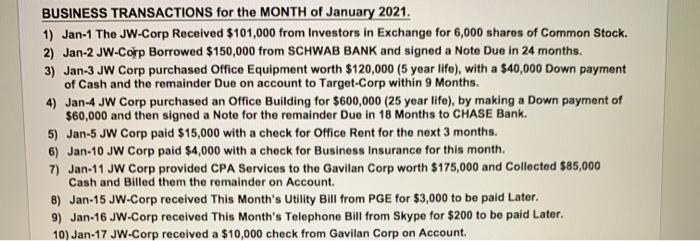

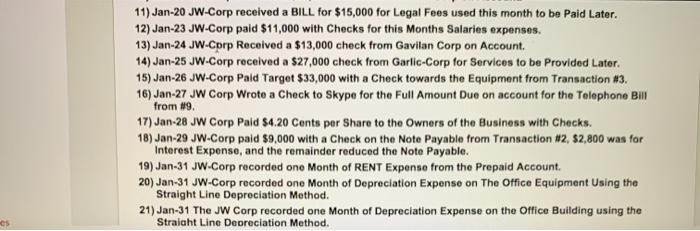

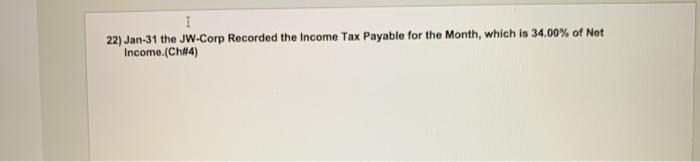

BUSINESS TRANSACTIONS for the MONTH of January 2021. 1) Jan-1 The JW-Corp Received $101,000 from Investors in Exchange for 6,000 shares of Common Stock. 2) Jan-2 JW-Corp Borrowed $150,000 from SCHWAB BANK and signed a Note Due in 24 months. 3) Jan-3 JW Corp purchased Office Equipment worth $120,000 (5 year life), with a $40,000 Down payment of Cash and the remainder Due on account to Target-Corp within 9 Months. 4) Jan-4 JW Corp purchased an Office Building for $600,000 (25 year life), by making a Down payment of $60,000 and then signed a Note for the remainder Due in 18 Months to CHASE Bank. 5) Jan-5 JW Corp paid $15,000 with a check for Office Rent for the next 3 months. 6) Jan-10 JW Corp paid $4,000 with a check for Business Insurance for this month. 7) Jan-11 JW Corp provided CPA Services to the Gavilan Corp worth $175,000 and Collected $85,000 Cash and Billed them the remainder on Account. 8) Jan-15 JW-Corp received This Month's Utility Bill from PGE for $3,000 to be paid Later. 9) Jan 16 JW-Corp received This Month's Telephone Bill from Skype for $200 to be paid Later. 10) Jan-17 JW-Corp received a $10,000 check from Gavilan Corp on Account 11) Jan-20 JW-Corp received a BILL for $15,000 for Legal Fees used this month to be paid Later. 12) Jan-23 JW-Corp paid $11,000 with Checks for this Months Salaries expenses. 13) Jan-24 JW-Corp Received a $13,000 check from Gavilan Corp on Account 14) Jan-25 JW-Corp received a $27,000 check from Garlic-Corp for Services to be provided Later. 15) Jan-26 JW-Corp Pald Target $33,000 with a Check towards the Equipment from Transaction #3. 16) Jan-27 JW Corp Wrote a Check to Skype for the Full Amount Due on account for the Telephone Bill from $9. 17) Jan-28 JW Corp Paid $4.20 Cents per Share to the Owners of the Business with Checks. 18) Jan 29 JW-Corp paid $9,000 with a Check on the Note Payable from Transaction #2, 52,800 was for Interest Expense, and the remainder reduced the Note Payable. 19) Jan-31 JW-Corp recorded ono Month of RENT Expense from the Prepaid Account 20) Jan-31 JW-Corp recorded one Month of Depreciation Expense on The Office Equipment Using the Straight Line Depreciation Method. 21) Jan-31 The JW Corp recorded one Month of Depreciation Expense on the Office Building using the Straight Line Depreciation Method. 1 22) Jan-31 the JW-Corp Recorded the Income Tax Payable for the Month, which is 34.00% of Net Income.(Ch#4) BUSINESS TRANSACTIONS for the MONTH of January 2021. 1) Jan-1 The JW-Corp Received $101,000 from Investors in Exchange for 6,000 shares of Common Stock. 2) Jan-2 JW-Corp Borrowed $150,000 from SCHWAB BANK and signed a Note Due in 24 months. 3) Jan-3 JW Corp purchased Office Equipment worth $120,000 (5 year life), with a $40,000 Down payment of Cash and the remainder Due on account to Target-Corp within 9 Months. 4) Jan-4 JW Corp purchased an Office Building for $600,000 (25 year life), by making a Down payment of $60,000 and then signed a Note for the remainder Due in 18 Months to CHASE Bank. 5) Jan-5 JW Corp paid $15,000 with a check for Office Rent for the next 3 months. 6) Jan-10 JW Corp paid $4,000 with a check for Business Insurance for this month. 7) Jan-11 JW Corp provided CPA Services to the Gavilan Corp worth $175,000 and Collected $85,000 Cash and Billed them the remainder on Account. 8) Jan-15 JW-Corp received This Month's Utility Bill from PGE for $3,000 to be paid Later. 9) Jan 16 JW-Corp received This Month's Telephone Bill from Skype for $200 to be paid Later. 10) Jan-17 JW-Corp received a $10,000 check from Gavilan Corp on Account 11) Jan-20 JW-Corp received a BILL for $15,000 for Legal Fees used this month to be paid Later. 12) Jan-23 JW-Corp paid $11,000 with Checks for this Months Salaries expenses. 13) Jan-24 JW-Corp Received a $13,000 check from Gavilan Corp on Account 14) Jan-25 JW-Corp received a $27,000 check from Garlic-Corp for Services to be provided Later. 15) Jan-26 JW-Corp Pald Target $33,000 with a Check towards the Equipment from Transaction #3. 16) Jan-27 JW Corp Wrote a Check to Skype for the Full Amount Due on account for the Telephone Bill from $9. 17) Jan-28 JW Corp Paid $4.20 Cents per Share to the Owners of the Business with Checks. 18) Jan 29 JW-Corp paid $9,000 with a Check on the Note Payable from Transaction #2, 52,800 was for Interest Expense, and the remainder reduced the Note Payable. 19) Jan-31 JW-Corp recorded ono Month of RENT Expense from the Prepaid Account 20) Jan-31 JW-Corp recorded one Month of Depreciation Expense on The Office Equipment Using the Straight Line Depreciation Method. 21) Jan-31 The JW Corp recorded one Month of Depreciation Expense on the Office Building using the Straight Line Depreciation Method. 1 22) Jan-31 the JW-Corp Recorded the Income Tax Payable for the Month, which is 34.00% of Net Income.(Ch#4)