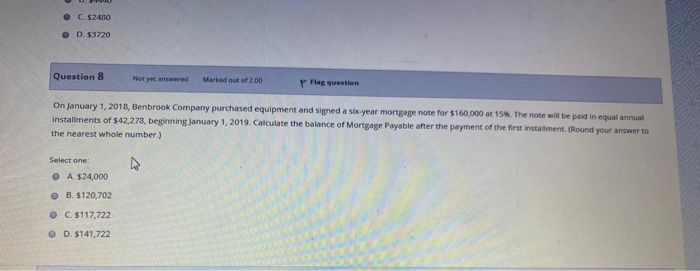

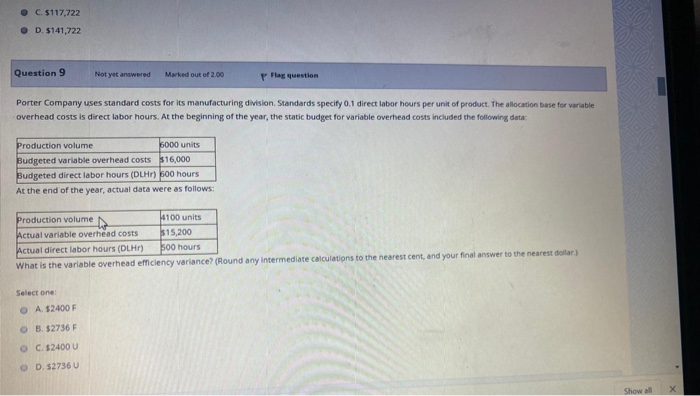

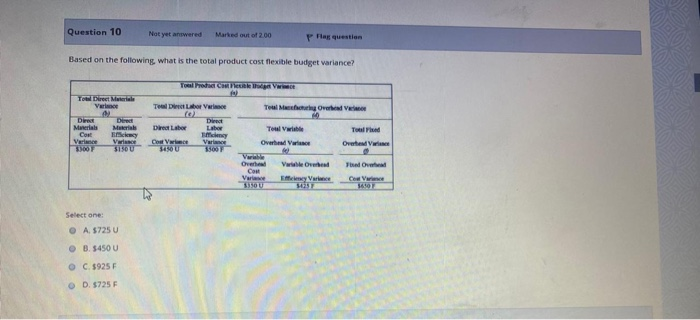

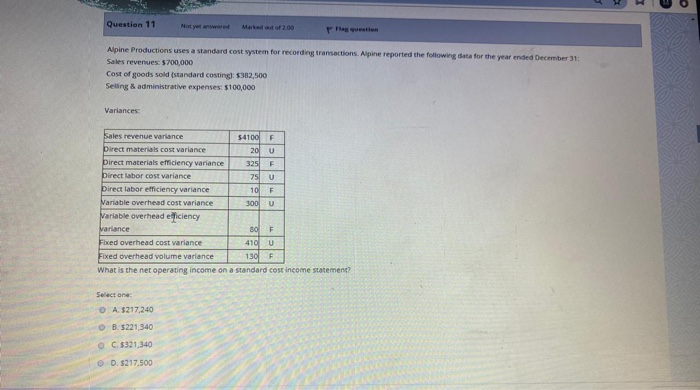

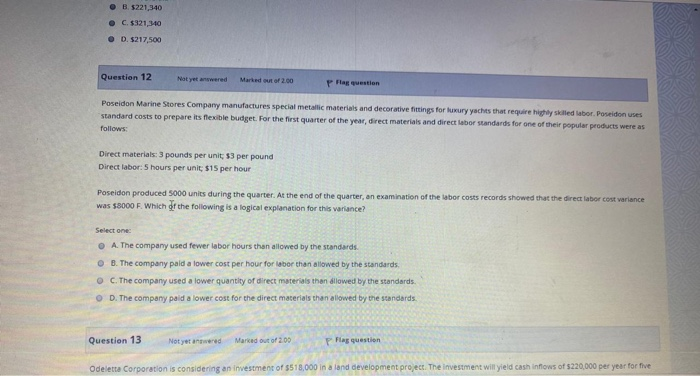

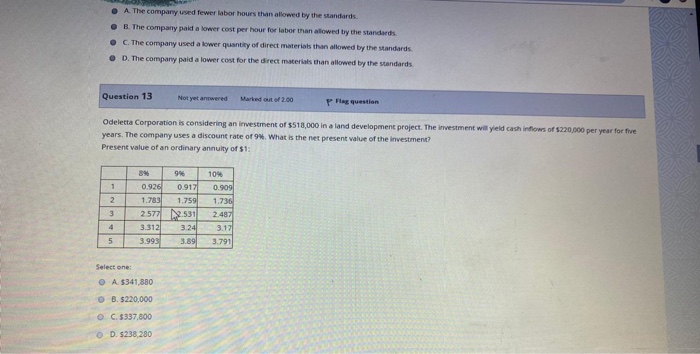

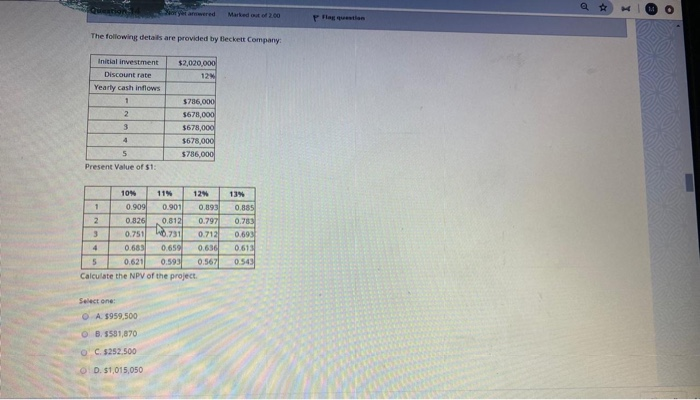

C. $2430 D. $3720 Question 8 Not yet answered Marked out of 2.00 P Flag question On January 1, 2018, Benbrook Company purchased equipment and signed a six-year mortgage note for $160,000 at 15%. The note will be paid in equal annual installments of $42,278, beginning January 1, 2019. Calculate the balance of Mortgage Payable after the payment of the first installment. (Round your answer to the nearest whole number) Select one: O A $24,000 B. $120,702 O C. $117,722 OD. $141,722 C. 5117,722 D. $141,722 Question 9 Not yet answered Marked out of 2.00 P Flag question Porter Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data Production volume 6000 units Budgeted variable overhead costs $16,000 Budgeted direct labor hours (DLHD) 600 hours At the end of the year, actual data were as follows: Production volume tho 4100 units Actual variable overhead costs 15,200 Actual direct labor hours (DLHO) soo hours What is the variable overhead efficiency variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dolar) Select one: A $2400 F B. $2736 F C. $2400 U D. $2736 Show all Question 10 Not yet answered Marted out of 200 Per question Based on the following what is the total product cost flexible budget variance? Toaleta To Dret Meral Ver To Di Vice Tu Meri Overhead Di Mukerials Die Labor Direct Labow Tuled De Materials Com Ver 3.300 Toulable Over Vare Verice 3150U Cow we 3450U Ver Overte Vw Valle Owl The Owl Overhead Com Vw Select one: O A 57250 B. $450U OC. $925 F D. 5725 F Question 11 Not yes wwered Marted of 200 Alpine Productions uses a standard cost system for recording transactions. Alpine reported the following data for the year ended December 31: Sales revenues $700,000 Cost of goods sold (standard costing: 382,500 Selling & administrative expenses: $100,000 Variances Sales revenue variance $4100 F Direct materials cost variance 20 U Direct materials efficiency variance 325 F Direct labor cost variance 75 U Direct labor efficiency variance 10 F Variable overhead cost variance 300 U Variable overhead efficiency Variance 80 F Fixed overhead cost variance 410U Fixed overhead volume variance 130 F What is the net operating income on a standard cost income