Answered step by step

Verified Expert Solution

Question

1 Approved Answer

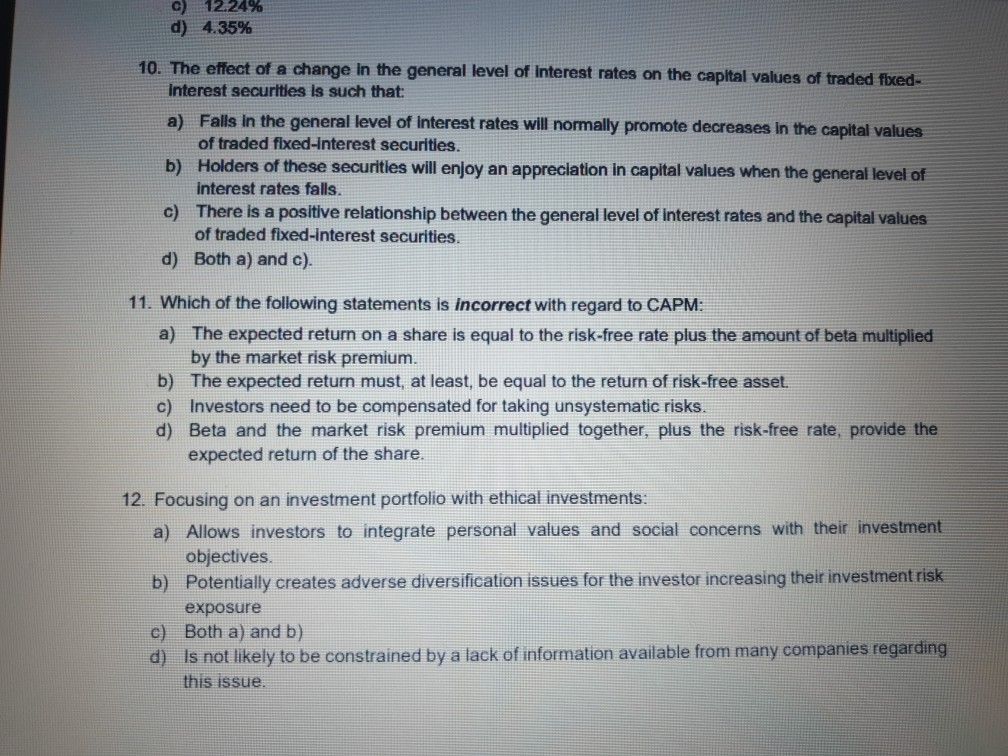

c) 12.24% d) 4.35% 10. The effect of a change in the general level of Interest rates on the capital values of traded fixed- Interest

c) 12.24% d) 4.35% 10. The effect of a change in the general level of Interest rates on the capital values of traded fixed- Interest securities is such that: a) Falls in the general level of Interest rates will normally promote decreases in the capital values of traded fixed-Interest securities. b) Holders of these securities will enjoy an appreciation in capital values when the general level of Interest rates falls. c) There is a positive relationship between the general level of interest rates and the capital values of traded fixed-interest securities. d) Both a) and c). 11. Which of the following statements is incorrect with regard to CAPM: a) The expected return on a share is equal to the risk-free rate plus the amount of beta multiplied by the market risk premium. b) The expected return must, at least, be equal to the return of risk-free asset. c) Investors need to be compensated for taking unsystematic risks. d) Beta and the market risk premium multiplied together, plus the risk-free rate, provide the expected return of the share. 12. Focusing on an investment portfolio with ethical investments: a) Allows investors to integrate personal values and social concerns with their investment objectives b) Potentially creates adverse diversification issues for the investor increasing their investment risk exposure c) Both a) and b) d) is not likely to be constrained by a lack of information available from many companies regarding this issue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started