Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Business Scenario Andrew founded and operated a wedding planning agency, which specialized in celebrity weddings. When he died, his business was dissolved because there was

Business Scenario

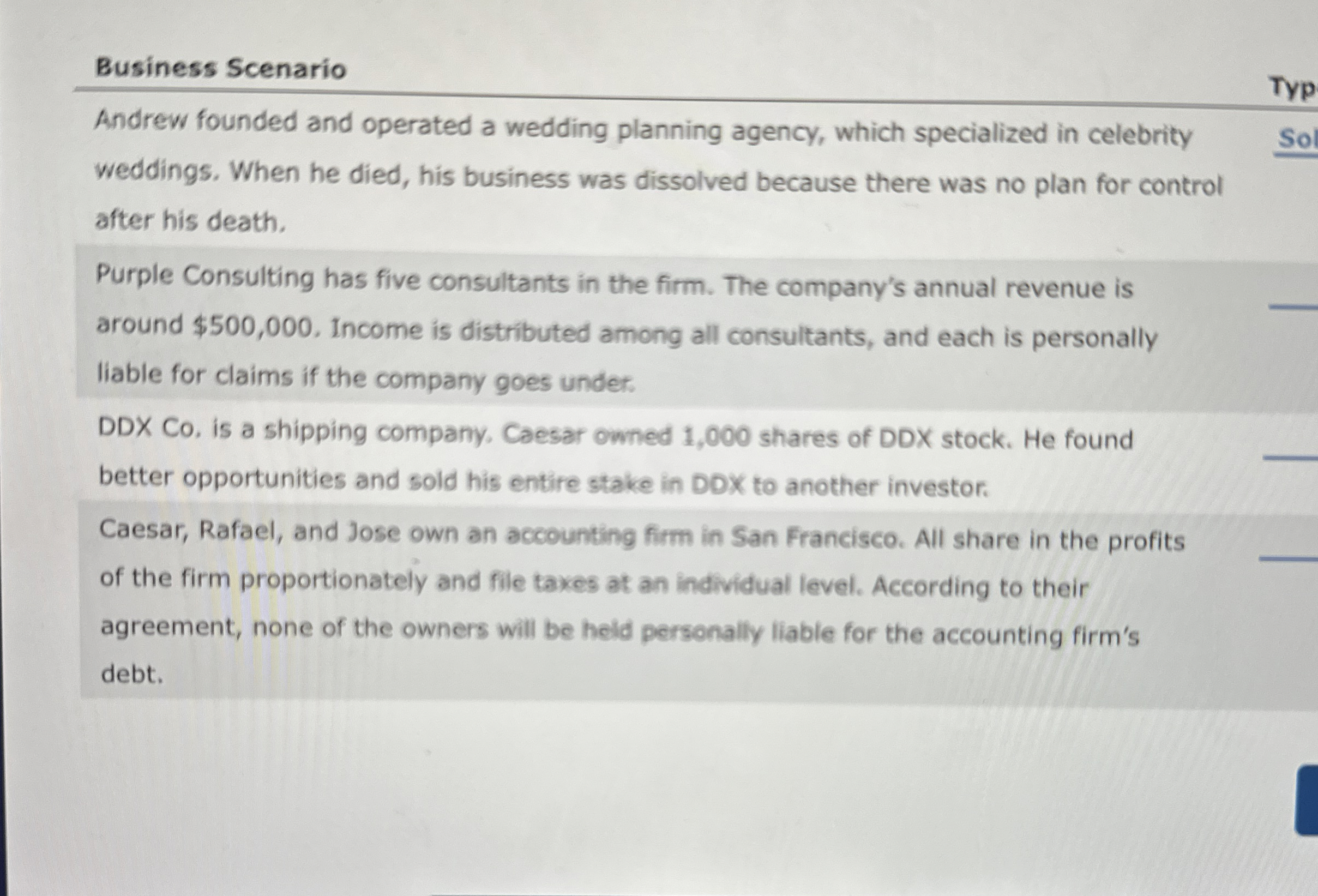

Andrew founded and operated a wedding planning agency, which specialized in celebrity weddings. When he died, his business was dissolved because there was no plan for control after his death.

Purple Consulting has five consultants in the firm. The company's annual revenue is around $ Income is distributed among all consultants, and each is personally liable for claims if the company goes under.

DDX Co is a shipping company, Caesar owned shares of DDX stock. He found better opportunities and sold his entire stake in DDX to another investor.

Caesar, Rafael, and Jose own an accounting firm in San Francisco. All share in the profits of the firm proportionately and file taxes at an individual level. According to their agreement, none of the owners will be held personally liable for the accounting firm's debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started