Question

There are numerous factors that affect the current state of the real estate market, its impact on potential investors, and the locations in which such

There are numerous factors that affect the current state of the real estate market, its impact on potential investors, and the locations in which such investments are most likely to be made. These factors also define where investors are most likely to make investments and provide a wealth of justifications for doing so. Location, supply and demand levels, housing affordability, and ratios like the rent to income ratio are a few examples of such factors. All relevant considerations must be taken into account by anyone looking to invest.

The Sydney housing market in Australia has been experiencing an unexpected and resilient trend despite a series of 12 interest rate increases from the Reserve Bank of Australia over the past year, resulting in a 4% rise in official rates. Contrary to expectations, property prices have not only halted their decline but have been steadily increasing for several months. This situation has created a sense of confusion among analysts who had anticipated significant price drops of 15%, 20%, or even 30% due to these interest rate hikes.

One of the factors contributing to the market's stability is lower listing volumes, meaning there are fewer properties available for sale. This reduced supply is helping protect the market from further downward pressure. Additionally, despite concerns about a potential "fixed rate cliff" on the horizon, data from the Reserve Bank of Australia indicates that most of the mortgage debt is on variable terms.

It's important to note that inflation appears to have peaked, and it's likely that interest rates have as well. Seen through the interest rate pause on the (3rd of October 2023) As consumer confidence gradually returns, the property markets are expected to continue their upward trajectory. However, it's crucial to temper expectations of a rapid recovery, as the market is likely to remain fragmented.

Furthermore, the rental market in Sydney is facing a significant crisis, with no end in sight to skyrocketing rents. This trend is expected to persist throughout the year as property prices are still valued high which puts pressure on those who want to buy but can afford it, so they go to renting which creates a high demand for the rental market. Which in this case for the client will be a positive as when you will have better chances of renting out the property to revenue.

In terms of recent housing market statistics, various research sources have reported higher dwelling prices in September 2023:

(By Forbes October 1, 2023, Prop Track) indicated that Australian home prices increased by 0.35% month-on-month in September, reaching a fresh price peak. On an annual basis, prices are up by 3.75%, effectively reversing the steep decline seen in 2022 and climbing 4.31% from the low in December 2022.

CoreLogic's national Home Value Index (HVI) posted its seventh consecutive month of recovery, with a 0.8% increase in September. Since hitting a trough in January, CoreLogic's HVI has rebounded by 6.6%. However, home values remain 1.3% below the record highs observed in April of the previous year.

Croydon Park, NSW

In the Australian state of New South Wales, the suburb of Croydon Park is in the Inner West of Sydney. Croydon Park is located 10 km south-west of the Sydney CBD and is shared among the City of Canterbury-Bankstown, Municipality of Burwood, and Inner West Council as local governments. To the north lies another suburb called Burwood. Along Georges River Road, Croydon Park contains a commercial shopping district. Which attracts all nearby local residence as this creates a local meeting area which creates a functional area. The growth of the years has shown there is a increasing interest in the area due to the population variance seen over the recent years as the current population is 29,637 from 2016 which had 11,004 and is forecasted to have a population of 35,976 by 2041. (Forecast.id.com.au 2023) It is also close to the bigger town centres of Burwood, Ashfield, and Campsie. In comparison to nearby areas, Croydon Park is rather sizable. Although it features a business strip along Georges River Road, a local thoroughfare that runs through the middle of the suburb, it is primarily residential.

there were 38 properties for sale and 45 homes for rent in Croydon Park. The median price of a property in the last year has ranged from $1,832,500 to $640,000. Croydon Park is a good place to look for an investment property, since residences lease for $782 weekly with a 2.3% annual rental yield and units rent for $480 per week with a 4.1% annual rental return. Based on a five-year period of sales, Croydon Park has had a compound growth rate of 0.4% for residences and 6.2% for units. (Realestate.com.au 2023)

Sydney Olympic Park, NSW

Moreover, Sydney Olympic park also has new development status of Croydon park as Sydney is growing day by day, new apartments have been built throughout Sydney NSW, to create affordable housing which has been pushed back to the inner west, and western region of Sydney which is shown by both properties. Greater Western Sydney includes Sydney Olympic Park, a neighbourhood that is around 13 kilometres to the west of Sydney's CBD. The City of Parramatta Council is the local council. Currently the statistics show the current population is 5,207 and is forecast to grow to 21,428 by 2041 which is a 311.54% growth rate. (Forecast.id.com.au 2023)

When comparing the two suburbs to the present market analysis of Sydney as it stands, both are classified as having affordable housing, and with the research done that corresponds with the present population and location of the two, it is possible to assume that both are affordable. Furthermore, given the evidence provided by the current statistics, it can be further predicted that demand for both will rise and that there will be a supply for those willing to invest. Given her circumstances, these two choices should enable Jane to make a more thorough assessment and take an even greater interest.

Prepare a Discounted cash flow.

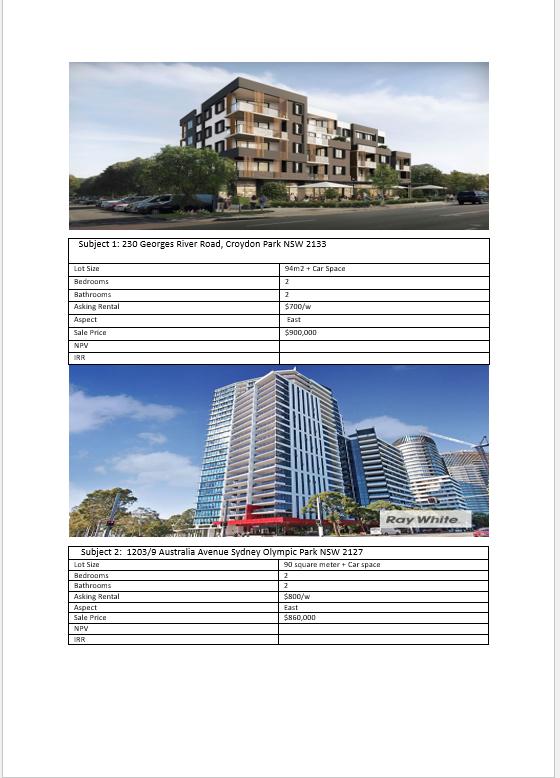

Subject 1: 230 Georges River Road, Croydon Park NSW 2133 Lot Size Bedrooms Bathrooms Asking Rental Aspect Sale Price NPV IRR 94m2 + Car Space 2 2 $700/w East $900,000 Subject 2: 1203/9 Australia Avenue Sydney Olympic Park NSW 2127 Lot Size Bedrooms Bathrooms Asking Rental Aspect Sale Price NPV RR 90 square meter + Car space 2 2 $800/w East $860,000 Ray White.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Investment Analysis Croydon Park vs Sydney Olympic Park This analysis aims to compare potential investment properties in Croydon Park and Sydney Olympic Parkconsidering discounted cash flow DCFNet Pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started