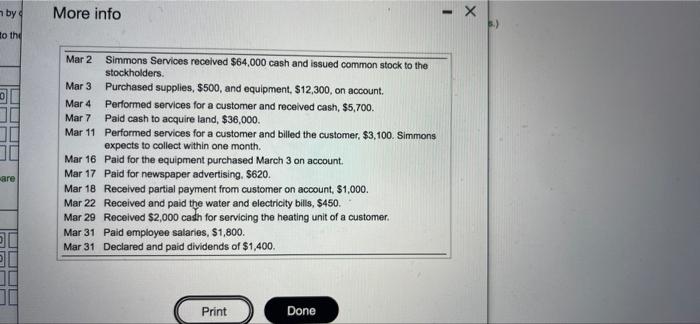

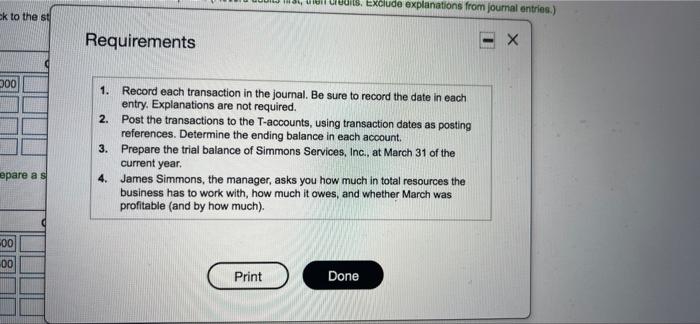

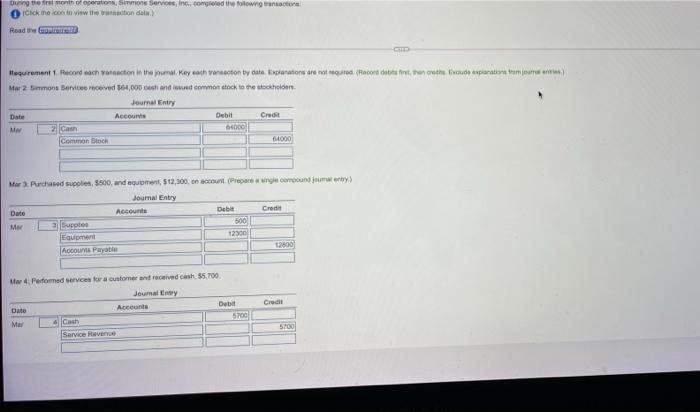

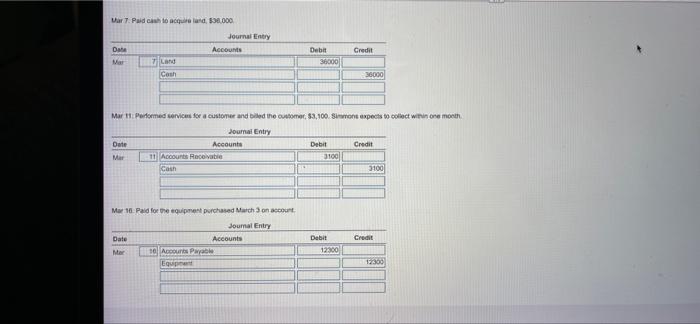

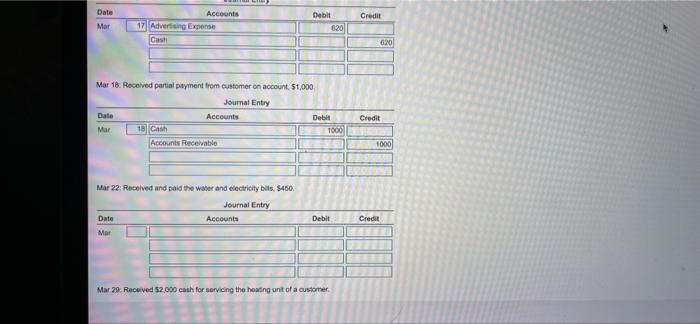

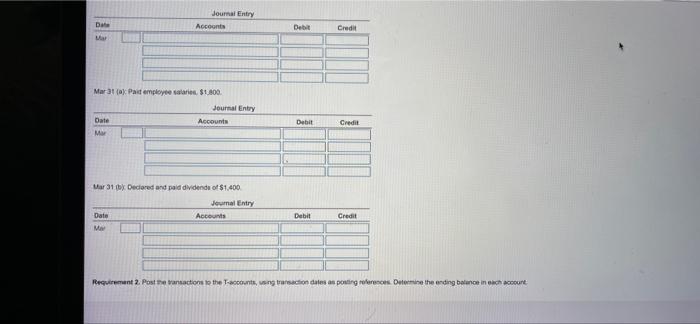

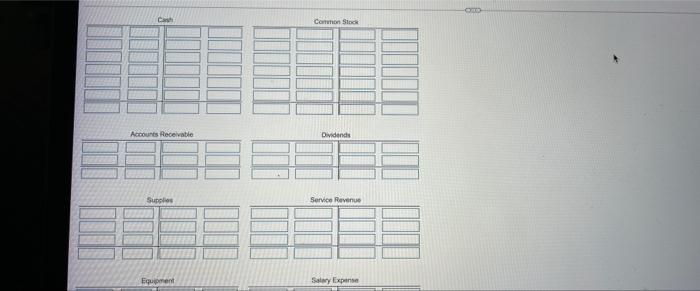

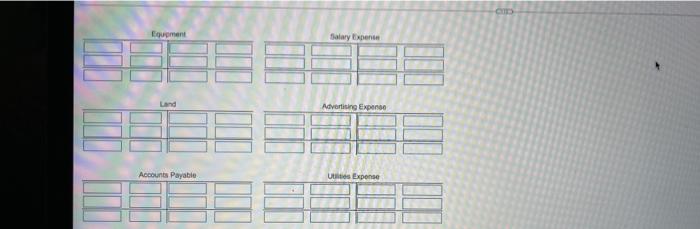

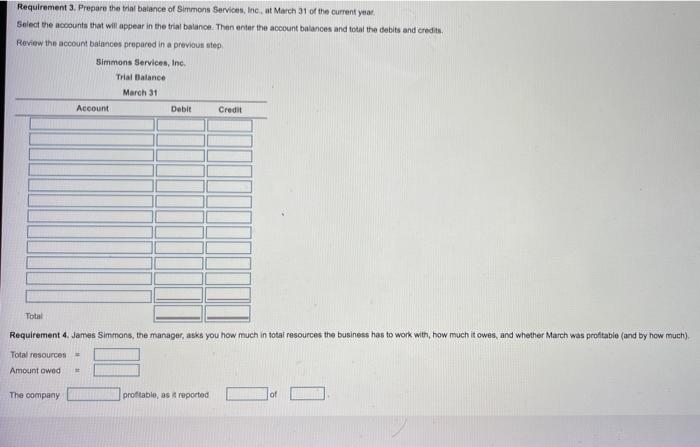

by More info - X to the Mar 2 Simmons Services received $64.000 cash and issued common stock to the stockholders. Mar 3 Purchased supplies, $500, and equipment, $12,300, on account. Mar 4 Performed services for a customer and received cash, $5,700. Mar 7 Paid cash to acquire land, $36.000. Mar 11 Performed services for a customer and billed the customer, $3,100. Simmons expects to collect within one month, Mar 16 Paid for the equipment purchased March 3 on account. Mar 17 Paid for newspaper advertising, $620. Mar 18 Received partial payment from customer on account, S1,000. Mar 22 Received and paid the water and electricity bills, $450. Mar 29 Received $2,000 cash for servicing the heating unit of a customer Mar 31 Paid employee salaries, $1,800. Mar 31 Declared and paid dividends of $1,400 are 20 Print Done 134, lai uwis. Exclude explanations from journal entries.) ck to the st Requirements 300 1. Record each transaction in the journal. Be sure to record the date in each entry. Explanations are not required. 2. Post the transactions to the T-accounts, using transaction dates as posting references. Determine the ending balance in each account. 3. Prepare the trial balance of Simmons Services, Inc., at March 31 of the current year 4. James Simmons, the manager, asks you how much in total resources the business has to work with, how much it owes, and whether March was profitable (and by how much). epare as 00 Print Done During the front of operations, in fervous, in controlowance Click the .conto vw the traction de Road CD Tequirement. Record can action in the key each action by cate Explanations are not acordat het de expansion of Mar 2mon Barices receved 164,000 and it common stock to the scholars Journal Entry Account Debit Credit Mw 3 can DOO Common Stock 04000 Marchased supplies, 3500, and