Answered step by step

Verified Expert Solution

Question

1 Approved Answer

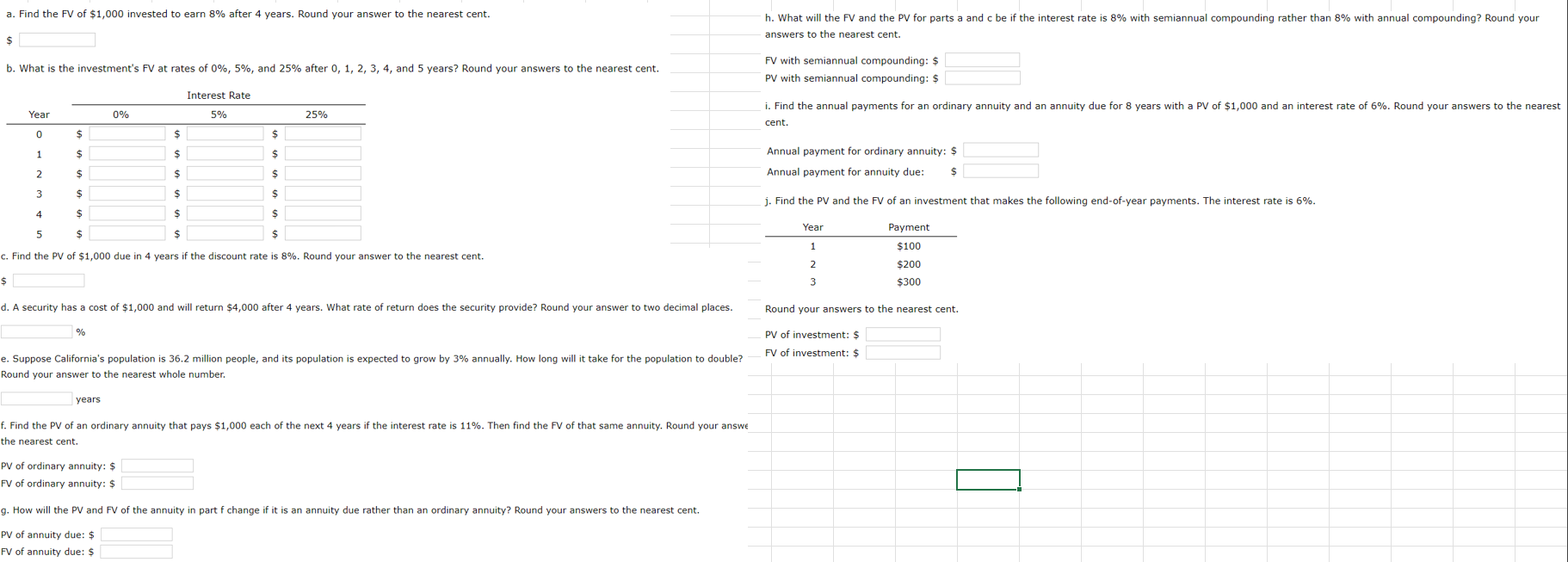

C 5 TIME VALUE * * * PLEASE ANSWER ACCORDING TO EVERYTHING THAT NEEDS TO BE ANSWERED / CORRECTED ON THE PICTURE TO GET A

C TIME VALUE PLEASE ANSWER ACCORDING TO EVERYTHING THAT NEEDS TO BE ANSWERED CORRECTED ON THE PICTURE TO GET A POSITIVE FEEDBACK a Find the FV of $ invested to earn after years. Round your answer to the nearest cent.

$

b What is the investment's FV at rates of and after and years? Round your answers to the nearest cent.

c Find the PV of $ due in years if the discount rate is Round your answer to the nearest cent.

d A security has a cost of $ and will return $ after years. What rate of return does the security provide? Round your answer to two decimal places.

e Suppose California's population is million people, and its population is expected to grow by annually. How long will it take for the population to double?

Round your answer to the nearest whole number.

years

f Find the PV of an ordinary annuity that pays $ each of the next years if the interest rate is Then find the FV of that same annuity. Round your answe

the nearest cent.

PV of ordinary annuity: $

FV of ordinary annuity: $

g How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent.

PV of annuity due: $

FV of annuity due: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started