Answered step by step

Verified Expert Solution

Question

1 Approved Answer

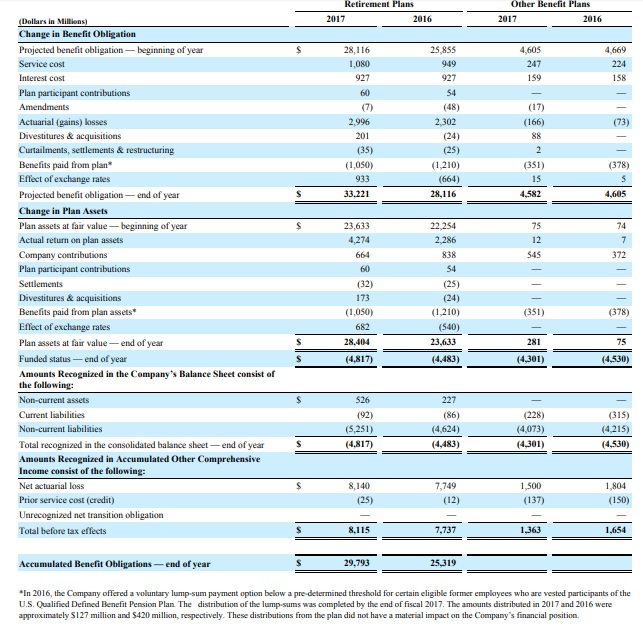

By looking at the picture you will find the reconciliation for the Benefit Obligation. What items in this number agree with the benefit cost calculation?

By looking at the picture you will find the reconciliation for the Benefit Obligation. What items in this number agree with the benefit cost calculation?

I need the correct answer Please

Retirement Plans Other Benefit Plans 2017 2016 2016 Change in Benefit Obligation Projected benefit obligation-beginning of year Service cost Interest cost 28,116 1,080 25,855 4,605 159 158 (48) Actuarial (gains) kosses 2,996 (166) (35) (1,050) 933 33,221 (24) (25) 1,210) (664) 28,116 (378) Benefits paid from plan* Effect of exchange rates Projected benefit obligation-end of year Change in Plan Assets Plan assets at fair value-beginning of year Actual return on plan assets Company contributions 23,633 372 (32) 173 (1,050) (378) Benefits paid from plan assets* Effect of exchange rates Plan assets at fair value-end of year Funded status- end of year Amounts Recognized in the Company's Balance Sheet consist of 1,210) (540) 23,633 (4,483) 28.404 281 (4,817) the following: Current liabilities (5,251) (4,817) (86) (4,624) (4,483) (228 (4,073) (4,301) (4,215) Total recognized in the consolidated balance sheet-end of year Amounts Recognized in Accumulated Other Comprehensive Income consist of the following: Net actuarial loss Prior service cost (credit) 8,140 7,749 1,804 (150) 1,500 (12) (137) Total before tax effects 8.115 7,737 1,363 1,654 Accumulated Benefit Obligations- end of year 29.793 25,319 In 2016, the Company offered a voluntary lump-sum payment option below a pre-determined threshold for certain eligible former employees who are vested participants of the U.S. Qualified Defined Benefit Pension Plan The distribution of the lump-sums was completed by the end of fiscal 2017. The amounts distributed in 2017 and 2016 were approximately $127 million and $420 million, respectively. These distributions from the plan did not have a material impact on the Company's financial position. Retirement Plans Other Benefit Plans 2017 2016 2016 Change in Benefit Obligation Projected benefit obligation-beginning of year Service cost Interest cost 28,116 1,080 25,855 4,605 159 158 (48) Actuarial (gains) kosses 2,996 (166) (35) (1,050) 933 33,221 (24) (25) 1,210) (664) 28,116 (378) Benefits paid from plan* Effect of exchange rates Projected benefit obligation-end of year Change in Plan Assets Plan assets at fair value-beginning of year Actual return on plan assets Company contributions 23,633 372 (32) 173 (1,050) (378) Benefits paid from plan assets* Effect of exchange rates Plan assets at fair value-end of year Funded status- end of year Amounts Recognized in the Company's Balance Sheet consist of 1,210) (540) 23,633 (4,483) 28.404 281 (4,817) the following: Current liabilities (5,251) (4,817) (86) (4,624) (4,483) (228 (4,073) (4,301) (4,215) Total recognized in the consolidated balance sheet-end of year Amounts Recognized in Accumulated Other Comprehensive Income consist of the following: Net actuarial loss Prior service cost (credit) 8,140 7,749 1,804 (150) 1,500 (12) (137) Total before tax effects 8.115 7,737 1,363 1,654 Accumulated Benefit Obligations- end of year 29.793 25,319 In 2016, the Company offered a voluntary lump-sum payment option below a pre-determined threshold for certain eligible former employees who are vested participants of the U.S. Qualified Defined Benefit Pension Plan The distribution of the lump-sums was completed by the end of fiscal 2017. The amounts distributed in 2017 and 2016 were approximately $127 million and $420 million, respectively. These distributions from the plan did not have a material impact on the Company's financial positionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started