Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BuyCo, Incorporated, holds 22 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related

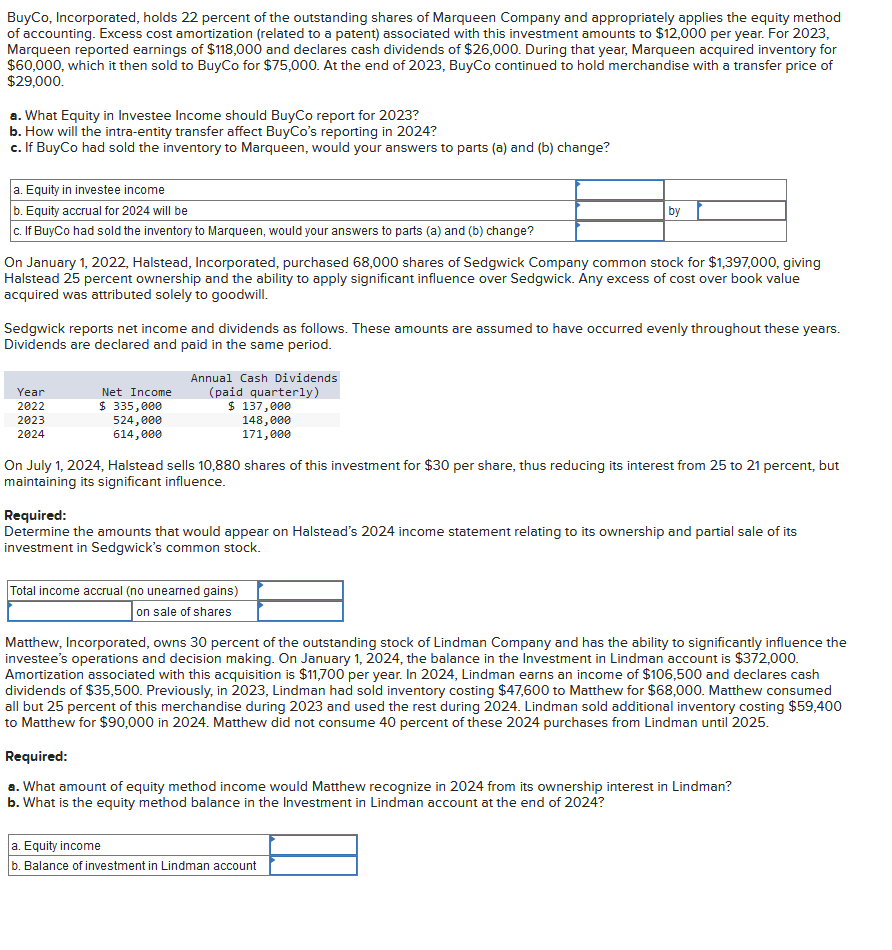

BuyCo, Incorporated, holds 22 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $12,000 per year. For 2023, Marqueen reported earnings of $118,000 and declares cash dividends of $26,000. During that year, Marqueen acquired inventory for $60,000, which it then sold to BuyCo for $75,000. At the end of 2023, BuyCo continued to hold merchandise with a transfer price of $29,000. a. What Equity in Investee Income should BuyCo report for 2023? b. How will the intra-entity transfer affect BuyCo's reporting in 2024? c. If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change? a. Equity in investee income b. Equity accrual for 2024 will be c. If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change? On January 1, 2022, Halstead, Incorporated, purchased 68,000 shares of Sedgwick Company common stock for $1,397,000, giving Halstead 25 percent ownership and the ability to apply significant influence over Sedgwick. Any excess of cost over book value acquired was attributed solely to goodwill. Sedgwick reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout these years. Dividends are declared and paid in the same period. Year 2022 2023 2024 Net Income $ 335,000 524,000 614,000 Annual Cash Dividends (paid quarterly) $ 137,000 by 148,000 171,000 On July 1, 2024, Halstead sells 10,880 shares of this investment for $30 per share, thus reducing its interest from 25 to 21 percent, but maintaining its significant influence. Total income accrual (no unearned gains) on sale of shares Required: Determine the amounts that would appear on Halstead's 2024 income statement relating to its ownership and partial sale of its investment in Sedgwick's common stock. Matthew, Incorporated, owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2024, the balance in the Investment in Lindman account is $372,000. Amortization associated with this acquisition is $11,700 per year. In 2024, Lindman earns an income of $106,500 and declares cash dividends of $35,500. Previously, in 2023, Lindman had sold inventory costing $47,600 to Matthew for $68,000. Matthew consumed all but 25 percent of this merchandise during 2023 and used the rest during 2024. Lindman sold additional inventory costing $59,400 to Matthew for $90,000 in 2024. Matthew did not consume 40 percent of these 2024 purchases from Lindman until 2025. Required: a. What amount of equity method income would Matthew recognize in 2024 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2024? a. Equity income b. Balance of investment in Lindman account

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a For BuyCos equity in investee income for 2023 Equity in Investee Income Marqueens Earnings Excess Cost Amortization Equity in Investee Income 118000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started