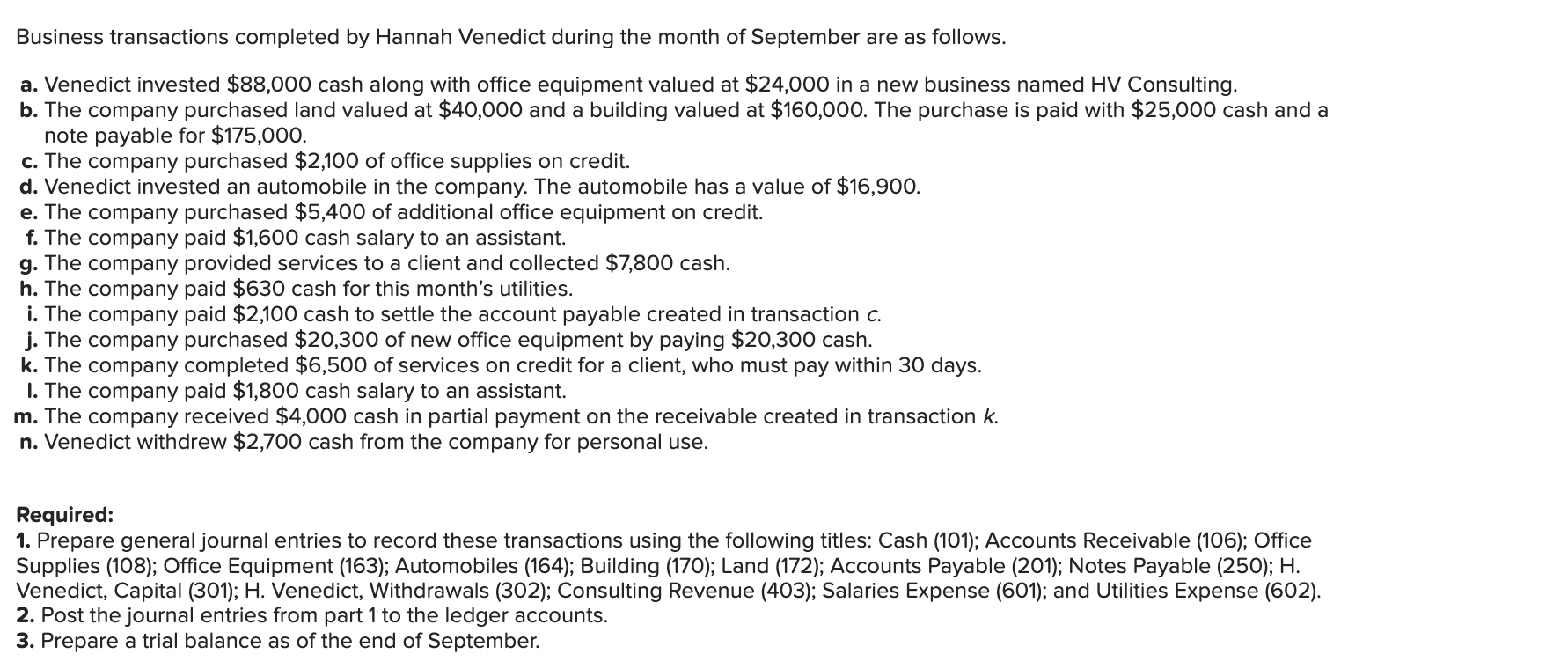

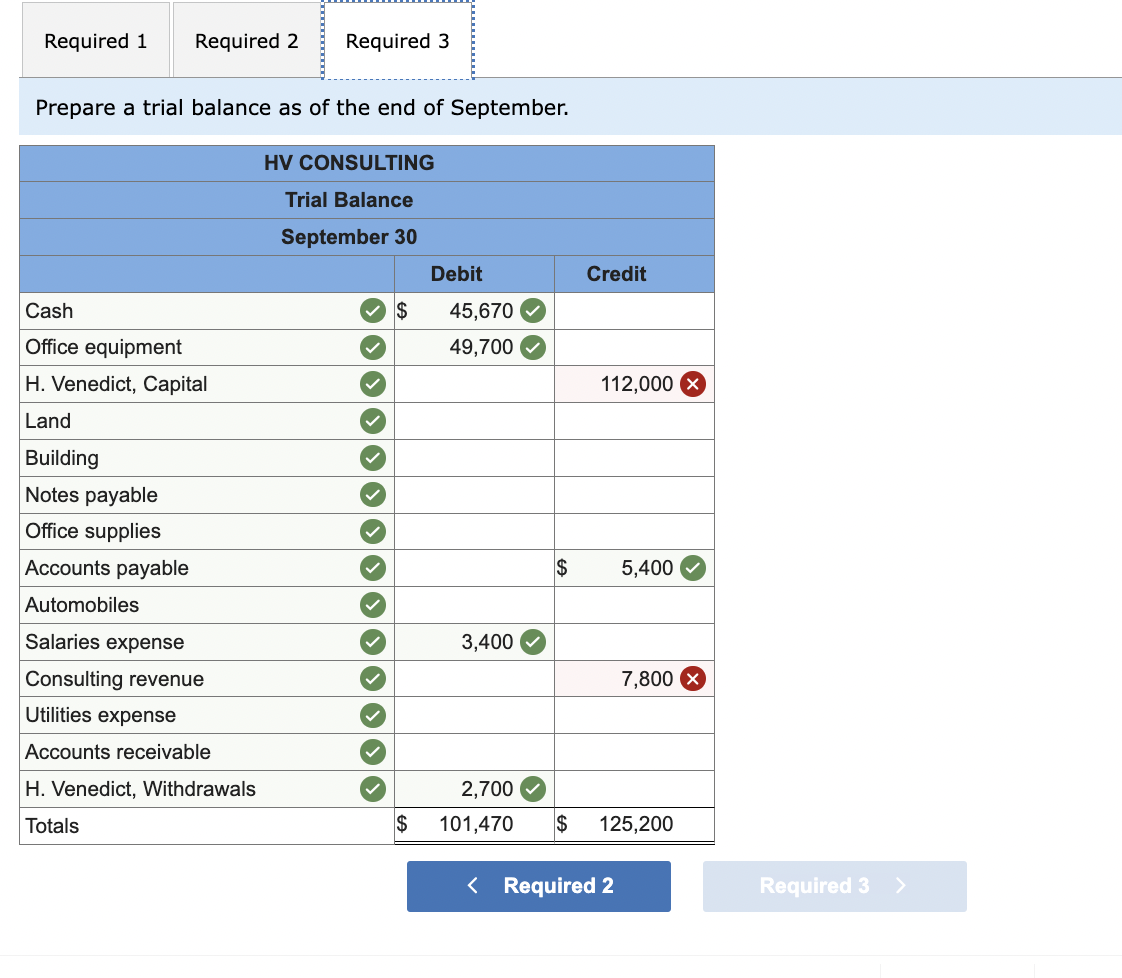

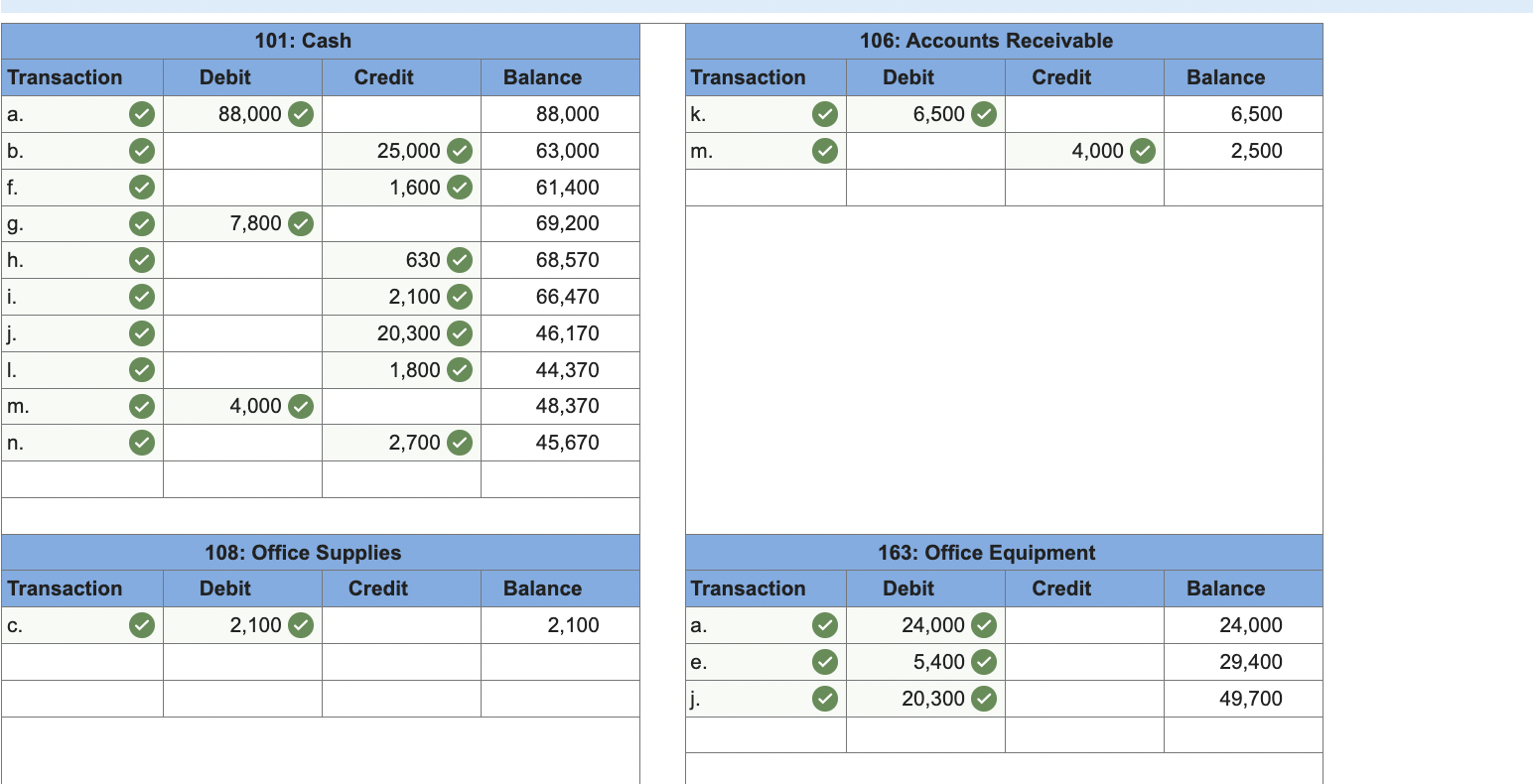

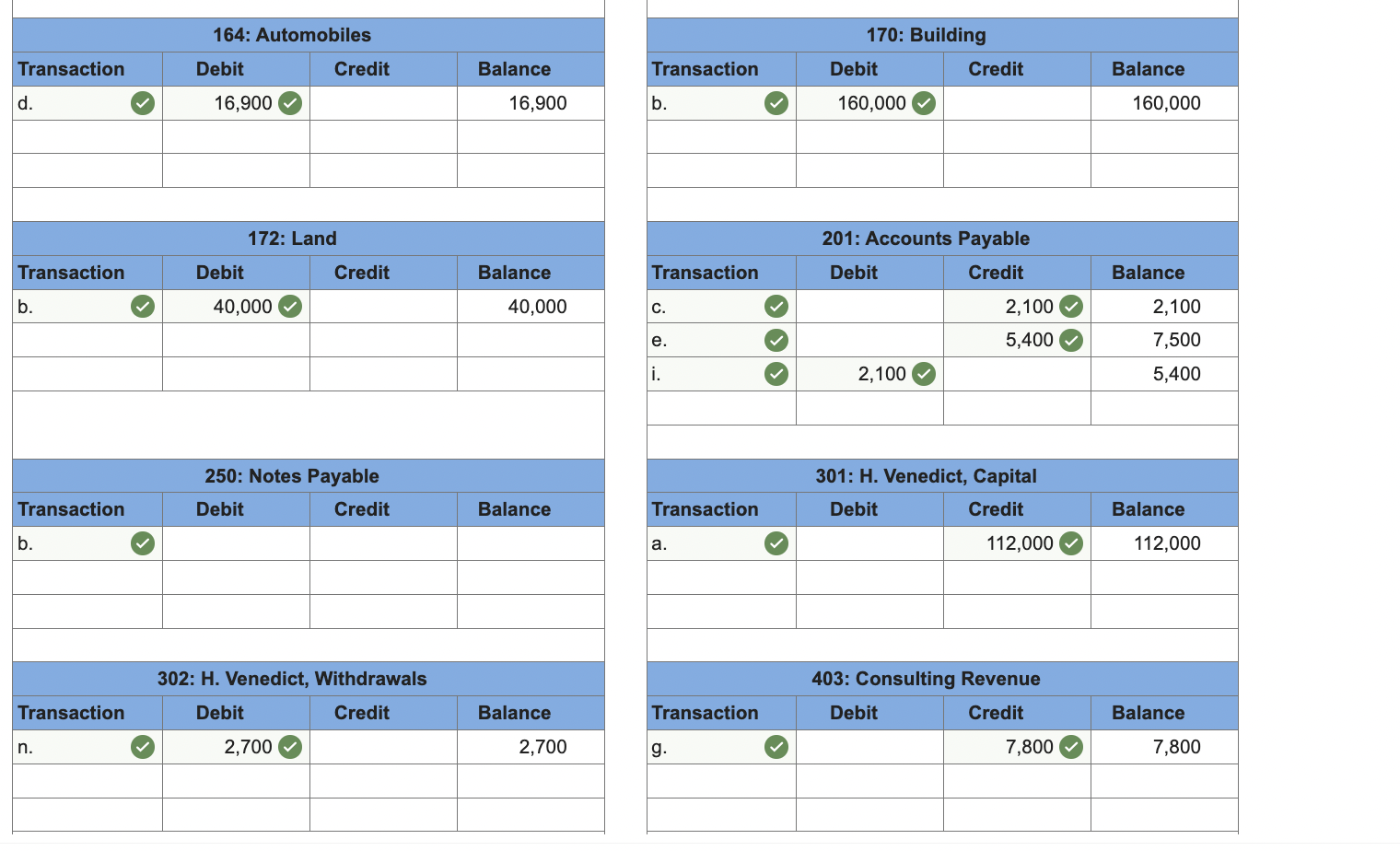

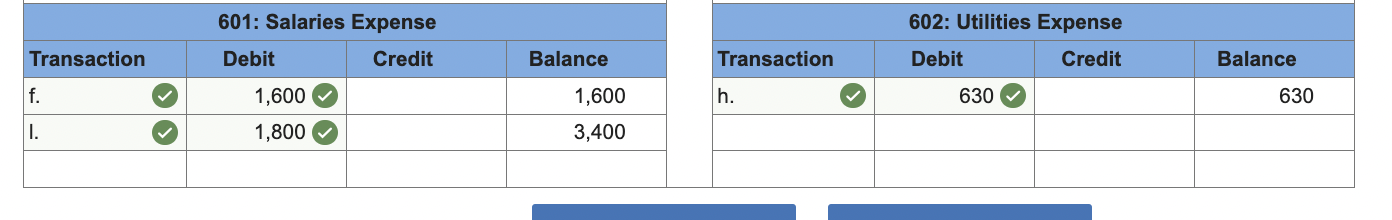

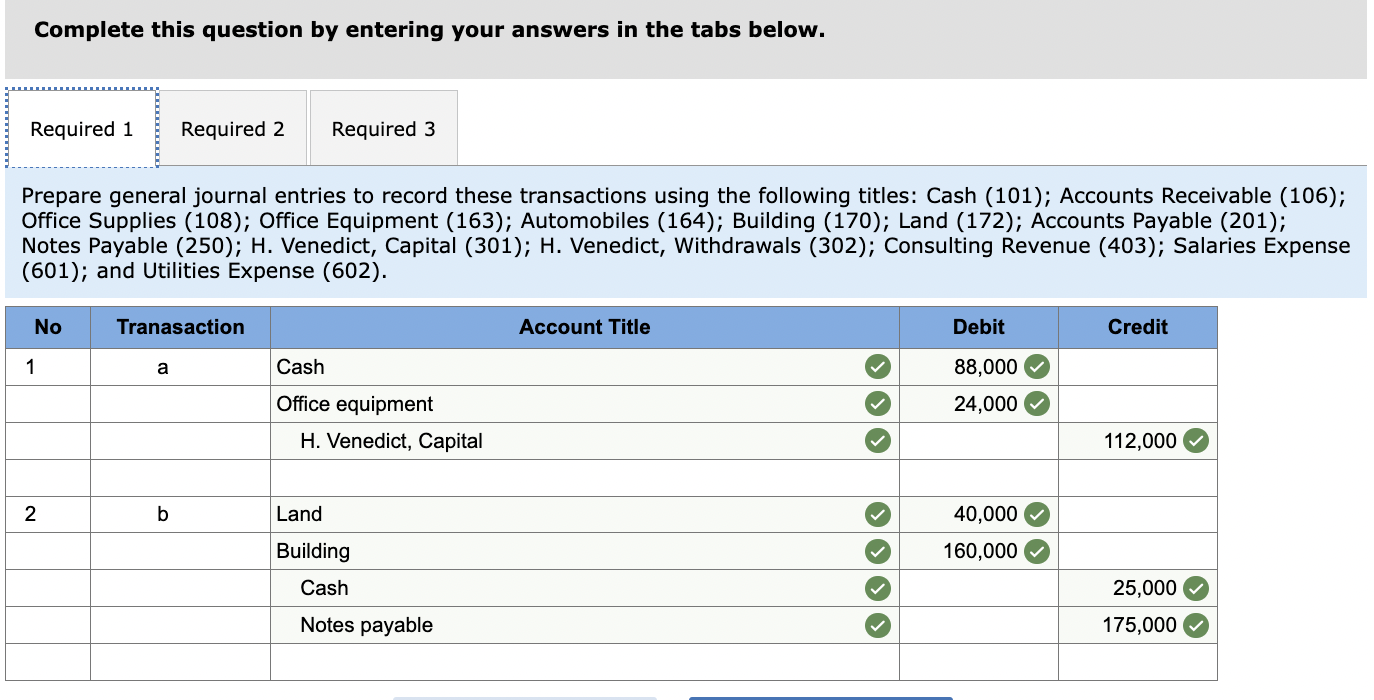

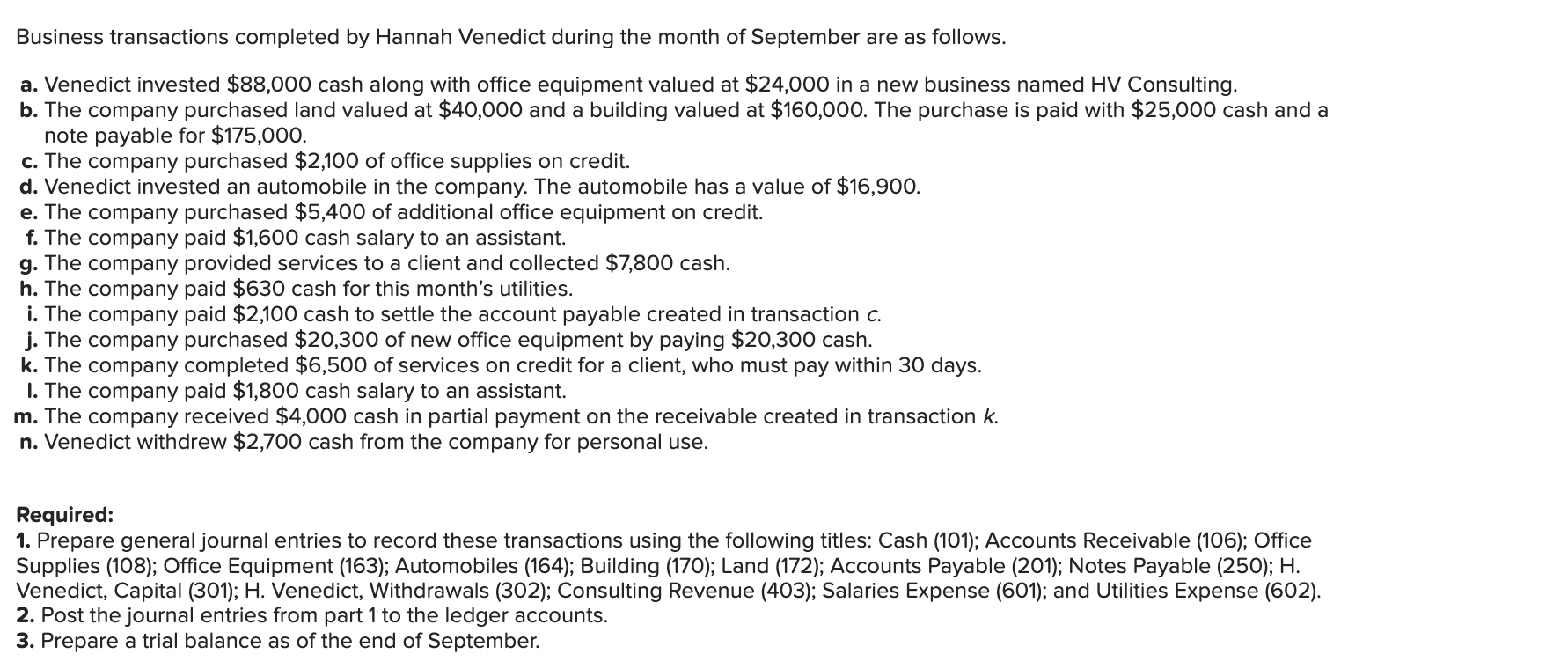

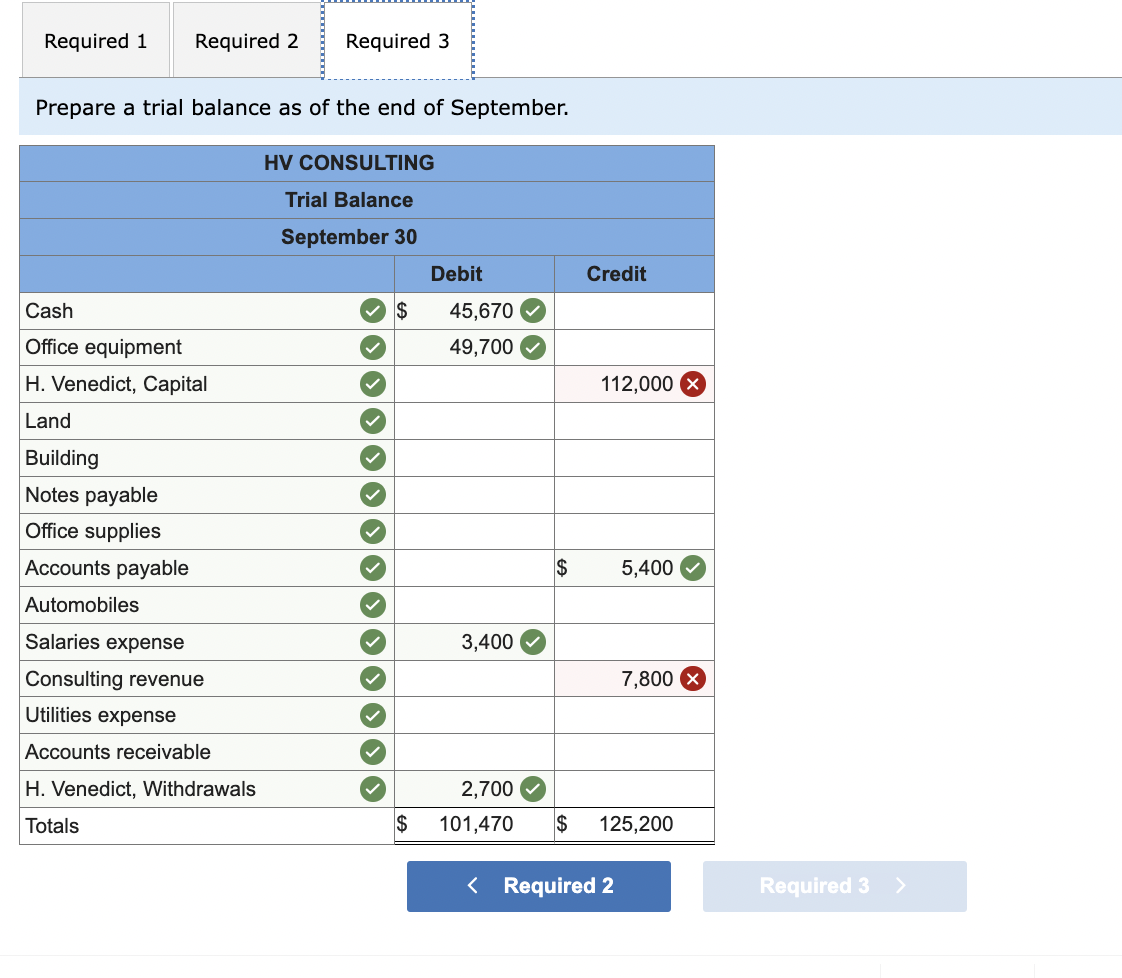

