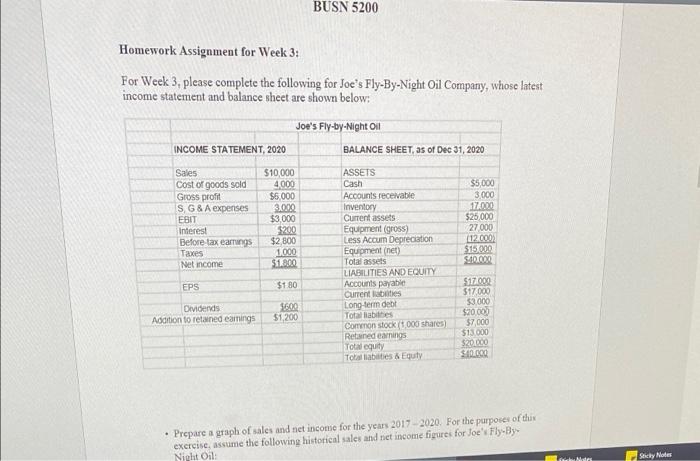

BUSN 5200 Homework Assignment for Week 3: For Week 3, please complete the following for Joe's Fly-By-Night Oil Company, whose latest income statement and balance sheet are shown below: Joe's Fly-by-Night Oil INCOME STATEMENT 2020 BALANCE SHEET, as of Dec 31, 2020 Sales $10,000 ASSETS Cost of goods sold 4000 Cash $5,000 Gross profit $5,000 Accounts receivable 3.000 SG & A expenses 3.000 Inventory 17.000 EBIT $3.000 Current assets $25,000 Interest 9200 Equipment (gross) 27 000 Before taxearings $2,800 Less Accum Depreciation 12.000 Taxes 1000 Equipment (net) $15.000 Net income $1800 Total assets SO LIABILITIES AND EQUITY EPS $180 Accounts payable $17.000 Current Rabilities 517.000 Dividends 16.00 Long-term debe $3.000 Addition to retained earnings $1,200 Total bilbes $20.00 Common stock/t.000 shares) $7.000 Retained earnings $13 000 Total equity Totalbes & Equity SO $20.000 Prepare a graph of sales and set income for the years 2017-2020. For the purposes of this exercise, assume the following historical sales and niet income figures for Joe's Fly By Night Oil: de Sticky Notes Prepare a pie chart of Joe's Fly By Night Oil's asset distribution for Dec 31, 2020 and comment on the results displayed Prepare a pie chart of Joe's Fly-ByNight Oil's capital structure for Dec 31, 2020 and comment on the results displayed Note: Be sure to comment on each of the four grapha. The mamber men little without your explanatory comments, BUSN 5200 Homework Assignment for Week 3: For Week 3, please complete the following for Joe's Fly-By-Night Oil Company, whose latest income statement and balance sheet are shown below: Joe's Fly-by-Night Oil INCOME STATEMENT 2020 BALANCE SHEET, as of Dec 31, 2020 Sales $10,000 ASSETS Cost of goods sold 4000 Cash $5,000 Gross profit $5,000 Accounts receivable 3.000 SG & A expenses 3.000 Inventory 17.000 EBIT $3.000 Current assets $25,000 Interest 9200 Equipment (gross) 27 000 Before taxearings $2,800 Less Accum Depreciation 12.000 Taxes 1000 Equipment (net) $15.000 Net income $1800 Total assets SO LIABILITIES AND EQUITY EPS $180 Accounts payable $17.000 Current Rabilities 517.000 Dividends 16.00 Long-term debe $3.000 Addition to retained earnings $1,200 Total bilbes $20.00 Common stock/t.000 shares) $7.000 Retained earnings $13 000 Total equity Totalbes & Equity SO $20.000 Prepare a graph of sales and set income for the years 2017-2020. For the purposes of this exercise, assume the following historical sales and niet income figures for Joe's Fly By Night Oil: de Sticky Notes Prepare a pie chart of Joe's Fly By Night Oil's asset distribution for Dec 31, 2020 and comment on the results displayed Prepare a pie chart of Joe's Fly-ByNight Oil's capital structure for Dec 31, 2020 and comment on the results displayed Note: Be sure to comment on each of the four grapha. The mamber men little without your explanatory comments