Answered step by step

Verified Expert Solution

Question

1 Approved Answer

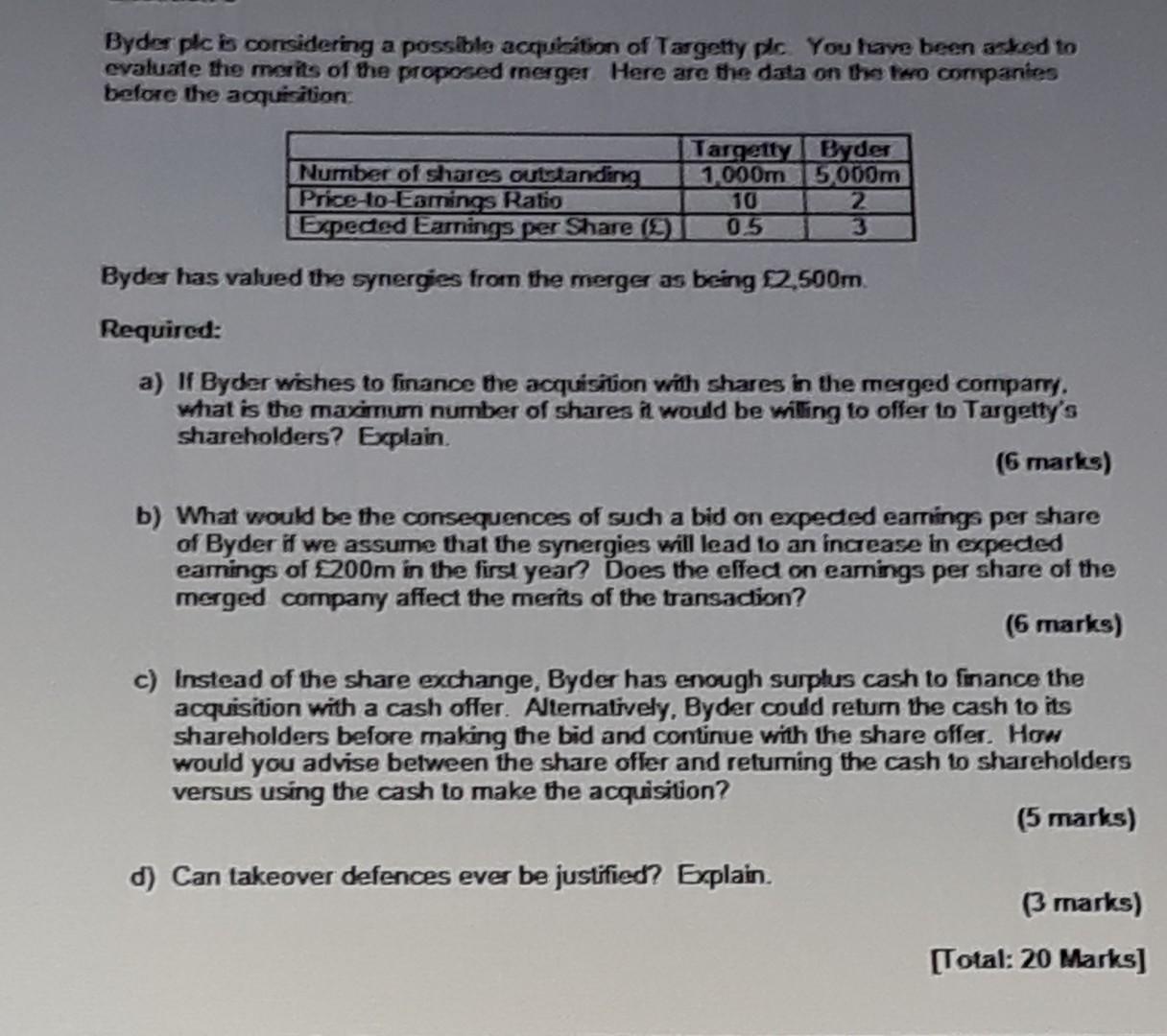

Byder plc is considering a possible acquisition of Targetty pic you leave been asked to evaluate the merits of the proposed merger Here are the

Byder plc is considering a possible acquisition of Targetty pic you leave been asked to evaluate the merits of the proposed merger Here are the data on the two companies before the acquisition Targetty Byder Number of shares outstanding 1.000m 5000m Price to Eamings Ratio 10 2 Expected Earnings per Share ( 0.5 Byder has valued the synergies from the merger as being 2,500m Required: a) If Byder wishes to finance the acquisition with shares in the merged company, what is the maximum number of shares i would be wiling to offer to Targetty's shareholders? Explain. (6 marks) b) What would be the consequences of such a bid on expeded earrings per share of Byder if we assume that the synergies will lead to an increase in expected earnings of 200m in the first year? Does the effect on earnings per share of the merged company affect the merits of the transaction? (6 marks) c) Instead of the share exchange, Byder has enough surplus cash to finance the acquisition with a cash offer. Alternatively, Byder could return the cash to its shareholders before making the bid and continue with the share offer. How would you advise between the share offer and returning the cash to shareholders versus using the cash to make the acquisition? (5 marks) d) Can takeover defences ever be justified? Explain. (3 marks) [Total: 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started