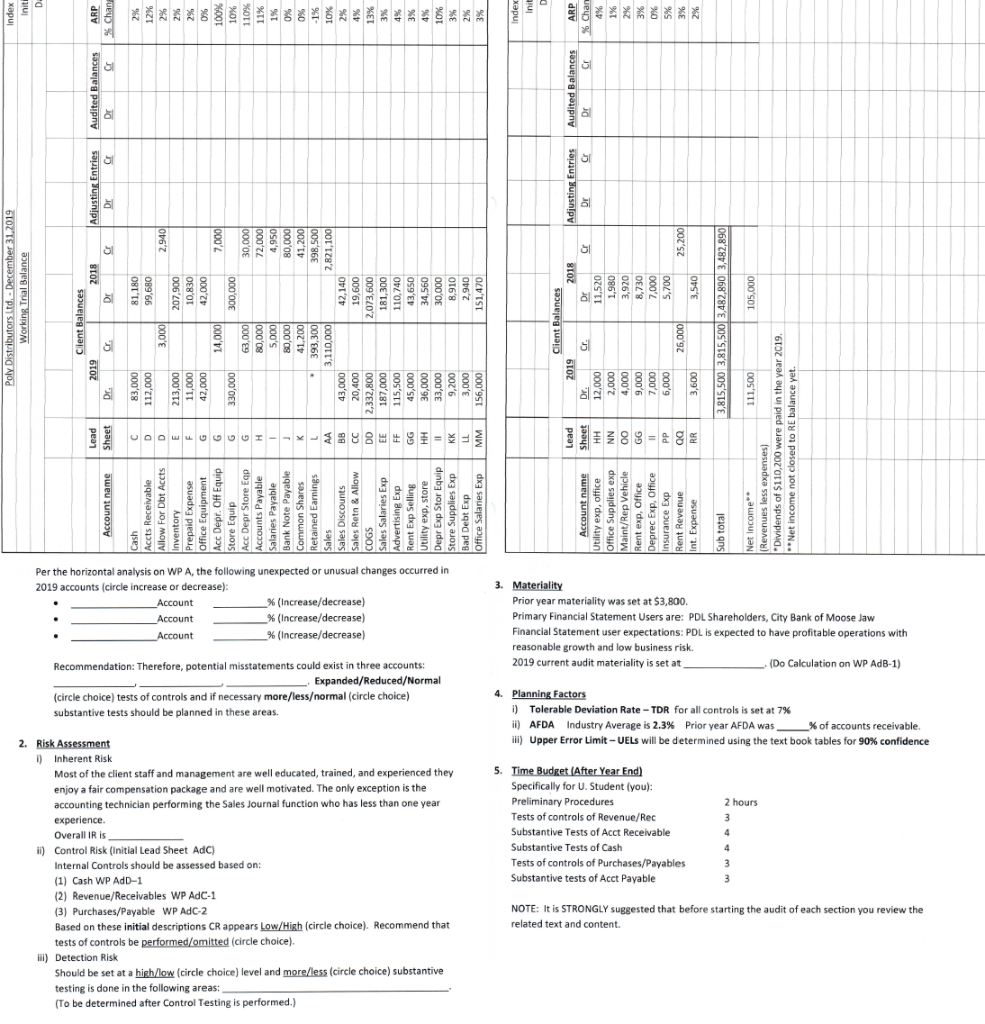

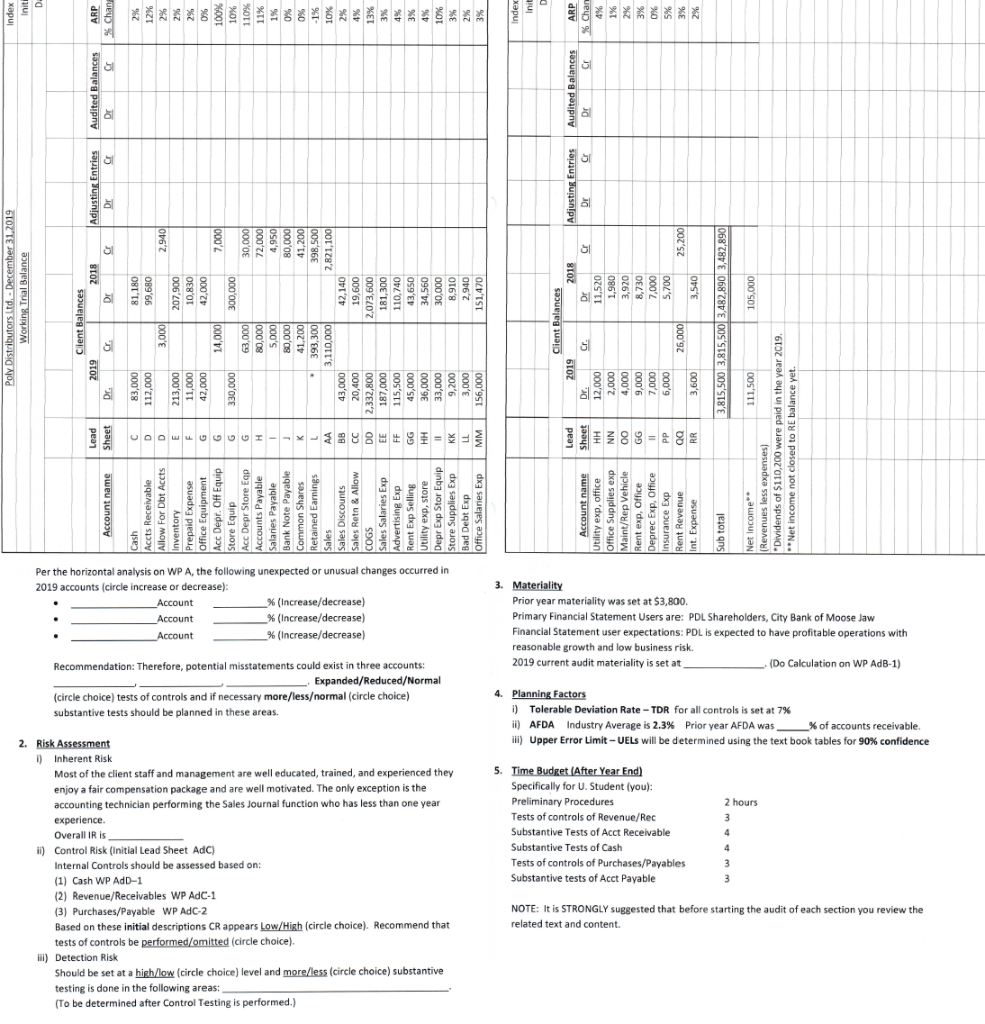

c Adjusting Entries Audited Balances Chan DEC Adjusting Entries Drar 2,940 Topo loss 398,500 2,821,100 25,200 ON 81 Poly Distributors Ltd. - December 31,2019 Working Trial Balance 81,180 99,680 006'CO2 operti 300,000 2018 11.52 1,980 Client Balances 3,000 sausjeg tudja 6102 SI 6TOZ 213.000 2. power 000's 000'05 130,000 de 105,000 3,815,500 3,815,500 3,482,890 3,482,890 111,500 Dividends of $110,200 were paid in the year 2019. **Net income not closed to RE balance yet. Sub total Net Income Sheet UwUUUUUI Utility exp, store Depr Exp Stor Equip Store Supplies Exp Bad Debt Exp Office Salaries ExpI Account name Utility exp, office Office Supplies exp Maint/Rep vehicle Deprec Exp. Office Insurance Exp Rent Revenue at. Expense Revenues less expenses) Sales Per the horizontal analysis on WPA, the following unexpected or unusual changes occurred in 2019 accounts (circle increase or decrease): ) _Account _% (Increase/decrease) Account % (Increase/decrease) Account % (Increase/decrease) 3. Materiality Prior year materiality was set at $3,800. Primary Financial Statement Users are: PDL Shareholders, City Bank of Moose Jaw , Financial Statement user expectations: PDL is expected to have profitable operations with reasonable growth and low business risk. 2019 current audit materiality is set at - (Do Calculation on WP AdB-1) Recommendation: Therefore, potential misstatements could exist in three accounts: Expanded/Reduced/Normal (circle choice) tests of controls and if necessary more/lessormal (circle choice) substantive tests should be planned in these areas. 