up, 512,300 account (Prepares ng commun juta) Journal Entry Dute Account Debit Credit M ape 500 Equipment 123001 2600 Accounts Payable Cro ar 4 Performed Services for customer and received cash 55.700 Journal Entry Date Account Deba Mer Cash 5700 Service Haven 5700 War 7. Pashto acquired 550.000 Journal Entry Dails ACCOUNT Credit Debit 36000 Mar Titan Cash 36000 Mar 11. Podemed services for customer and bied the customer. 33,100. Sumont expects to collect within one month Journal Entry Date Accounts Debit Credit Mar Accounts Rovatie 3100 3100 co Mar 16 Paid for the equipment purchased March on account Credit Date Mer Joumal Entry Accounts 10 Accounts Payable Equipe Debit 12300 17300 Date Debit Credit Mar Accounts 17 Advertising Expense Cash 620 620 Mar 18. Received partial payment from customer on account $1,000 Journal Entry Date Accounts Debit Mar 18 Cash 1000 Accounts Receivable Credit 1000 Mar 22: Received and paid the water and electricity bils. 5460 Journal Entry Date Accounts Debit Credit Mar Mar 29. Receved 52.000 cash for servicing the heating unit of a customer Journal Entry Accounts Date De Credit Marta Pait employees $1.00 Journal Entry Date Account M Debit Credit Mar 31 by Declared and paid dividends of $1.400 Journal Entry Accounts Debit Credit Date M Requirement 2. Post the transactions to the accounts, using transaction dates as porting rooms Determine the ending balance in each account Can Coron Stock Accounts Receivable Dividends Supplies Service Revenue Equipment Salary Expense Equipment falary Expense Land Advertising Expono Accounts Payable Ut Expense Requirement 3. Prepare the trial balance of Simmons Services, Inc. at March 31 of the current year. Select the accounts that will appear in the trial balance. Then enter the account balances and total the dobits and credits Review the account balances prepared in a previous step Simmons Services, Inc. Trial Balance March 31 Debit Account Credit Total Requirement 4. James Simmons, the manager, asks you how much in total resources the business has to work with, how much it owes, and whether March was profitable (and by how much). Total resources Amount owed The company profitable, as reported of