Answered step by step

Verified Expert Solution

Question

1 Approved Answer

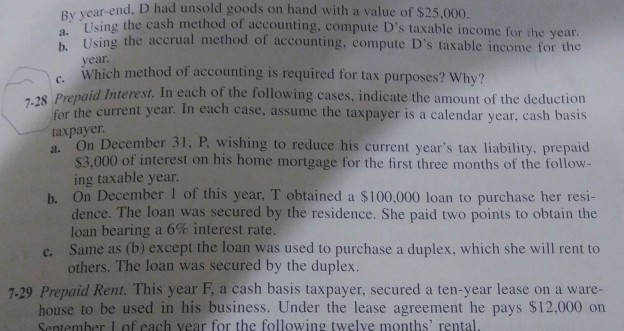

By year-end. D had unsold goods on hand with a value of $25,000 yg the cash method of accounting, compute D's taxable income for the

By year-end. D had unsold goods on hand with a value of $25,000 yg the cash method of accounting, compute D's taxable income for the a. Using the accrual method of accounting, compute D's taxable income for the Which method of accounting is required for tax purposes? Why? year c. . s Prepaid Interest. In each of the following cases, indicate the amount of the deduction for the current year. In each case, assume the taxpayer is a calendar year, cash basis taxpayer a. On December 31, P, wishing to reduce his current year's tax liability, prepaid b. On December 1 of this year, T obtained a $100,000 loan to purchase her resi- c. Same as (b) except the loan was used to purchase a duplex, which she will rent to house to be used in his business. Under the lease agreement he pays $12,000 on $3,000 of interest on his home mortgage for the first three months of the follow- ing taxable year. dence. The loan was secured by the residence. She paid two points to obtain the loan bearing a 6% interest rate. others. The loan was secured by the duplex. 7-29 Prepaid Rent. This year F, a cash basis taxpayer, secured a ten-year lease on a ware- Sentemher 1 of each vear for the following twelve months' rental

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started