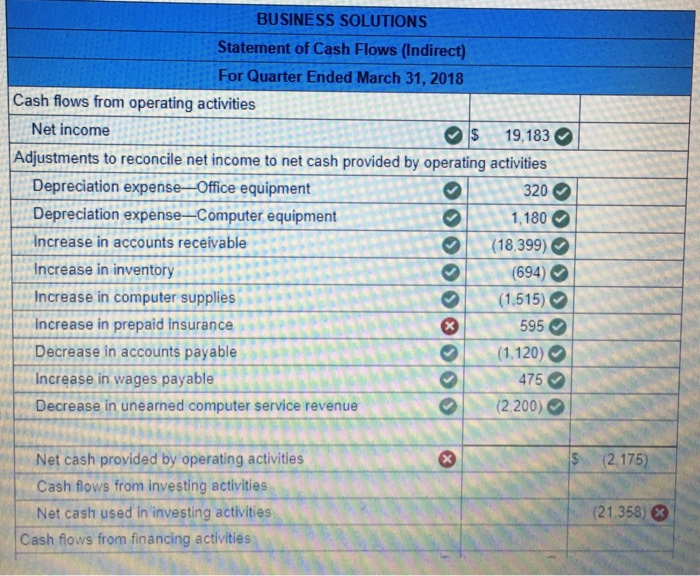

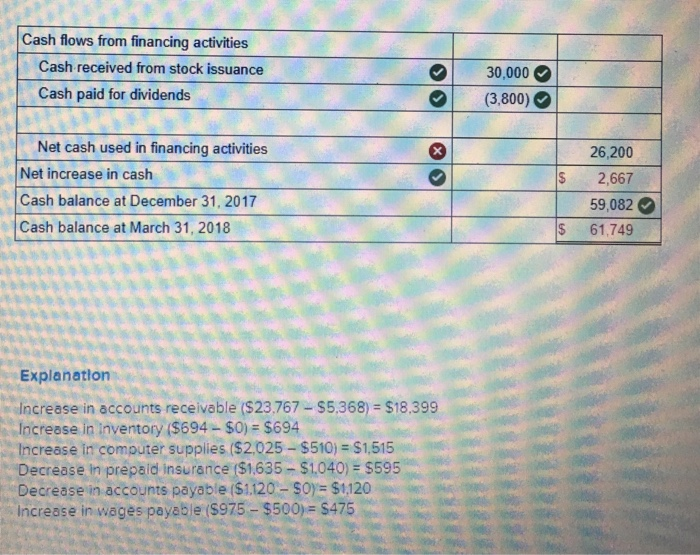

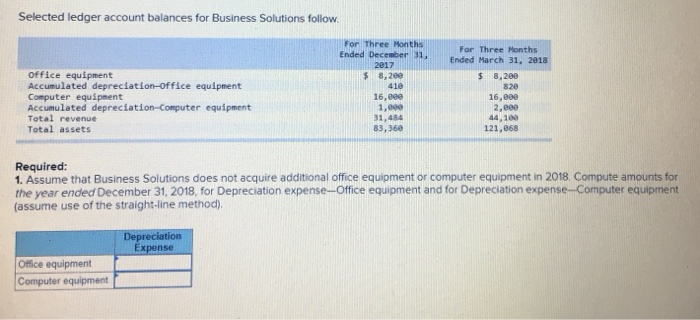

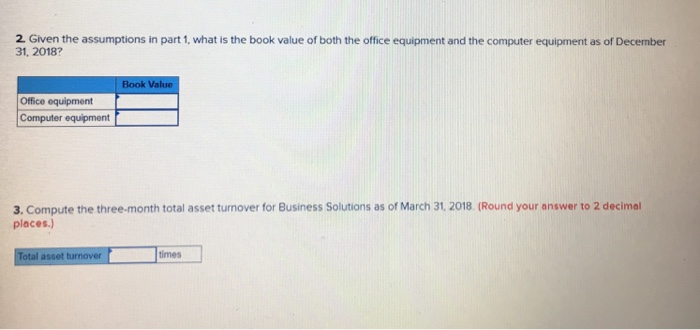

BUSINESS SOLUTIONS Statement of Cash Flows (Indirect) For Quarter Ended March 31, 2018 Cash flows from operating activities Net income S 19,183 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense- Office equipment Depreciation expense-Computer equipment Increase in accounts receivable Increase in inventory Increase in computer supplies Increase in prepaid insurance Decrease in accounts payable Increase in wages payable Decrease in unearned computer service revenue 320 1,180 (18 399) 694) (1.515) 595 (1,120) 475 (2.200) Net cash provided by operating activities Cash flows from investing activities Net cash used in investing activities S (2 175) (21.358) Cash flows from financing activities Cash flows from financing activities Cash received from stock issuance 30,000 (3,800) Cash paid for dividends Net cash used in financing activities Net increase in cash Cash balance at December 31, 2017 Cash balance at March 31, 2018 26,200 2,667 59,082 $ 61,749 Explanaton Increase in accounts receivable ($23.767-$5368) = $18,399 Increase in inventory ($694- $0) $694 Increase in computer supplies ($2.025 $510) $1,515 Decrease in prpaid insurarce ($1635-$1.040) $595 Decrease in accounts payable $1.120- soE $1120 Increase in wages payable ($975-$500) $475 Selected ledger account balances for Business Solutions follow For Three Month:s Ended December 31+Ended March 31, 2818 For Three Honths 2017 Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets $ 8,2ee 416 16,800 1,e90 31,484 83,360 s 8,288 820 16,800 2, eee 44,100 121,068 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2018. Compute amounts for the year ended December 31, 2018, for Depreciation expense--Office equipment and for Depreciation expense Computer equipment (assume use of the straight-line method). Ex Office equipment Computer equipment 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2018? Office equipment Computer equipment 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2018. (Round your answer to 2 decimal places.) otal asset turnover times BUSINESS SOLUTIONS Statement of Cash Flows (Indirect) For Quarter Ended March 31, 2018 Cash flows from operating activities Net income S 19,183 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense- Office equipment Depreciation expense-Computer equipment Increase in accounts receivable Increase in inventory Increase in computer supplies Increase in prepaid insurance Decrease in accounts payable Increase in wages payable Decrease in unearned computer service revenue 320 1,180 (18 399) 694) (1.515) 595 (1,120) 475 (2.200) Net cash provided by operating activities Cash flows from investing activities Net cash used in investing activities S (2 175) (21.358) Cash flows from financing activities Cash flows from financing activities Cash received from stock issuance 30,000 (3,800) Cash paid for dividends Net cash used in financing activities Net increase in cash Cash balance at December 31, 2017 Cash balance at March 31, 2018 26,200 2,667 59,082 $ 61,749 Explanaton Increase in accounts receivable ($23.767-$5368) = $18,399 Increase in inventory ($694- $0) $694 Increase in computer supplies ($2.025 $510) $1,515 Decrease in prpaid insurarce ($1635-$1.040) $595 Decrease in accounts payable $1.120- soE $1120 Increase in wages payable ($975-$500) $475 Selected ledger account balances for Business Solutions follow For Three Month:s Ended December 31+Ended March 31, 2818 For Three Honths 2017 Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Total assets $ 8,2ee 416 16,800 1,e90 31,484 83,360 s 8,288 820 16,800 2, eee 44,100 121,068 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2018. Compute amounts for the year ended December 31, 2018, for Depreciation expense--Office equipment and for Depreciation expense Computer equipment (assume use of the straight-line method). Ex Office equipment Computer equipment 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2018? Office equipment Computer equipment 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2018. (Round your answer to 2 decimal places.) otal asset turnover times