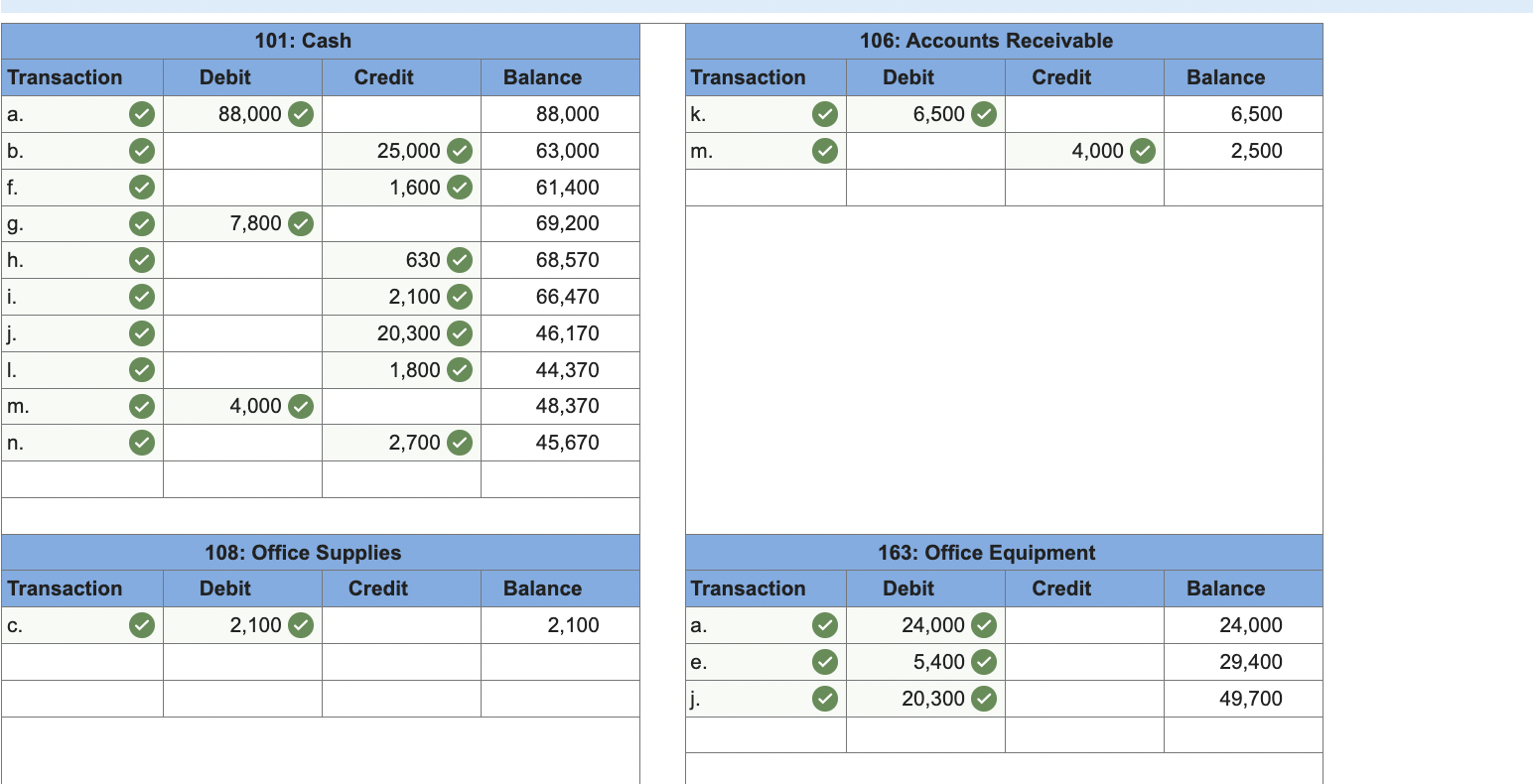

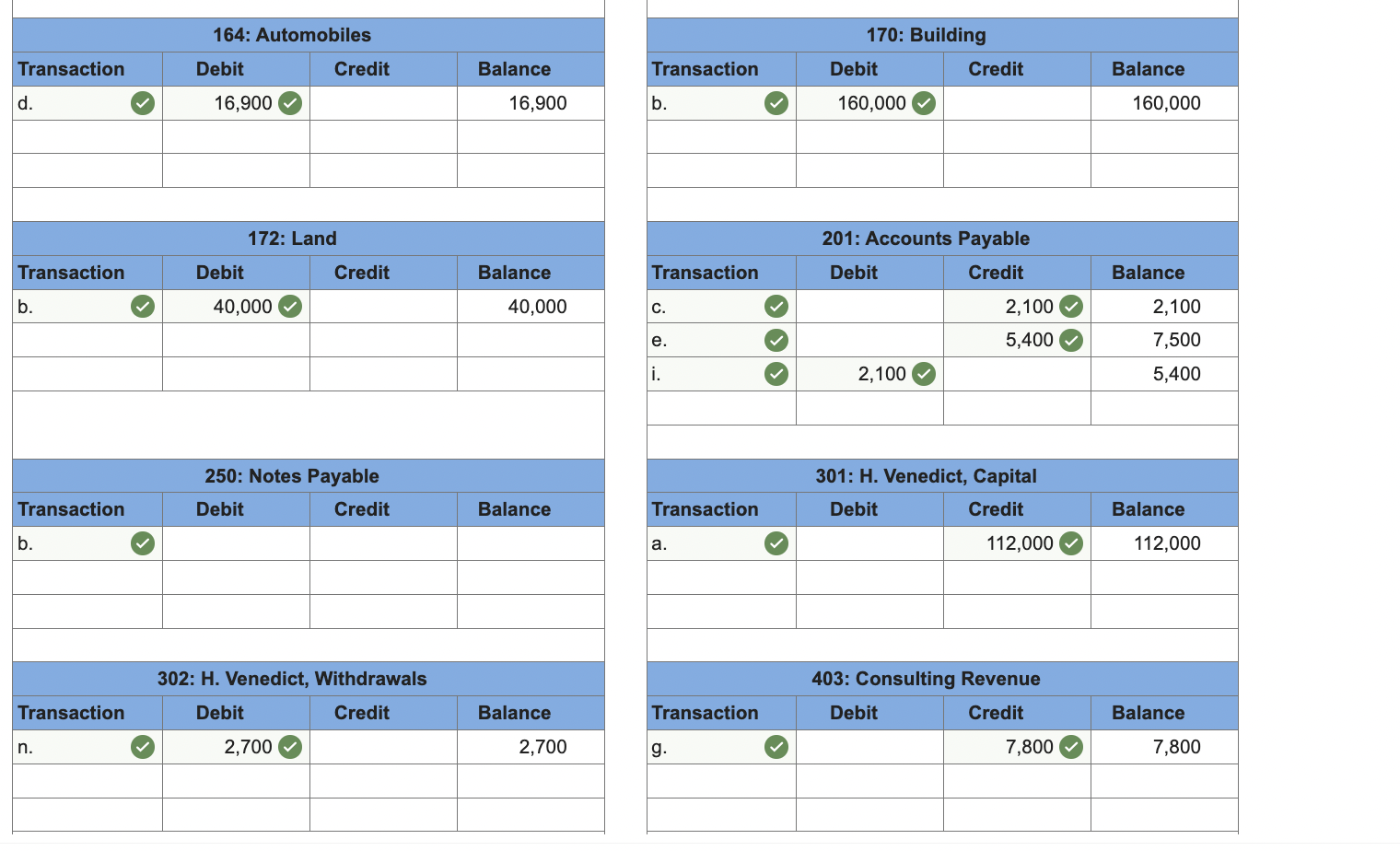

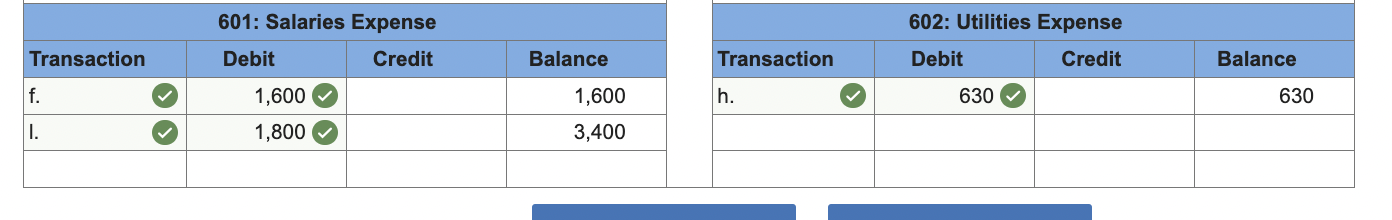

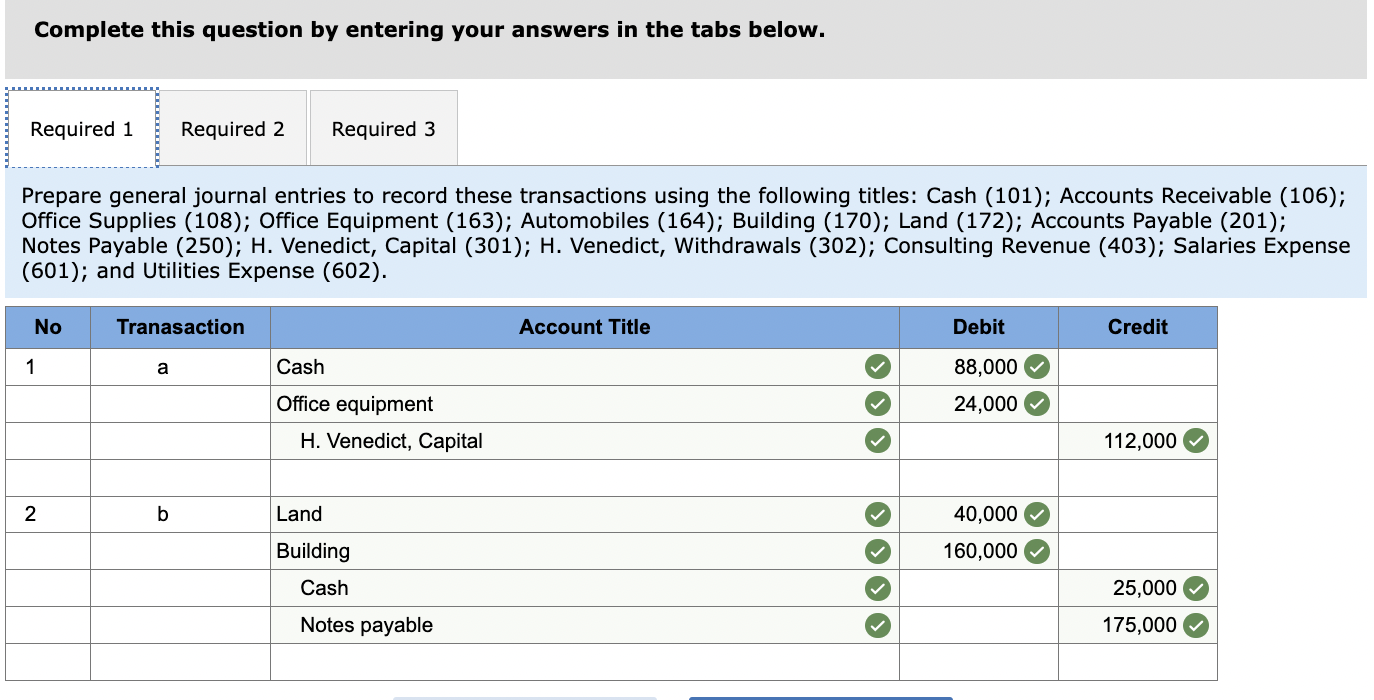

Business transactions completed by Hannah Venedict during the month of September are as follows. a. Venedict invested $88,000 cash along with office equipment valued at $24,000 