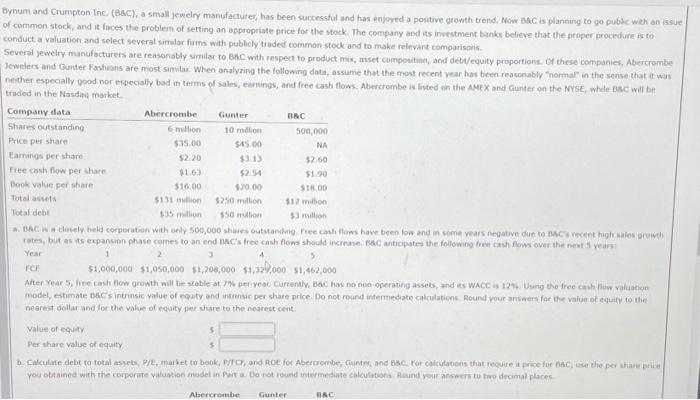

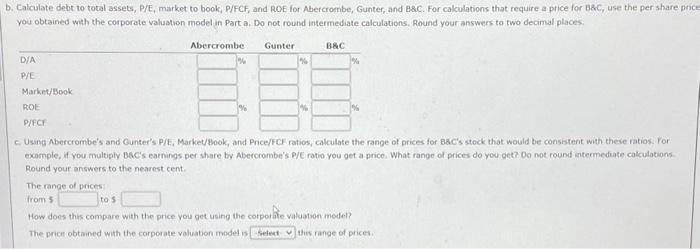

Bynum and Crumpton Inc (BaC), a small jewelry manufacturer, has been successful and has enjoyed a positive growth trend, Now zbC is planning to go puble weh an issue of common stock, and it loces the problem of setting an appropriate price for the stock. The company and iss investmen banks believe that the proper procedure ts to: conduct a valustion and select several simblar firms with publicly traded common stock and to make relevart comparisons. Several jewelry manufacturers are reasonably similar to BAC with respect to product mix, asset composition, and debulequity proportions. Of these companies, Abercombe Jewelers and Gurter Fashions are most simlar. When analyring the following data, assiame that the most recent year has bieen reasonably "normal" in the sense that it was nenther especally good nor especially bad in terms of sales, earnings, and free cash flows Abercrombe is listed on the AMEX and Gunter on the NYSE, whele BAC will be traded in the Nasdac market. rates, but as to expansion phase comes to an end bac's treo cash flows should increave, BaC anticipates the following free cash fons over the neent 5 years Yearrer1$1,000,0002$1,050,0003$1,200,0004$1,32%,000S$1,462,000 model, estimate bse s intrinsic value of cqufy and intrinsic per share price. Do not round intemiediate calculabons Round pour arswers for the value of equify to the nearest dellar and for the value of equity per stare to the rearest cent. you ottained with the corperate valuation model in Pat a. Do rot round intermedate calculitora. Reund your arsmerntu tes decimal places . Calculate debt to total assets, P/E, market to book, P/FCF, and ROE for Abercrombe, Gunter, and BsC. For calculations that require a price for BeC, use the per share pi you obtained whth the corporate valuation model in Part a. Do not round intermediate calculations. Round your answers to two decimal places: C. Using Abercrombe's and Gunter's P/E, Market/Book, and Price/FCE ratios, calculate the range of prices for BaC's stock that would be consistent with theve ratios. For exomple, If you multiply BLC's earnings per share ty Abercrombe's p/E rotio you get a price. What range of prices do you get? Do not round intermediate calculations Round your answers to the nearest cent. The range of prices from 5 to 5 How does this compare with the price you get using the corporthe valuatson medel? The price obtained with the corporate valuation modet is tiw range of pricen