Answered step by step

Verified Expert Solution

Question

1 Approved Answer

By looking at both the balance sheet and income statement for target corp. 2017 and 2018 data . What are some areas that draw your

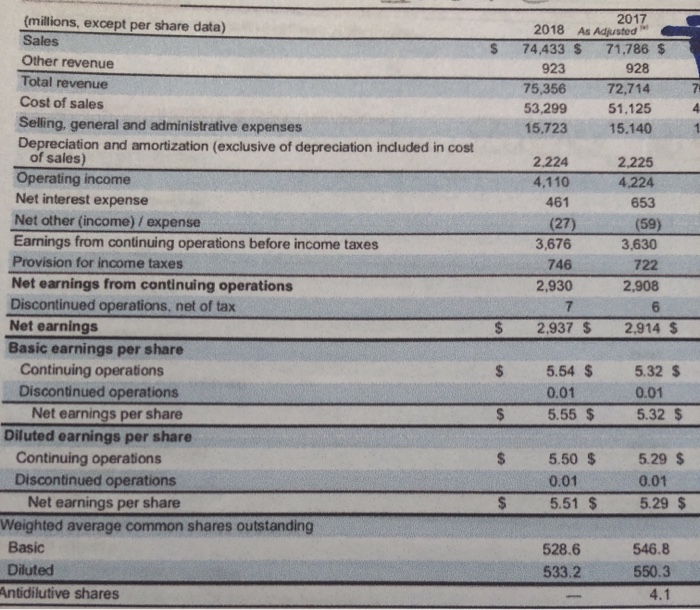

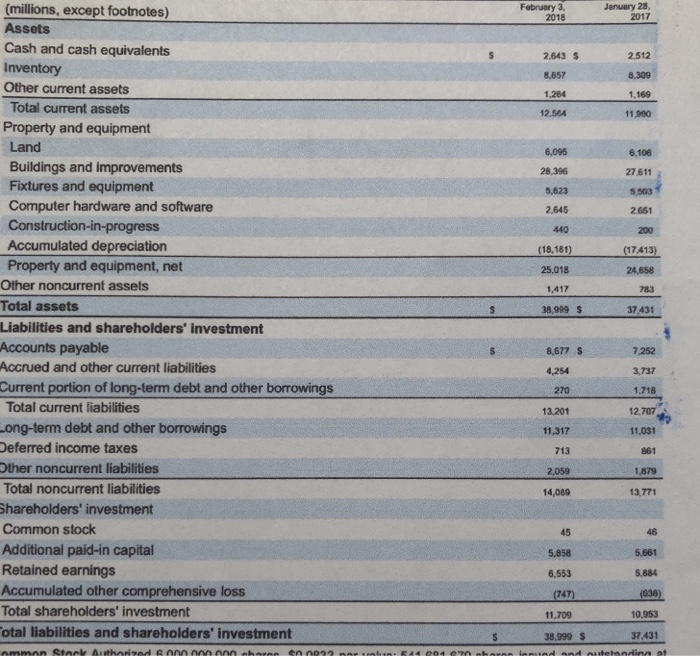

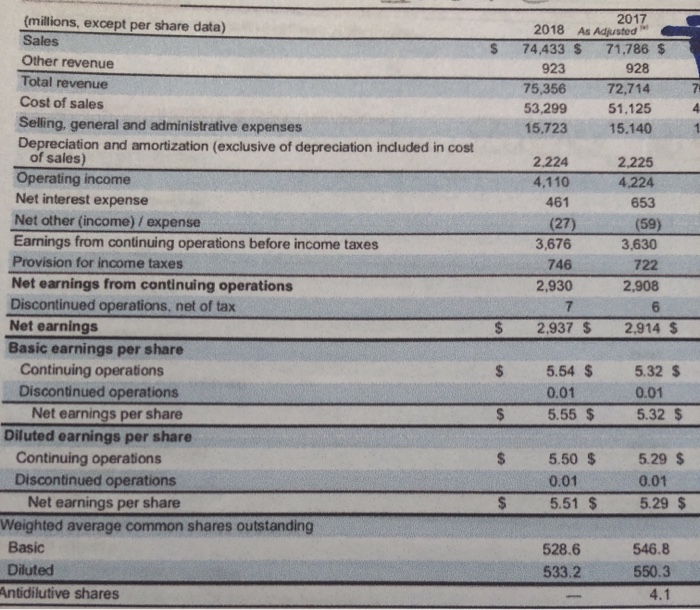

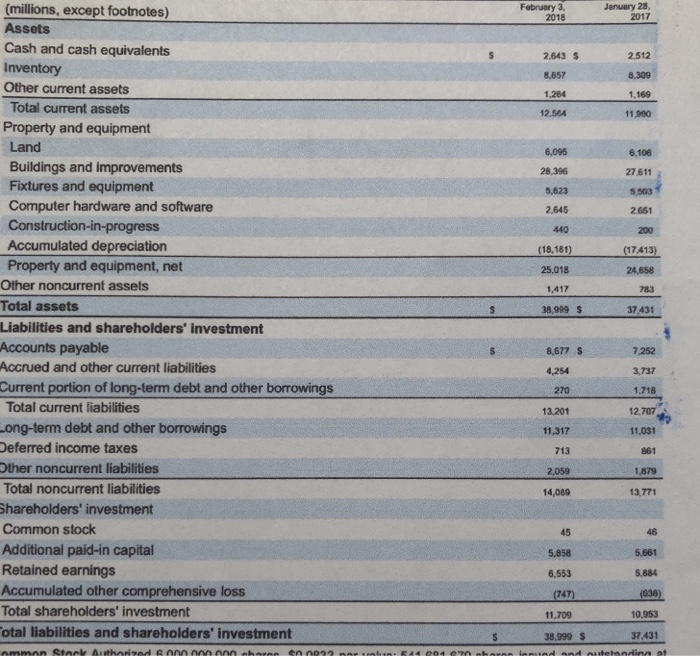

By looking at both the balance sheet and income statement for target corp. 2017 and 2018 data . What are some areas that draw your attention ? What are some increases and decreases ? what do you think are the reasons for the changes?

2017 2018 As Adjusted 74,433 $ 71,786 $ 923 928 75,356 53,299 51,125 15,723 15.140 2.224 4,110 461 (27) 3,676 746 2,930 2.225 4.224 653 (59) 3,630 722 2,908 (millions, except per share data) Sales Other revenue Total revenue Cost of sales Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Operating income Net interest expense Net other (income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earnings per share Weighted average common shares outstanding Basic Diluted Antidilutive shares $ 2,937 $ 2.914 S $ 5.54 $ 0.01 5.55 $ 5.32 $ 0.01 5.32 $ S $ 5.50 $ 0.01 5.51 $ 5.29 $ 0.01 5.29 $ $ 528.6 533.2 546.8 550.3 4.1 February 3, 2018 January 28, 2017 2,643 $ 2,512 8,309 8,657 1.284 1.169 12.564 11,900 6.106 6,095 28,396 27611 5,623 5503 2,645 2.661 200 440 (18,181) (17,413) 25.018 1.417 24,658 783 38,999 $ 37.431 (millions, except footnotes) Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Other noncurrent assets Total assets Liabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' investment otal liabilities and shareholders' investment 8,677 S 7.252 3,737 4,254 270 1.718 13.201 12.707 11,317 11.031 713 861 2,059 1879 14,089 13.771 5,858 5.661 6,553 5.884 (747) (638) 11,709 10,953 38,999 $ 37,431 Common Stanl Authorized o n her en no rs 544 204 havo innited and tendinaat

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started