Answered step by step

Verified Expert Solution

Question

1 Approved Answer

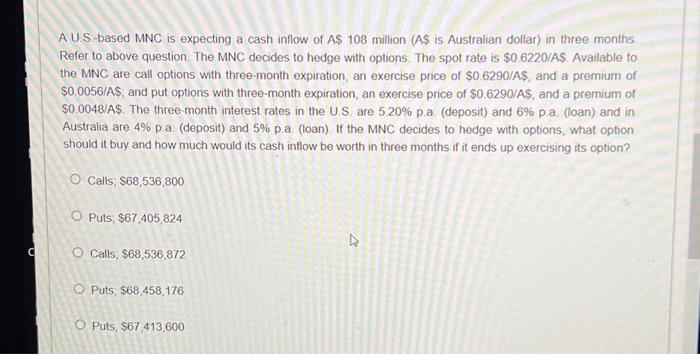

C A U.S.-based MNC is expecting a cash inflow of A$ 108 million (A$ is Australian dollar) in three months. Refer to above question. The

C A U.S.-based MNC is expecting a cash inflow of A$ 108 million (A$ is Australian dollar) in three months. Refer to above question. The MNC decides to hedge with options. The spot rate is $0.6220/A$. Available to the MNC are call options with three-month expiration, an exercise price of $0.6290/A$, and a premium of $0.0056/A$; and put options with three-month expiration, an exercise price of $0.6290/A$, and a premium of $0.0048/A$. The three-month interest rates in the U.S. are 5.20% p.a. (deposit) and 6% p.a. (loan) and in Australia are 4% p.a. (deposit) and 5% p.a. (loan). If the MNC decides to hedge with options, what option should it buy and how much would its cash inflow be worth in three months if it ends up exercising its option? O Calls; $68,536,800 O Puts; $67,405,824 O Calls, $68,536,872 O Puts, $68,458,176 O Puts, $67,413,600 K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started