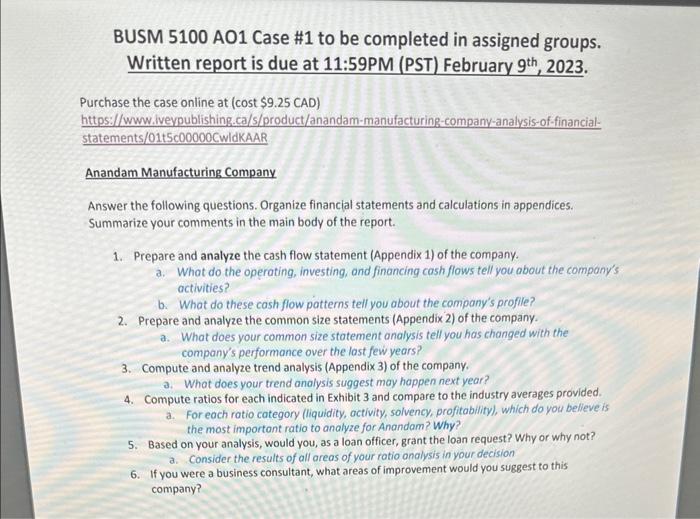

BUSM 5100 A01 Case \#1 to be completed in assigned groups. Written report is due at 11:59PM (PST) February 9th,2023. Purchase the case online at (cost \$9.25 CAD) https://www.iveypublishing.ca/s/product/anandam-manufacturing-company-analysis-of-financialstatements/01t5c00000CwldKAAR Anandam Manufacturing Company Answer the following questions. Organize financial statements and calculations in appendices. Summarize your comments in the main body of the report. 1. Prepare and analyze the cash flow statement (Appendix 1) of the company. a. What do the operating, investing, and financing cash flows tell you about the company's octivities? b. What do these cash flow patterns tell you about the company's profile? 2. Prepare and analyze the common size statements (Appendix 2) of the company. a. What does your common size statement analysis tell you has changed with the company's performance over the last few years? 3. Compute and analyze trend analysis (Appendix 3) of the company. a. What does your trend anolysis suggest moy happen next year? 4. Compute ratios for each indicated in Exhibit 3 and compare to the industry averages provided. a. For each ratio category (liquidity, activity, solvency, profitability), which do you believe is the most important ratio to analyze for Anandam? Why? 5. Based on your analysis, would you, as a loan officer, grant the loan request? Why or why not? a. Consider the results of all areas of your ratio analysis in your decision 6. If you were a business consultant, what areas of improvement would you suggest to this company? BUSM 5100 A01 Case \#1 to be completed in assigned groups. Written report is due at 11:59PM (PST) February 9th,2023. Purchase the case online at (cost \$9.25 CAD) https://www.iveypublishing.ca/s/product/anandam-manufacturing-company-analysis-of-financialstatements/01t5c00000CwldKAAR Anandam Manufacturing Company Answer the following questions. Organize financial statements and calculations in appendices. Summarize your comments in the main body of the report. 1. Prepare and analyze the cash flow statement (Appendix 1) of the company. a. What do the operating, investing, and financing cash flows tell you about the company's octivities? b. What do these cash flow patterns tell you about the company's profile? 2. Prepare and analyze the common size statements (Appendix 2) of the company. a. What does your common size statement analysis tell you has changed with the company's performance over the last few years? 3. Compute and analyze trend analysis (Appendix 3) of the company. a. What does your trend anolysis suggest moy happen next year? 4. Compute ratios for each indicated in Exhibit 3 and compare to the industry averages provided. a. For each ratio category (liquidity, activity, solvency, profitability), which do you believe is the most important ratio to analyze for Anandam? Why? 5. Based on your analysis, would you, as a loan officer, grant the loan request? Why or why not? a. Consider the results of all areas of your ratio analysis in your decision 6. If you were a business consultant, what areas of improvement would you suggest to this company