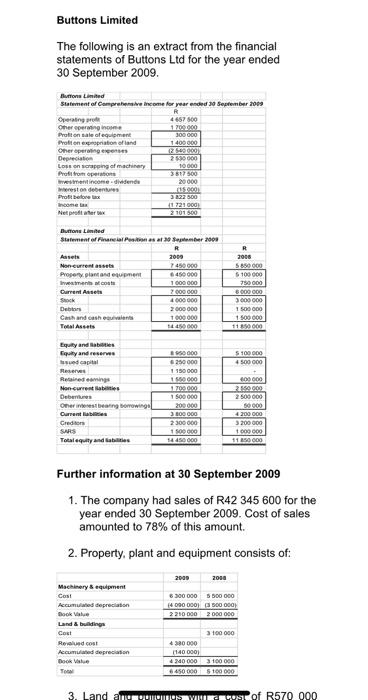

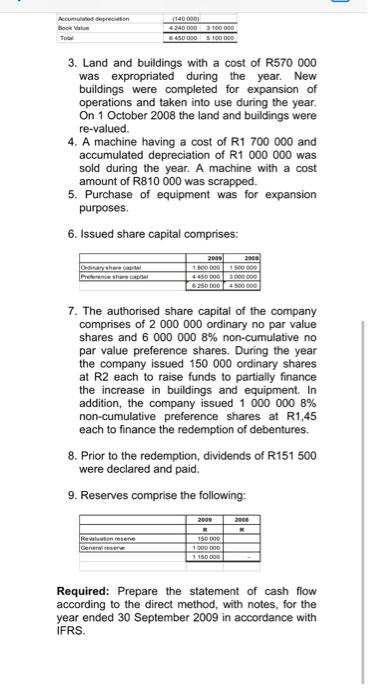

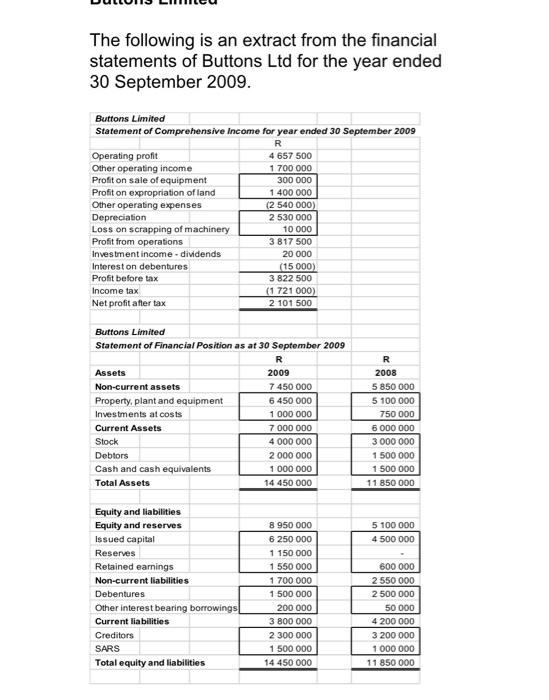

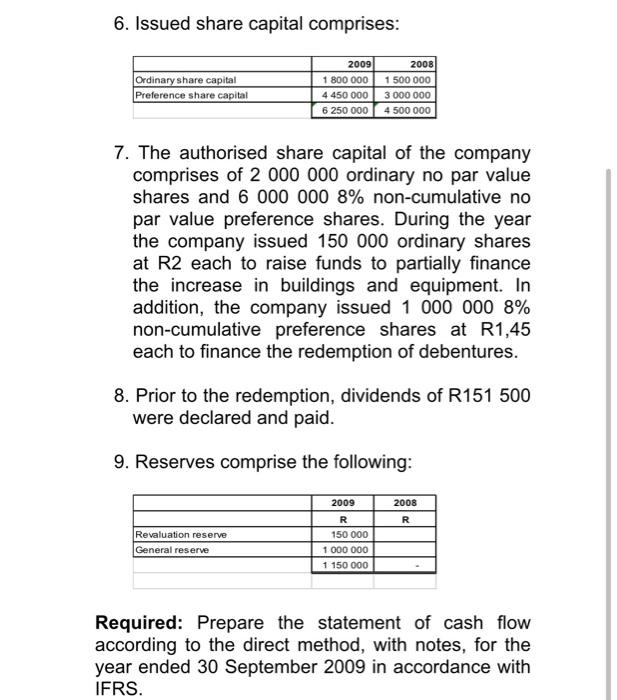

Buttons Limited The following is an extract from the financial statements of Buttons Ltd for the year ended 30 September 2009. Buttons Limited Statement of Comprende lame for year ended September 2009 Operating 4657 500 Other peringe 1.700.000 Proton sale of equipment 300 000 Problematon of land 1400000 Cheraperingernes ( 2000) 2500000 Centrapping of machinery 10000 Profitroopers need Wer income dividende 20000 reston coeur 15100 Protetores 30500 07211000 2101500 home Buttons Limited Stafevent of Financial Posts at 20 September 2008 Assets Honcurrents Propery plant and equipment Investments Current Assets 2009 7490000 6450 000 1000000 2 000 000 4 000 000 2 000 000 1000000 4000 R 2008 5850 000 $ 100 000 750 000 B00Q000 3 000 000 1 500 000 1 500 000 11.350.000 Debt Cash and cash Total Assets 5100 000 4 500 000 Equity and Babies Equity and reser sed capital Reserve Reinige Mon current abilities Deberes One est being borowing Current les Creditor SARS Total equity and abilities 950 000 250000 1 150 000 1000 1709000 1 500 000 200.000 3 000 000 2300 000 1.500.000 1450 000 400000 21.50 000 2 500 000 50 000 4200 000 3200 000 1 000 000 11 650 000 Further information at 30 September 2009 1. The company had sales of R42 345 600 for the year ended 30 September 2009. Cost of sales amounted to 78% of this amount. 2. Property, plant and equipment consists of: 2000 2000 6300000 5000 000 14 000 000 500 000 2210 000 2 000 000 Machinery & quipment Cost Accumulated depreciation Book Value Land & building Cost Red cost Accumes oan Book Value 3700000 438000 1140 000) 200 000 6450.000 3 100 000 5100 000 3. Land amennounos WIST of R570 000 Accumuwepro took Value 40 000 4240 000 100 000 450 000 $ 100 000 3. Land and buildings with a cost of R570 000 was expropriated during the year. New buildings were completed for expansion of operations and taken into use during the year. On 1 October 2008 the land and buildings were re-valued 4. A machine having a cost of R1 700 000 and accumulated depreciation of R1 000 000 was sold during the year. A machine with a cost amount of R810 000 was scrapped. 5. Purchase of equipment was for expansion purposes. 6. Issued share capital comprises: 70 Ortiran share il 300 000 100 000 450 000 3 000 000 6250000 500000 7. The authorised share capital of the company comprises of 2 000 000 ordinary no par value shares and 6 000 000 8% non-cumulative no par value preference shares. During the year the company issued 150 000 ordinary shares at R2 each to raise funds to partially finance the increase in buildings and equipment. In addition, the company issued 1 000 000 8% non-cumulative preference shares at R1,45 each to finance the redemption of debentures. 