- (b)What will be the effect of the increased capital accumulation on the marginal product of capital? On the rental price of capital?

- (c)If we assume a Cobb-Douglas production function, what will be the effect of increased capital accumulation on the share of income that goes to capital?

(d) Do you think your answer to part (c) is reasonable? Do you think Thomas Piketty would think it a reasonable conclusion? What do you think could happen?

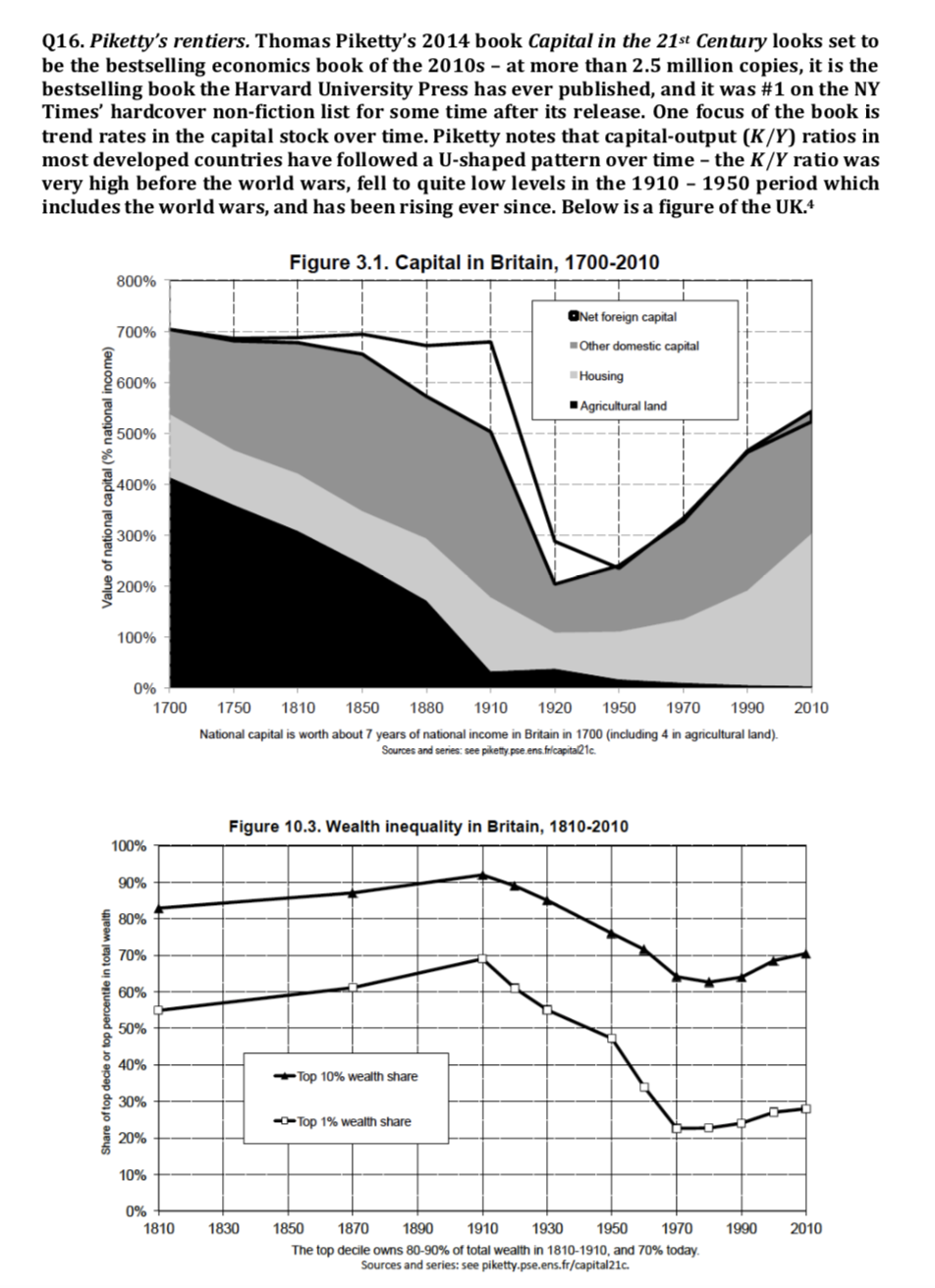

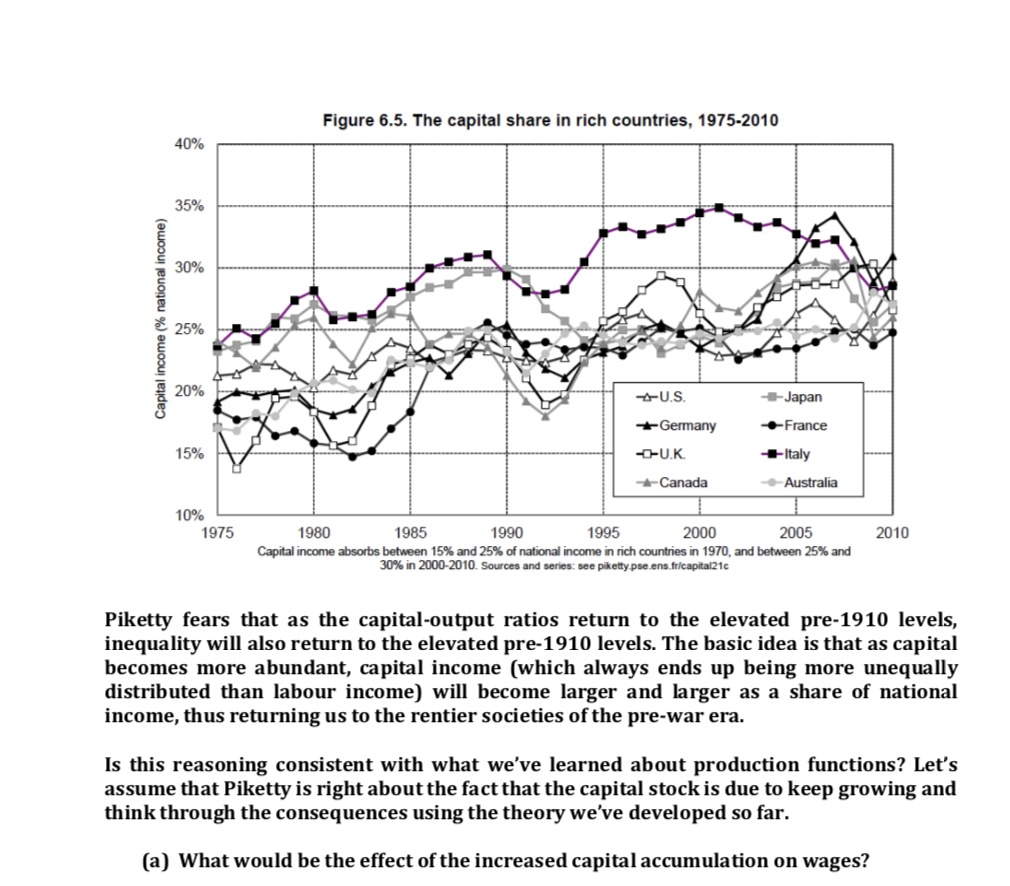

Q16. Piketty's rentiers. Thomas Piketty's 2014 book Capital in the 21st Century looks set to be the bestselling economics book of the 2010s - at more than 2.5 million copies, it is the bestselling book the Harvard University Press has ever published, and it was #1 on the NY Times' hardcover non-fiction list for some time after its release. One focus of the book is trend rates in the capital stock over time. Piketty notes that capital-output (K/Y) ratios in most developed countries have followed a U-shaped pattern over time - the K/Y ratio was very high before the world wars, fell to quite low levels in the 1910 - 1950 period which includes the world wars, and has been rising ever since. Below is a figure of the UK.^ Figure 3.1. Capital in Britain, 1700-2010 800% Net foreign capital 700% Other domestic capital 600% Housing Agricultural land 500% Value of national capital (% national income) 400% 300% 200% 100% 0% 1700 1750 1810 1850 1880 1910 1920 1950 1970 1990 2010 National capital is worth about 7 years of national income in Britain in 1700 (including 