4. Planning Factors i) Tolerable Deviation Rate - TDR for all controls is set at 7% ii) AFDA Industry Average is 2.3% Prior year AFDA was __% of accounts receivable III) Upper Error Limit - UELs will be determined using the text book tables for 90% confidence % 2 hours 3 5. Time Budget (After Year End) Specifically for U. Student (you): Preliminary Procedures Tests of controls of Revenue/Rec Substantive Tests of Acct Receivable Substantive Tests of Cash Tests of controls of Purchases/Payables Substantive tests of Acct Payable 4 4 4 2. Risk Assessment 1) Inherent Risk Most of the client staff and management are well educated, trained, and experienced they enjoy a fair compensation package and are well motivated. The only exception is the accounting technician performing the Sales Journal function who has less than one year experience. Overall IRIS ii) Control Risk (Initial Lead Sheet AdC) Internal Controls should be assessed based on: (1) Cash WP ADD-1 (2) Revenue/Receivables WP AdC-1 (3) Purchases/Payable WP AC-2 Based on these initial descriptions CR appears Low/High (circle choice). Recommend that tests of controls be performed/omitted (circle choice). I) Detection Risk Should be set at a high/low (circle choice) level and more/less (circle choice) substantive testing is done in the following areas: (To be determined after Control Testing is performed.) .) 3 NOTE: It is STRONGLY suggested that before starting the audit of each section you review the related text and content. c Adjusting Entries Audited Balances Chan DEC Adjusting Entries Drar 2,940 Topo loss 398,500 2,821,100 25,200 ON 81 Poly Distributors Ltd. - December 31,2019 Working Trial