Answered step by step

Verified Expert Solution

Question

1 Approved Answer

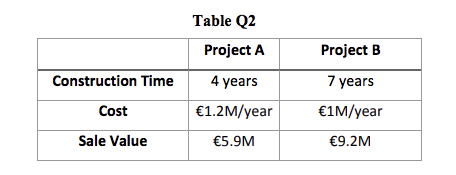

(c) A company is presented with two possible projects as shown in Table Q2 overpage: Assume costs are incurred at the end of each year.

(c) A company is presented with two possible projects as shown in Table Q2 overpage:

Assume costs are incurred at the end of each year. Which project is more attractive using the following methods? i) Net present value at 5% discount rate ii) Net present value at 10% discount rate Your companys weighted cost of capital is currently 6%. If you could select just one of the above projects, which would you choose and why? Would you reject both? How would the level of risk in the project affect your thinking about the discount rate? [10]

Table Q2 Project A 4 years 1.2M/year Construction Time Project B 7 years 1M/year Cost Sale Value 5.9M 9.2MStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started