Answered step by step

Verified Expert Solution

Question

1 Approved Answer

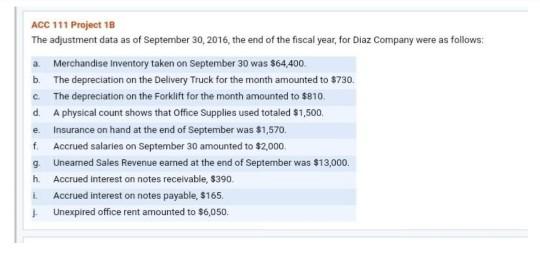

c ACC 111 Project 18 The adjustment data as of September 30, 2016, the end of the fiscal year, for Diaz Company were as follows:

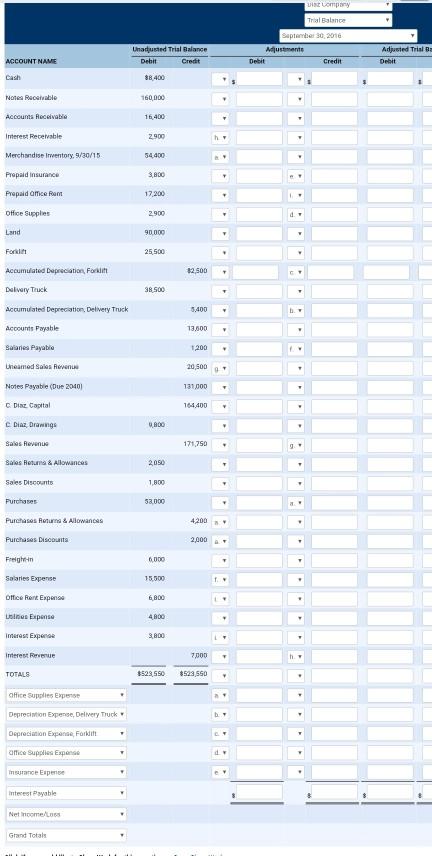

c ACC 111 Project 18 The adjustment data as of September 30, 2016, the end of the fiscal year, for Diaz Company were as follows: a. Merchandise Inventory taken on September 30 was $64,400 b. The depreciation on the Delivery Truck for the month amounted to $730 The depreciation on the Forklift for the month amounted to $810 d. A physical count shows that Office Supplies used totaled $1,500, Insurance on hand at the end of September was $1,570 Accrued salaries on September 30 amounted to $2,000 g Uneamed Sales Revenue earned at the end of September was $13,000. Accrued interest on notes receivable, $390 Accrued interest on notes payable, $165. Unexpired office rent amounted to $6,050 e. f h c ACC 111 Project 18 The adjustment data as of September 30, 2016, the end of the fiscal year, for Diaz Company were as follows: a. Merchandise Inventory taken on September 30 was $64,400 b. The depreciation on the Delivery Truck for the month amounted to $730 The depreciation on the Forklift for the month amounted to $810 d. A physical count shows that Office Supplies used totaled $1,500, Insurance on hand at the end of September was $1,570 Accrued salaries on September 30 amounted to $2,000 g Uneamed Sales Revenue earned at the end of September was $13,000. Accrued interest on notes receivable, $390 Accrued interest on notes payable, $165. Unexpired office rent amounted to $6,050 e. f h Uit Lompany Trial Balance September 30, 2016 Mjustments Debit Credit Unarunted Trial Balance Debit Credit Adjusted Trial Debit ACCOUNT NAME 88.400 Not Receivable 160,000 Accounts Receivable 16400 Imerest Receivable 2900 Merchandise Inventory, 9/30/15 54400 Prepaid Insurance 3800 Prepaid Omce Rent 17.200 Office Supplies 2.900 Land 90 000 Ford 25,500 82.500 Accumulated Depreciation Form Dalvary Truck 38.500 Accumulated Depreciation Delivery truck 5,400 Accounts Payable 13,600 Baiaries Payable 1,200 Uneamed Sales Revenue 20,500 Notes Payable (Due 2040 131000 C Die Capital 164,400 Diaz Drawings 800 Sales Revenue 171.750 Sales Returns & Allowances 2050 Sales Discounts 1,800 33.000 Purchases Purchases Rerum & Allowances 4200 Purchases Discount 2.000 Freight 6.000 Salaries Expense 15.000 Office Rent Espen 6,800 Unes Expense 4.800 Interest Expense 3.800 Imeres forvenue 7,000 TOTALS $529,550 8523 550 Office Supplies Expense Deprecision Expense, Delivery Truck Depreciation Expense, Fordi amice Supplies Expo insurance Experie Interest Payable Netcomes Grand Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started