Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adele lives in South Africa and faces the following tax on her income (table 1) The currency is ZAR and you may assume 1

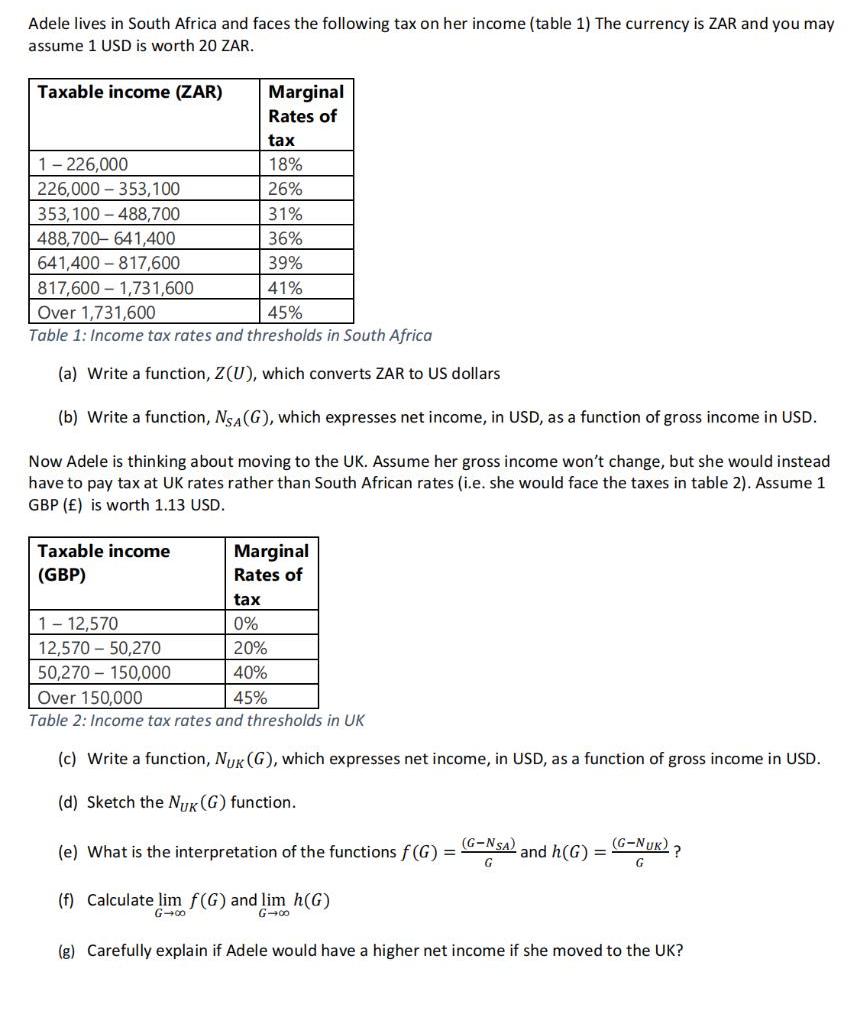

Adele lives in South Africa and faces the following tax on her income (table 1) The currency is ZAR and you may assume 1 USD is worth 20 ZAR. Marginal Taxable income (ZAR) Rates of tax 1-226,000 18% 226,000 353,100 26% 353,100 488,700 31% 488,700-641,400 36% 641,400 817,600 39% 817,600 1,731,600 41% Over 1,731,600 45% Table 1: Income tax rates and thresholds in South Africa (a) Write a function, Z(U), which converts ZAR to US dollars (b) Write a function, NSA (G), which expresses net income, in USD, as a function of gross income in USD. Now Adele is thinking about moving to the UK. Assume her gross income won't change, but she would instead have to pay tax at UK rates rather than South African rates (i.e. she would face the taxes in table 2). Assume 1 GBP () is worth 1.13 USD. Taxable income (GBP) Marginal Rates of tax 1-12,570 0% 12,570 - 50,270 20% 50,270 150,000 40% Over 150,000 45% Table 2: Income tax rates and thresholds in UK (c) Write a function, NUK (G), which expresses net income, in USD, as a function of gross income in USD. (d) Sketch the NUK (G) function. (G-NSA) (e) What is the interpretation of the functions f(G) = and h(G): (G-NUK) = 2? (f) Calculate lim f(G) and lim h(G) G-00 G-00 (g) Carefully explain if Adele would have a higher net income if she moved to the UK?

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a ZU U20 b NSAG if G 22600020 082G else if G 35310020 074G else if G 48...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started