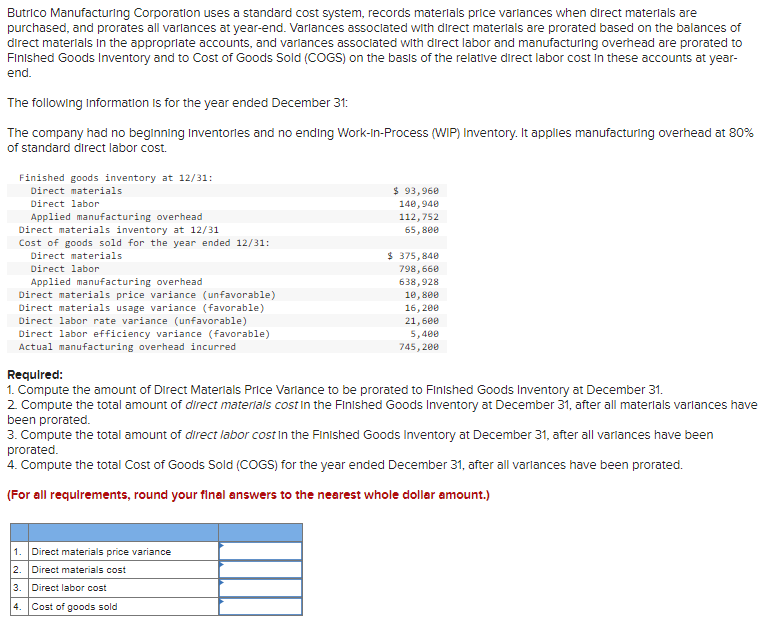

Butrico Manufacturing Corporation uses a standard cost system, records materlals price varlances when direct materlals are purchased, and prorates all varlances at year-end. Varlances assoclated with direct materlals are prorated based on the balances of direct materials in the approprlate accounts, and varlances associated with direct labor and manufacturing overhead are prorated to Finished Goods Inventory and to Cost of Goods Sold (COGS) on the basis of the relative direct labor cost in these accounts at yearend. The following information is for the year ended December 31 : The company had no beginning Inventorles and no ending Work-In-Process (WIP) Inventory. It applies manufacturing overhead at 80% of standard direct labor cost. Required: 1. Compute the amount of Direct Materlals Price Varlance to be prorated to Finished Goods Inventory at December 31. 2. Compute the total amount of dlrect materials cost in the Finished Goods Inventory at December 31 , after all materlals varlances have been prorated. 3. Compute the total amount of direct labor cost in the Finished Goods Inventory at December 31 , after all varlances have been prorated. 4. Compute the total Cost of Goods Sold (COGS) for the year ended December 31, after all varlances have been prorated. (For all requlrements, round your flnal answers to the nearest whole dollar amount.) Butrico Manufacturing Corporation uses a standard cost system, records materlals price varlances when direct materlals are purchased, and prorates all varlances at year-end. Varlances assoclated with direct materlals are prorated based on the balances of direct materials in the approprlate accounts, and varlances associated with direct labor and manufacturing overhead are prorated to Finished Goods Inventory and to Cost of Goods Sold (COGS) on the basis of the relative direct labor cost in these accounts at yearend. The following information is for the year ended December 31 : The company had no beginning Inventorles and no ending Work-In-Process (WIP) Inventory. It applies manufacturing overhead at 80% of standard direct labor cost. Required: 1. Compute the amount of Direct Materlals Price Varlance to be prorated to Finished Goods Inventory at December 31. 2. Compute the total amount of dlrect materials cost in the Finished Goods Inventory at December 31 , after all materlals varlances have been prorated. 3. Compute the total amount of direct labor cost in the Finished Goods Inventory at December 31 , after all varlances have been prorated. 4. Compute the total Cost of Goods Sold (COGS) for the year ended December 31, after all varlances have been prorated. (For all requlrements, round your flnal answers to the nearest whole dollar amount.)