in a new business named HV Consulting. b. The company purchased land valued at $40,000 and a building valued at $160,000. The purchase is paid with $25,000 cash and a note payable for $175,000. c. The company purchased $2,100 of office supplies on credit. d. Venedict invested an automobile in the company. The automobile has a value of $16,900. e. The company purchased $5,400 of additional office equipment on credit. f. The company paid $1,600 cash salary to an assistant. g. The company provided services to a client and collected $7,800 cash. h. The company paid $630 cash for this month's utilities. i. The company paid $2,100 cash to settle the account payable created in transaction c. j. The company purchased $20,300 of new office equipment by paying $20,300 cash. k. The company completed $6,500 of services on credit for a client, who must pay within 30 days. I. The company paid $1,800 cash salary to an assistant. m. The company received $4,000 cash in partial payment on the receivable created in transaction k. n. Venedict withdrew $2,700 cash from the company for personal use. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (108); Office Equipment (163); Automobiles (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); H. Venedict, Capital (301); H. Venedict, Withdrawals (302); Consulting Revenue (403); Salaries Expense (601); and Utilities Expense (602). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of September. Prepare a trial balance as of the end of September. \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ 601: Salaries Expense } \\ \hline \multicolumn{1}{|l|}{ Transaction } & Debit & Credit & Balance \\ \hline f. & & 1,600 & & 1,600 \\ \hline I. & & 1,800 & & 3,400 \\ \hline & & & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (10 Office Supplies (108); Office Equipment (163); Automobiles (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); H. Venedict, Capital (301); H. Venedict, Withdrawals (302); Consulting Revenue (403); Salaries Expe (601); and Utilities Expense (602)