8. Prior to the redemption, dividends of R151 500 were declared and paid. 9. Reserves comprise the following: Reverse Cenesen 150 000 1000 GOD 1150 000 Required: Prepare the statement of cash flow according to the direct method, with notes, for the year ended 30 September 2009 in accordance with IFRS. The following is an extract from the financial statements of Buttons Ltd for the year ended 30 September 2009. Buttons Limited Statement of Comprehensive Income for year ended 30 September 2009 R Operating profit 4 657 500 Other operating income 1 700 000 Profit on sale of equipment 300 000 Profit on expropriation of land 1 400 000 Other operating expenses (2 540 000) Depreciation 2 530 000 Loss on scrapping of machinery 10 000 Profit from operations 3 817 500 Investment income - dividends 20 000 Interest on debentures (15000) Profit before tax 3 822 500 Income tax (1 721 000) Net profit after tax 2 101 500 Buttons Limited Statement of Financial Position as at 30 September 2009 R Assets 2009 Non-current assets 7 450 000 Property, plant and equipment 6450 000 Investments at costs 1 000 000 Current Assets 7 000 000 Stock 4 000 000 Debtors 2 000 000 Cash and cash equivalents 1 000 000 Total Assets 14 450 000 R 2008 5 850 000 5 100 000 750 000 6 000 000 3 000 000 1 500 000 1 500 000 11 850 000 5 100 000 4 500 000 Equity and liabilities Equity and reserves Issued capital Reserves Retained earnings Non-current liabilities Debentures Other interest bearing borrowings Current liabilities Creditors SARS Total equity and liabilities 8 950 000 6 250 000 1 150 000 1 550 000 1 700 000 1 500 000 200 000 3 800 000 2 300 000 1 500 000 14 450 000 600 000 2 550 000 2 500 000 50 000 4 200 000 3 200 000 1 000 000 11 850 000 6. Issued share capital comprises: Ordinary share capital Preference share capital 2009 1 800 000 4 450 000 6 250 000 2008 1 500 000 3 000 000 4 500 000 7. The authorised share capital of the company comprises of 2 000 000 ordinary no par value shares and 6 000 000 8% non-cumulative no par value preference shares. During the year the company issued 150 000 ordinary shares at R2 each to raise funds to partially finance the increase in buildings and equipment. In addition, the company issued 1 000 000 8% non-cumulative preference shares at R1,45 each to finance the redemption of debentures. 