Buy one October 165 put contract. Hold it until the

options expire. Determine the profits and graph the results. Identify the breakeven stock price at expi- ration. What are the maximum possible gain and loss on this transaction?

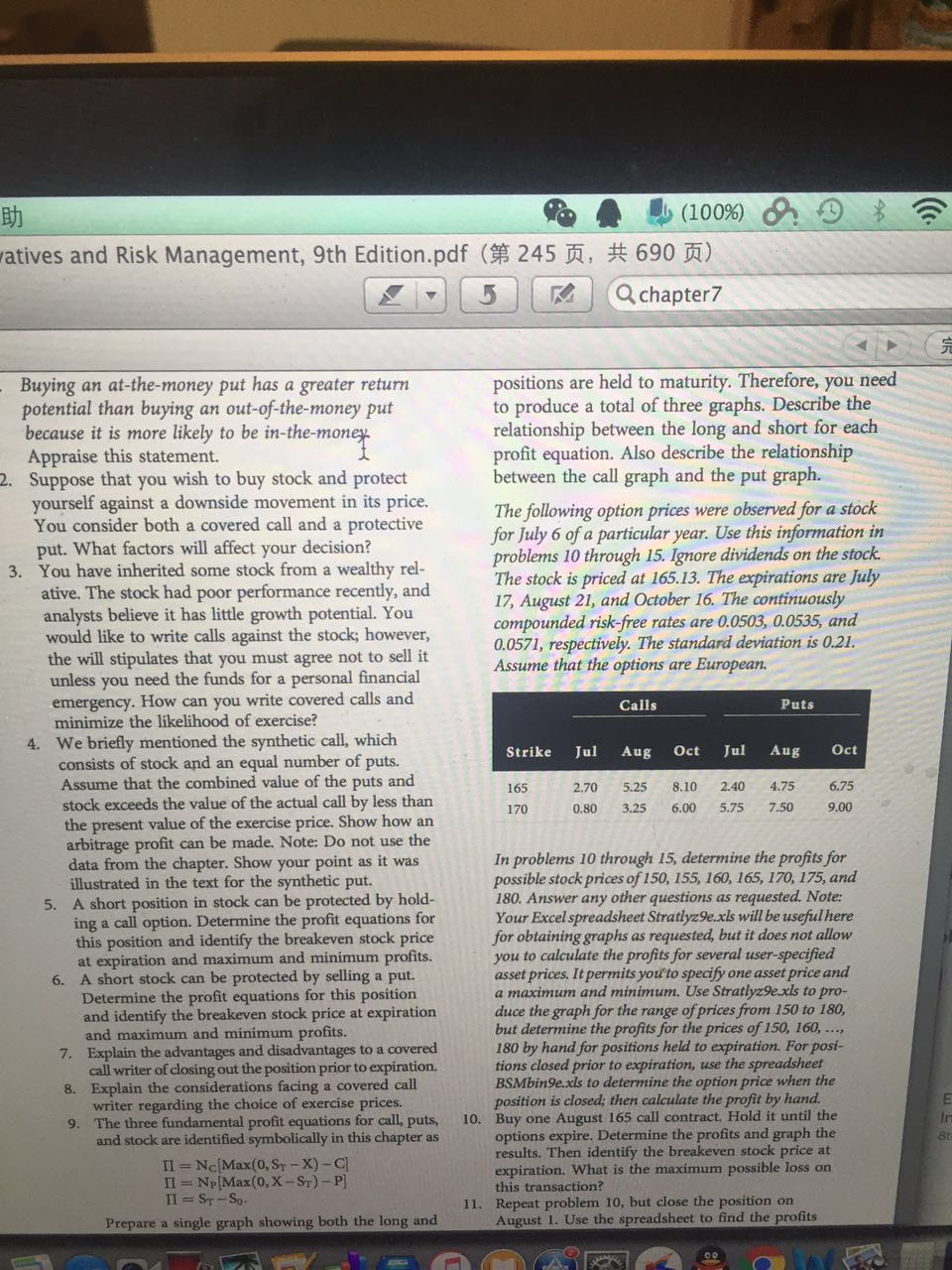

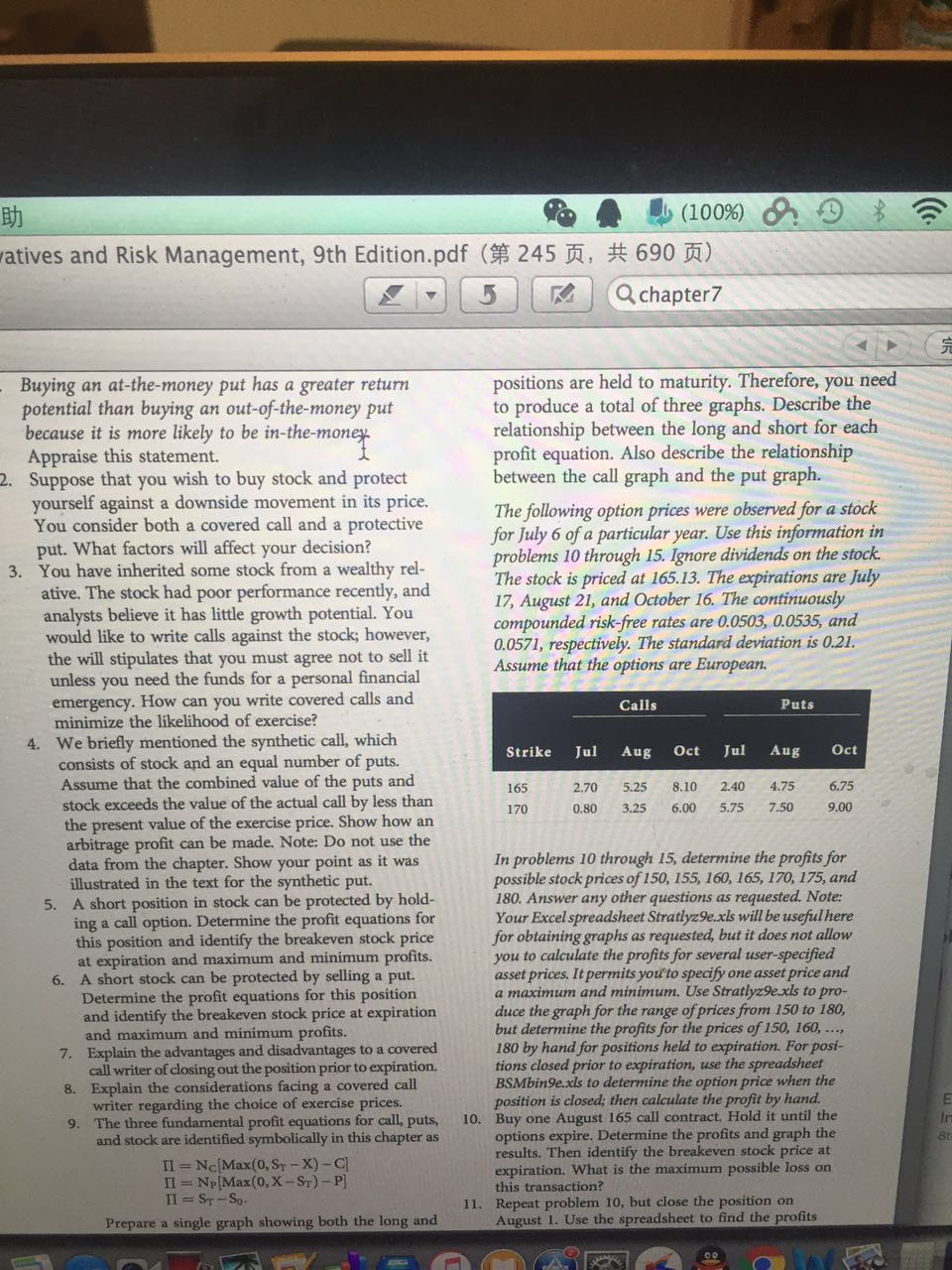

atives and Risk Management, 9th Edition.pdf (245,690) positions are held to maturity. Therefore, you need to produce a total of three graphs. Describe the relationship between the long and short for each profit equation. Also describe the relationship between the call graph and the put graph. Buying an at-the-money put has a greater return potential than buying an out-of-the-money put because it is more likely to be in-the-mo . Suppose that you wish to buy stock and protect yourself against a downside movement in its price. You consider both a covered call and a protective ative. The stock had poor performance recently, and would like to write calls against the stock; however, The following option prices were observed for a stock for July 6 of a particular year. Use this information in problems 10 through 15. Ignore dividends on the stock. The stock is priced at 165.13. The expirations are July 17, August 21, and October 16. The continuously put. What factors will affect your decision? You have inherited some stock from a wealthy rel 3. analysts believe it has little growth potential. You 0503, 0.0535, and compounded risk-free rates are O 0.0571, respectively. The standard deviation is 0.21. Assume that the options are European the will stipulates that you must agree not to sell it unless you need the funds for a personal financial emergency. How can you write covered calls and minimize the likelihood of exercise? We briefly mentioned the synthetic call, which consists of stock and an equal number of puts. 4. Strike Jul Aug Oct Jul Aug Oct Assume that the combined value of the puts and 165 2.70 5.25 8.10 2.40 4.5 6.75 0.80 3.25 6.00 5.75 7.50 9.00 stock exceeds the value of the actual call by less than the