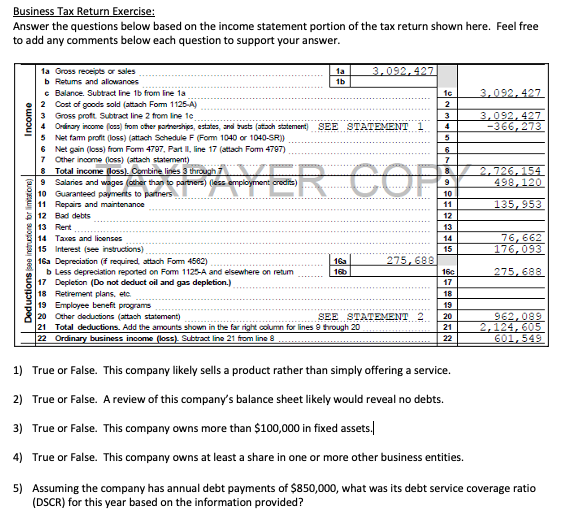

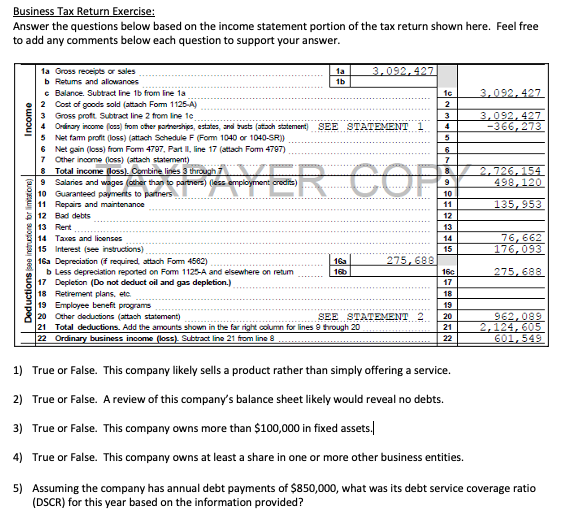

Business Tax Return Exercise: Answer the questions below based on the income statement portion of the tax return shown here. Feel free to add any comments below each question to support your answer. 3.092.427 Income 3,092, 427 -366, 273 laR cort 2,726. 154 498, 120 9 1a Gross receipts or sales 1a 3.092,427 b Reums and allowances 1b c Balance. Subtract line 1b from line 13 1c 2 Cost of goods sold (sittach Form 1125-A) 2 3 Gross proft Subtract line 2 from line 10 3 4 Ordinary income foss) from other partnerships, estates and sustatach statement SEE STATEMENT 1 4 5 Netfam profit loss) (attach Schedule F Fom 1040 or 1040-SR)) 5 6 Net gain (loss) from Form 4797, Part 1, line 17 (attach Form 4797) 6 7 Other income (loss) (attach statement) 7 8 Total income (loss). Combine lines 3 through 7 9 Salaries and wages (other than to partners) (less employmen credits 10 Guaranteed payments to partners 11 Repairs and maintenance 11 12 Bad debts 12 13 Rent 13 14 Taxes and licenses 14 15 Interest (see instructions) 15 16a Depreciation (f required. attach Form 4562) 16a 275, 688 b Less depreciation reported on Form 1125-A and elsewhere on retum 16 16c 17 Depletion (Do not deduct oil and gas depletion.) 17 18 Retirement plans, etc. 18 19 Employee beneft program 19 20 Other deductions (attach statement) SEE STATEMENT 2 20 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 21 22 Ordinary business income (loss). Subtract line 21 from line 8 22 135, 953 Deductions see instructions for imitations) 76,662 176,093 275, 688 962,089 2,124, 605 601,549 1) True or False. This company likely sells a product rather than simply offering a service. 2) True or False. A review of this company's balance sheet likely would reveal no debts. 3) True or False. This company owns more than $100,000 in fixed assets./ 4) True or False. This company owns at least a share in one or more other business entities. 5) Assuming the company has annual debt payments of $850,000, what was its debt service coverage ratio (DSCR) for this year based on the information provided? Business Tax Return Exercise: Answer the questions below based on the income statement portion of the tax return shown here. Feel free to add any comments below each question to support your answer. 3.092.427 Income 3,092, 427 -366, 273 laR cort 2,726. 154 498, 120 9 1a Gross receipts or sales 1a 3.092,427 b Reums and allowances 1b c Balance. Subtract line 1b from line 13 1c 2 Cost of goods sold (sittach Form 1125-A) 2 3 Gross proft Subtract line 2 from line 10 3 4 Ordinary income foss) from other partnerships, estates and sustatach statement SEE STATEMENT 1 4 5 Netfam profit loss) (attach Schedule F Fom 1040 or 1040-SR)) 5 6 Net gain (loss) from Form 4797, Part 1, line 17 (attach Form 4797) 6 7 Other income (loss) (attach statement) 7 8 Total income (loss). Combine lines 3 through 7 9 Salaries and wages (other than to partners) (less employmen credits 10 Guaranteed payments to partners 11 Repairs and maintenance 11 12 Bad debts 12 13 Rent 13 14 Taxes and licenses 14 15 Interest (see instructions) 15 16a Depreciation (f required. attach Form 4562) 16a 275, 688 b Less depreciation reported on Form 1125-A and elsewhere on retum 16 16c 17 Depletion (Do not deduct oil and gas depletion.) 17 18 Retirement plans, etc. 18 19 Employee beneft program 19 20 Other deductions (attach statement) SEE STATEMENT 2 20 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 21 22 Ordinary business income (loss). Subtract line 21 from line 8 22 135, 953 Deductions see instructions for imitations) 76,662 176,093 275, 688 962,089 2,124, 605 601,549 1) True or False. This company likely sells a product rather than simply offering a service. 2) True or False. A review of this company's balance sheet likely would reveal no debts. 3) True or False. This company owns more than $100,000 in fixed assets./ 4) True or False. This company owns at least a share in one or more other business entities. 5) Assuming the company has annual debt payments of $850,000, what was its debt service coverage ratio (DSCR) for this year based on the information provided