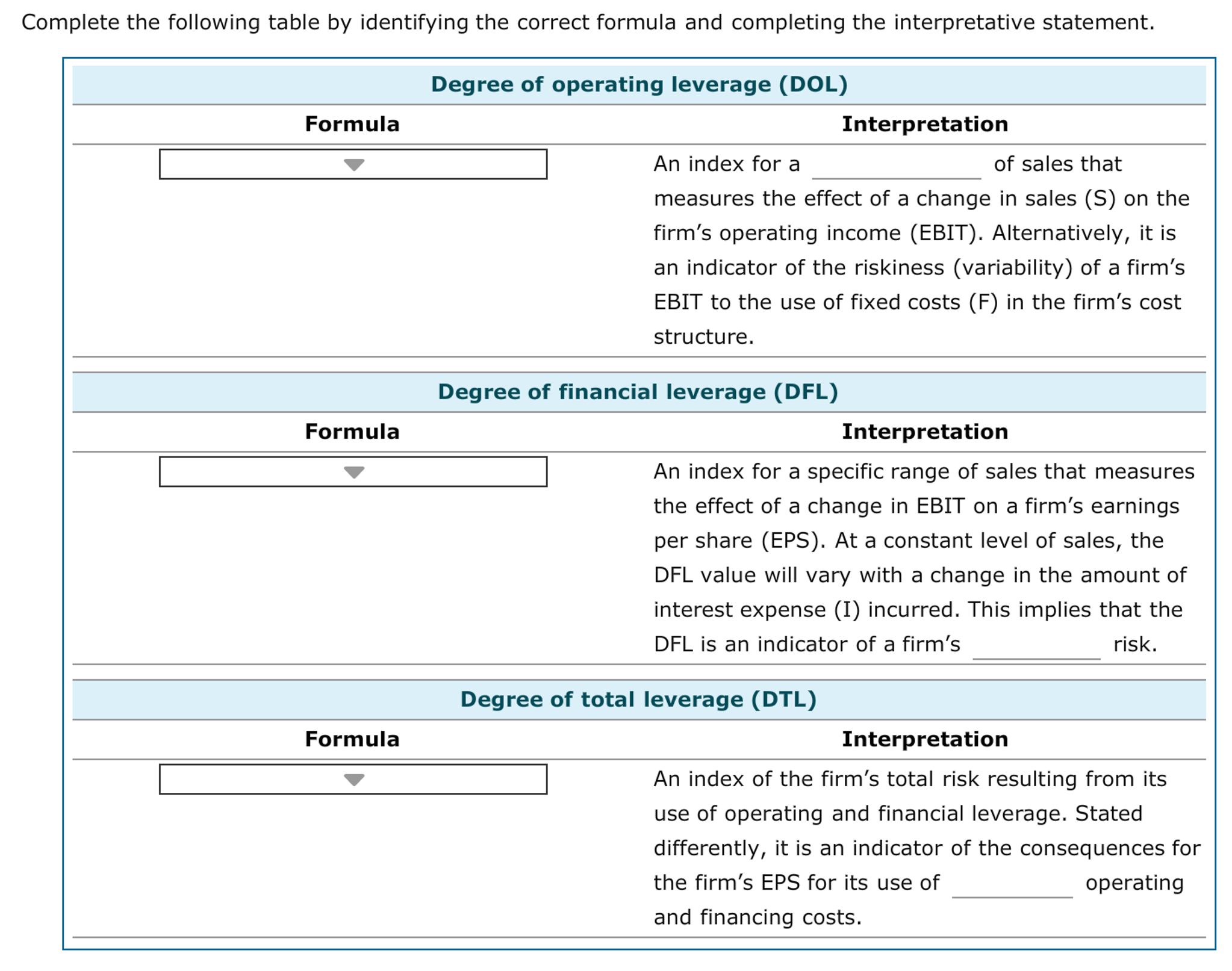

Business risk The risk experienced by the firm resulting from its operations and activities, and without the risks associated with the methods used to finance the firm. Asymmetric information The risk to the firm's shareholders resulting from management's decision to employ fixed-cost financing sources in the firm's capital structure. Operating leverage The practice of employing a capital structure that contains a large proportion of fixed-cost sources of financing, such as debt securities and preferred stock. Financial leverage The situation in which managers have different, and usually better, information about their firm's past, current, and future conditions and prospects, compared to outsiders, such as external investors, creditors, suppliers, and customers. Reserve borrowing capacity The mix of debt, preferred stock, and common stock that maximizes the price of the firm's common stock. Signal The level of sales at which the firm's earnings per share (EPS) is the same, and there is no advantage to using more debt or more equity in the firm's capital structure. Financial risk The extent to which a firm's cost structure contains a large proportion of fixed costs, which raises its level of business risk if the firm's sales decline. EPS indifference point Management's decision to issue new common stock versus new debt securities in response to its evaluation of the firm's future opportunities. Optimal capital structure The mix of debt, preferred stock, and common stock that finances a firm's assets. Capital structure The financial flexibility available to a firm which allows it to borrow additional debt capital when needed or desired as a result of using less than the optimal level of debt in its current capital structure. Complete the following table by identifying the correct formula and completing the interpretative statement. Formula Interpretation An index for a of sales that measures the effect of a change in sales (S) on the firm's operating income (EBIT). Alternatively, it is an indicator of the riskiness (variability) of a firm's EBIT to the use of fixed costs (F) in the firm's cost structure. An index for a specific range of sales that measures the effect of a change in EBIT on a firm's earnings per share (EPS). At a constant level of sales, the DFL value will vary with a change in the amount of interest expense (I) incurred. This implies that the DFL is an indicator of a firm's risk. An index of the firm's total risk resulting from its use of operating and financial leverage. Stated differently, it is an indicator of the consequences for the firm's EPS for its use of operating and financing costs