present value of the exercise price. Show how an arbitrage profit can be made. Note: Do not use the In problems 10 through 15, determine the profits for possible stock prices of 150, 155, 160, 165, 170, 175, and 180. Answer any other questions as requested. Note: Your Excel spreadsheet Stratlyz9e.xls will be useful here for obtaining graphs as requested, but it does not allow you to calculate the profits for several user-specified asset prices. Itpermits yout to specify one asset price and a maximum and minimum. Use Stratlyz9e.xls to pro- data from the chapter. Show your point as it was illustrated in the text for the synthetic put. A short position in stock can be protected by hold ing a call option. Determine the profit equations for this position and identify the breakeven stock price at expiration and maximum and minimum profits 5. A short stock can be protected by selling a put. Determine the profit equations for this position and identify the breakeven stock price at expirationduce the graph for the range ofprices from 150 to 180, and maximum and minimum profits. 6. but determine the profits for the prices of 150, 160, 180 by hand for positions held to expiration. For posi- tions closed prior to expiration, use the spreadsheet BSMbin9e.xls to determine the option price when the position is closed, then calculate the profit by hand Explain the advantages and disadvantages to a covered call writer of closing out the position prior to expiration. 7. Explain the considerations facing a covered call writer regarding the choice of exercise prices 8. In 9. The three fundamental profit equations for call, puts, 10. Buy one August 165 call contract. Hold it until the options expire. Determine the profits and graph the results. Then identify the breakeven stock price at expiration. What is the maximum possible loss on and stock are identified symbolically in this chapter as 11. Repeat problem 10, but close the position on Prepare a single graph showing both the long and August 1. Use the spreadsheet to find the profits