Answered step by step

Verified Expert Solution

Question

1 Approved Answer

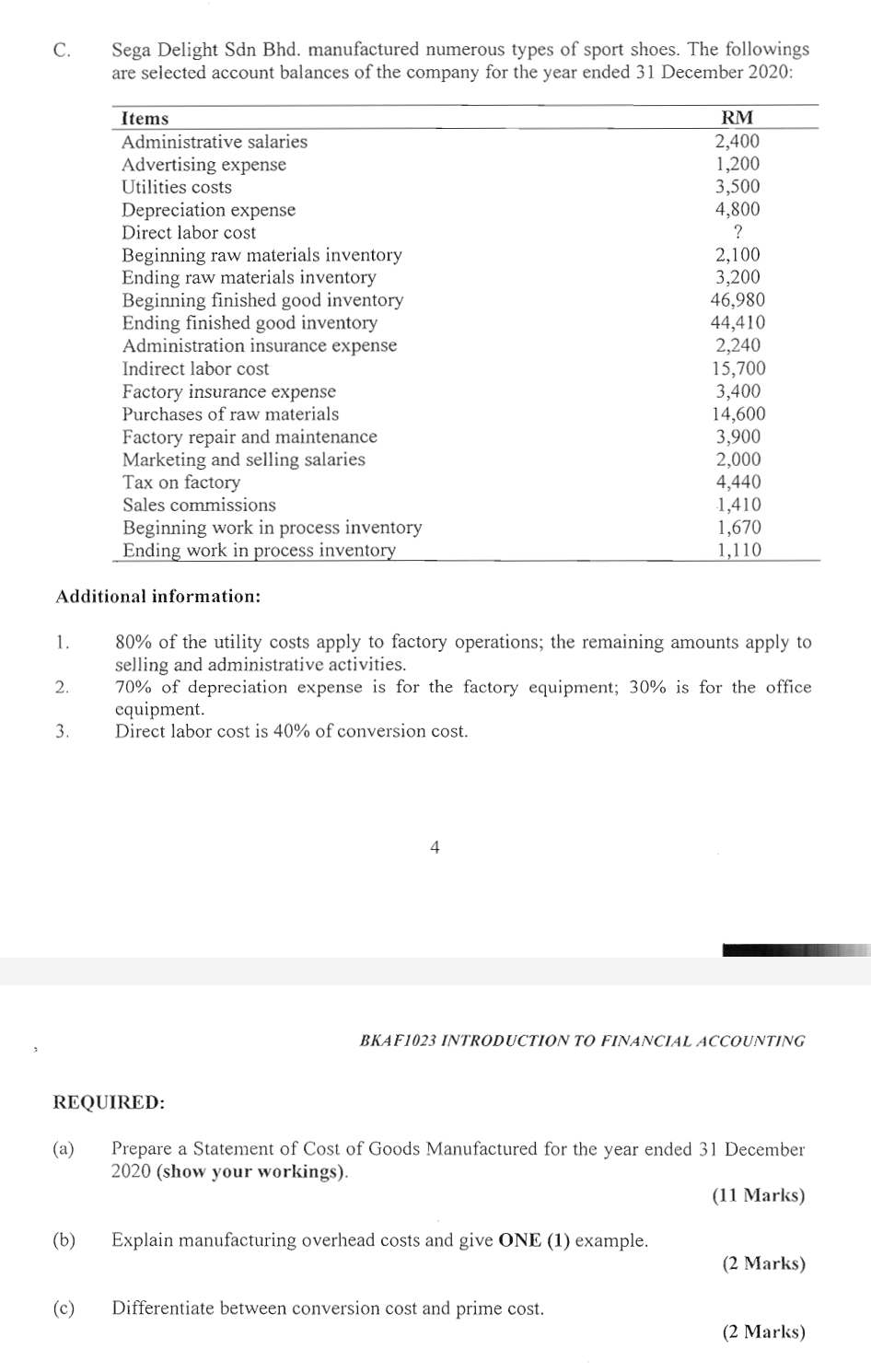

C. 1. 2. 3. (a) Sega Delight Sdn Bhd. manufactured numerous types of sport shoes. The followings are selected account balances of the company

C. 1. 2. 3. (a) Sega Delight Sdn Bhd. manufactured numerous types of sport shoes. The followings are selected account balances of the company for the year ended 31 December 2020: Additional information: (b) Items (c) Administrative salaries Advertising expense Utilities costs Depreciation expense Direct labor cost Beginning raw materials inventory Ending raw materials inventory Beginning finished good inventory Ending finished good inventory Administration insurance expense Indirect labor cost Factory insurance expense Purchases of raw materials Factory repair and maintenance Marketing and selling salaries Tax on factory Sales commissions Beginning work in process inventory Ending work in process inventory REQUIRED: 4 80% of the utility costs apply to factory operations; the remaining amounts apply to selling and administrative activities. 70% of depreciation expense is for the factory equipment; 30% is for the office equipment. Direct labor cost is 40% of conversion cost. RM 2,400 1,200 3,500 4,800 ? 2,100 3,200 46,980 44,410 2,240 15,700 3,400 14,600 3,900 2,000 Explain manufacturing overhead costs and give ONE (1) example. 4,440 1,410 1,670 1,110 BKAF1023 INTRODUCTION TO FINANCIAL ACCOUNTING Differentiate between conversion cost and prime cost. Prepare a Statement of Cost of Goods Manufactured for the year ended 31 December 2020 (show your workings). (11 Marks) (2 Marks) (2 Marks)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Beginning work in process inventory Direct materials used in production WN3 Direct Labor WN2 Manufac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started