Answered step by step

Verified Expert Solution

Question

1 Approved Answer

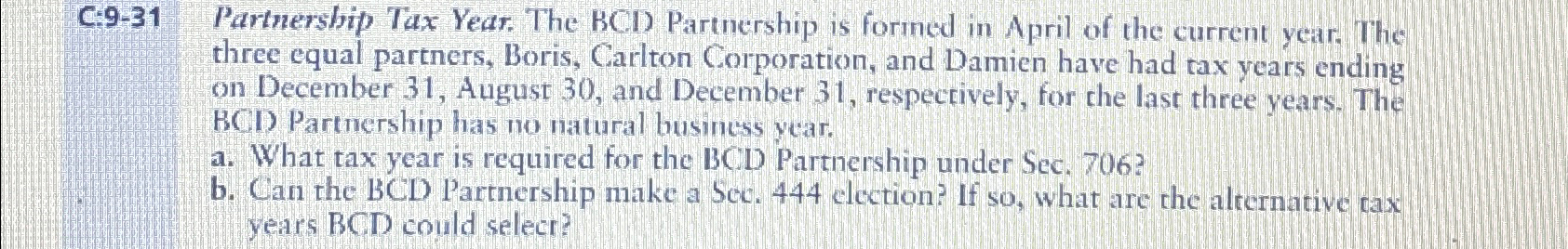

C 9 - 3 1 Partnership Tax Year. The BCI ) Partnership is formed in April of the current year. The three equal partners, Boris,

C Partnership Tax Year. The BCI Partnership is formed in April of the current year. The three equal partners, Boris, Carlton Corporation, and Damien have had tax years ending on December August and December respectively, for the last three years. The BCD Partnership has no natural business year.

a What tax year is required for the BCD Partnership under Sec.

b Can the BCD Partnership make a Sec. election? If so what are the alternative cax years BCD could selecr?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started