4 in agricultural land). Sources and series: see piketly pse.ens.fricapital21c. Figure 10.3. Wealth inequality in Britain, 1810-2010 100% 90% 80% 70% 60% Share of top decie or top percentile in total wealth 50% 40% -Top 10% wealth share 30% -0-Top 1% wealth share 20% 10% 0% 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010 The top decile owns 80-90% of total wealth in 1810-1910, and 70% today. Sources and series: see piketty.pse.ens.fr/capital21c.Figure 6.5. The capital share in rich countries, 1975-2010 40% 35% 30% Capital income (% national income) 25% 20% U.S. Japan Germany -France 15% -OU.K Italy Canada Australia 10% 1975 1980 1985 1990 1995 2000 2005 2010 Capital income absorbs between 15% and 25% of national income in rich countries in 1970, and between 25% and 30% in 2000-2010. Sources and series: see piketty pse.ens.fr/capital21c Piketty fears that as the capital-output ratios return to the elevated pre-1910 levels, inequality will also return to the elevated pre-1910 levels. The basic idea is that as capital becomes more abundant, capital income (which always ends up being more unequally distributed than labour income) will become larger and larger as a share of national income, thus returning us to the rentier societies of the pre-war era. Is this reasoning consistent with what we've learned about production functions? Let's assume that Piketty is right about the fact that the capital stock is due to keep growing and think through the consequences using the theory we've developed so far. (a) What would be the effect of the increased capital accumulation on wages