8. Prior to the redemption, dividends of R151 500 were declared and paid. 9. Reserves comprise the following: 2008 R Revaluation reserve General reserve 2009 R 150 000 1 000 000 1 150 000 Required: Prepare the statement of cash flow according to the direct method, with notes, for the year ended 30 September 2009 in accordance with IFRS. Buttons Limited The following is an extract from the financial statements of Buttons Ltd for the year ended 30 September 2009. Buttons Limited Statement of Comprende lame for year ended September 2009 Operating 4657 500 Other peringe 1.700.000 Proton sale of equipment 300 000 Problematon of land 1400000 Cheraperingernes ( 2000) 2500000 Centrapping of machinery 10000 Profitroopers need Wer income dividende 20000 reston coeur 15100 Protetores 30500 07211000 2101500 home Buttons Limited Stafevent of Financial Posts at 20 September 2008 Assets Honcurrents Propery plant and equipment Investments Current Assets 2009 7490000 6450 000 1000000 2 000 000 4 000 000 2 000 000 1000000 4000 R 2008 5850 000 $ 100 000 750 000 B00Q000 3 000 000 1 500 000 1 500 000 11.350.000 Debt Cash and cash Total Assets 5100 000 4 500 000 Equity and Babies Equity and reser sed capital Reserve Reinige Mon current abilities Deberes One est being borowing Current les Creditor SARS Total equity and abilities 950 000 250000 1 150 000 1000 1709000 1 500 000 200.000 3 000 000 2300 000 1.500.000 1450 000 400000 21.50 000 2 500 000 50 000 4200 000 3200 000 1 000 000 11 650 000 Further information at 30 September 2009 1. The company had sales of R42 345 600 for the year ended 30 September 2009. Cost of sales amounted to 78% of this amount. 2. Property, plant and equipment consists of: 2000 2000 6300000 5000 000 14 000 000 500 000 2210 000 2 000 000 Machinery & quipment Cost Accumulated depreciation Book Value Land & building Cost Red cost Accumes oan Book Value 3700000 438000 1140 000) 200 000 6450.000 3 100 000 5100 000 3. Land amennounos WIST of R570 000 Accumuwepro took Value 40 000 4240 000 100 000 450 000 $ 100 000 3. Land and buildings with a cost of R570 000 was expropriated during the year. New buildings were completed for expansion of operations and taken into use during the year. On 1 October 2008 the land and buildings were re-valued 4. A machine having a cost of R1 700 000 and accumulated depreciation of R1 000 000 was sold during the year. A machine with a cost amount of R810 000 was scrapped. 5. Purchase of equipment was for expansion purposes. 6. Issued share capital comprises: 70 Ortiran share il 300 000 100 000 450 000 3 000 000 6250000 500000 7. The authorised share capital of the company comprises of 2 000 000 ordinary no par value shares and 6 000 000 8% non-cumulative no par value preference shares. During the year the company issued 150 000 ordinary shares at R2 each to raise funds to partially finance the increase in buildings and equipment. In addition, the company issued 1 000 000 8% non-cumulative preference shares at R1,45 each to finance the redemption of debentures. 