Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C . A modest management fee plus substantial incentives or performance fees under which the management takes about 2 0 % of the fund's dividend

C A modest management fee plus substantial incentives or performance fees under which

the management takes about of the fund's dividend incomes

D A modest management fee plus substantial incentives or performance fees under which

the management takes about of the capital gains when the client sells their shares

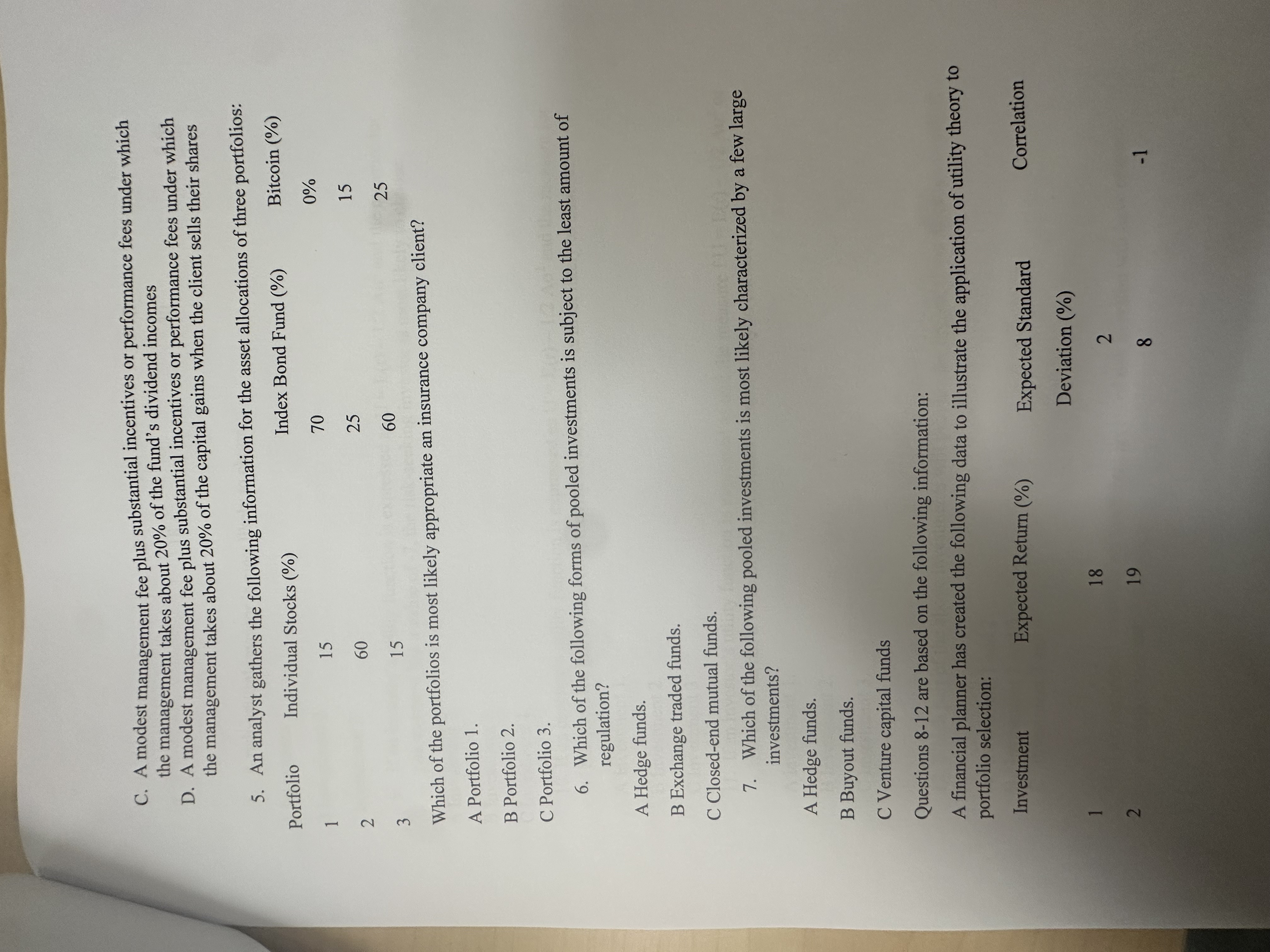

An analyst gathers the following information for the asset allocations of three portfolios:

Which of the portfolios is most likely appropriate an insurance company client?

A Portfolio

B Portfolio

C Portfolio

Which of the following forms of pooled investments is subject to the least amount of

regulation?

A Hedge funds.

B Exchange traded funds.

C Closedend mutual funds.

Which of the following pooled investments is most likely characterized by a few large

investments?

A Hedge funds.

B Buyout funds.

C Venture capital funds

Questions are based on the following information:

A financial planner has created the following data to illustrate the application of utility theory to

portfolio selection:

Investment

Expected Return

Expected Standard

Deviation

Deviation

Correlation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started