statement? Select one A. $217,240 8.5221,340 O. C.5321,340 D. $217,500 B. $221,340 . C. $321,340 D. $217,500 Question 12 Not yet awered Marked out of 2.00 P Flag question Poseidon Marine Stores Company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor. Poseidon uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 3 pounds per unit: 33 per pound Direct labor: 5 hours per unit: $15 per hour Poseidon produced 5000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the direct labor cost variance was $8000 F Which of the following is a logical explanation for this variance? Select one O A. The company used fewer labor hours than allowed by the standards OB. The company paid a lower cost per hour for labor than allowed by the standards C. The company used a lower quantity of direct materials than allowed by the standards. O D. The company paid a lower cost for the direct materials than allowed by the standards. Question 13 Not yet answered Marked out of 200 P Flag question Odeletta Corporation is considering an investment of $518,000 in a land development project. The investment will yield cash inflows of $220,000 per year for five . A The company used fewer labor hours than allowed by the standards B. The company paid a lower cost per hour for labor than allowed by the standards . C. The company used a lower quantity of direct materials than allowed by the standards . D. The company paid a lower cost for the direct materials than allowed by the standards Question 13 Not yet awered Marked out of 2.00 P Flag question Odeletta Corporation is considering an investment of $518,000 in a land development project. The investment will yield cash inflows of $220.000 per year for five years. The company uses a discount rate of 9%. What is the net present value of the investment Present value of an ordinary annuity of 51: 10% 0.909 1 2 9% 0.926 0.917 1.783 1.759 2.57 18.531 3.312 3.993 3.89 1.736 2.487 3 4 3.24 3.17 3.791 5 Select one: O A. $341,880 OB. $220,000 C. 5337,800 O D. $238,280 @ ryetarwered Marked 200 Flax question The following details are provided by Beckett Company Initial investment $2,020,000 12 Discount rate Yearly cash inflows 1 2 3 $786,000 $678,000 $678,000 $678,000 5786,000 5 Present Value of $1: 10% 11% 12 1 0.909 0.901 0.393 2 0.826 0.812 0.797 3 0.751 731 0.712 4 0.689 0.650 0.636 5 0.621 0.593 0.567 Calculate the NPV of the project 13 0.885 0.789 0.693 0.6131 0.5431 Select one A. 5959,500 O 3.5581,870 C. 5252.500 OD. $1,015,050