8. Prior to the redemption, dividends of R151 500 were declared and paid. 9. Reserves comprise the following: Reverse Cenesen 150 000 1000 GOD 1150 000 Required: Prepare the statement of cash flow according to the direct method, with notes, for the year ended 30 September 2009 in accordance with IFRS. The following is an extract from the financial statements of Buttons Ltd for the year ended 30 September 2009. Buttons Limited Statement of Comprehensive Income for year ended 30 September 2009 R Operating profit 4 657 500 Other operating income 1 700 000 Profit on sale of equipment 300 000 Profit on expropriation of land 1 400 000 Other operating expenses (2 540 000) Depreciation 2 530 000 Loss on scrapping of machinery 10 000 Profit from operations 3 817 500 Investment income - dividends 20 000 Interest on debentures (15000) Profit before tax 3 822 500 Income tax (1 721 000) Net profit after tax 2 101 500 Buttons Limited Statement of Financial Position as at 30 September 2009 R Assets 2009 Non-current assets 7 450 000 Property, plant and equipment 6450 000 Investments at costs 1 000 000 Current Assets 7 000 000 Stock 4 000 000 Debtors 2 000 000 Cash and cash equivalents 1 000 000 Total Assets 14 450 000 R 2008 5 850 000 5 100 000 750 000 6 000 000 3 000 000 1 500 000 1 500 000 11 850 000 5 100 000 4 500 000 Equity and liabilities Equity and reserves Issued capital Reserves Retained earnings Non-current liabilities Debentures Other interest bearing borrowings Current liabilities Creditors SARS Total equity and liabilities 8 950 000 6 250 000 1 150 000 1 550 000 1 700 000 1 500 000 200 000 3 800 000 2 300 000 1 500 000 14 450 000 600 000 2 550 000 2 500 000 50 000 4 200 000 3 200 000 1 000 000 11 850 000 6. Issued share capital comprises: Ordinary share capital Preference share capital 2009 1 800 000 4 450 000 6 250 000 2008 1 500 000 3 000 000 4 500 000 7. The authorised share capital of the company comprises of 2 000 000 ordinary no par value shares and 6 000 000 8% non-cumulative no par value preference shares. During the year the company issued 150 000 ordinary shares at R2 each to raise funds to partially finance the increase in buildings and equipment. In addition, the company issued 1 000 000 8% non-cumulative preference shares at R1,45 each to finance the redemption of debentures. 8. Prior to the redemption, dividends of R151 500 were declared and paid. 9. Reserves comprise the following: 2008 R Revaluation reserve General reserve 2009 R 150 000 1 000 000 1 150 000 Required: Prepare the statement of cash flow according to the direct method, with notes, for the year ended 30 September 2009 in accordance with IFRS