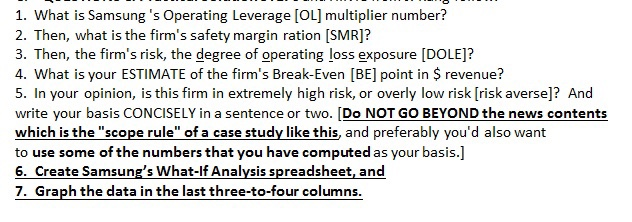

Question

By Jonathan Cheng and Eun-Young Jeong SEOULSamsung Electronics Co. said its net profit fell 16.8% to 4.54 trillion Korean won ($4.0 billion) in the third

By Jonathan Cheng and Eun-Young Jeong

SEOULSamsung Electronics Co. said its net profit fell 16.8% to 4.54 trillion Korean won ($4.0 billion) in the third quarter, as a disastrous recall of its premium Galaxy Note 7 smartphone caused the companys mobile division to report its smallest quarterly profit since it launched its first Galaxy series phone more than six years ago.

Samsungs mobile operating profit plunged 96% from a year earlier to 100 billion won after the discontinuation of the Galaxy Note 7, which went one sale Aug. 19. Dozens of reports of overheating forced the company to first recall the phone on Sept. 2 and then on Oct. 11 to abandon it altogether.

Overall operating profit for the three months ended Sept. 30 fell 30% to 5.2 trillion won from nearly 7.4 trillion won a year earlier, while revenue fell 7.5% to 47.82 trillion won.

The company said earlier this month that it expects to take an additional hit of about 3.5 trillion won from the Galaxy Note 7 fiasco in the last three months of 2016 and the first three months of next year.

Samsungs earnings damage would have been much worse if it werent for the relative stability of sales of semiconductors and display panels. The semiconductor division earned 3.37 trillion won, a decline of 7.9% from a year earlier, while display panels brought in 1.02 trillion won, up 9.7%.

As a result, semiconductors and display panels accounted for 84% of Samsungs overall operating profit the highest level in years.

Samsungs Galaxy Note 7 fiasco comes as longtime rival Apple Inc. is also struggling to maintain demand for its iPhones. On Tuesday, the Cupertino, Calf.-based smartphone maker reported its first annual revenue decline in 15 years and offered an outlook for the holiday quarter that disappointed investors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started