Balance 81,180 99,680 006'CO2 operti 300,000 2018 11.52 1,980 Client Balances 3,000 sausjeg tudja 6102 SI 6TOZ 213.000 2. power 000's 000'05 130,000 de 105,000 3,815,500 3,815,500 3,482,890 3,482,890 111,500 Dividends of $110,200 were paid in the year 2019. **Net income not closed to RE balance yet. Sub total Net Income Sheet UwUUUUUI Utility exp, store Depr Exp Stor Equip Store Supplies Exp Bad Debt Exp Office Salaries ExpI Account name Utility exp, office Office Supplies exp Maint/Rep vehicle Deprec Exp. Office Insurance Exp Rent Revenue at. Expense Revenues less expenses) Sales Per the horizontal analysis on WPA, the following unexpected or unusual changes occurred in 2019 accounts (circle increase or decrease): ) _Account _% (Increase/decrease) Account % (Increase/decrease) Account % (Increase/decrease) 3. Materiality Prior year materiality was set at $3,800. Primary Financial Statement Users are: PDL Shareholders, City Bank of Moose Jaw , Financial Statement user expectations: PDL is expected to have profitable operations with reasonable growth and low business risk. 2019 current audit materiality is set at - (Do Calculation on WP AdB-1) Recommendation: Therefore, potential misstatements could exist in three accounts: Expanded/Reduced/Normal (circle choice) tests of controls and if necessary more/lessormal (circle choice) substantive tests should be planned in these areas. 4. Planning Factors i) Tolerable Deviation Rate - TDR for all controls is set at 7% ii) AFDA Industry Average is 2.3% Prior year AFDA was __% of accounts receivable III) Upper Error Limit - UELs will be determined using the text book tables for 90% confidence % 2 hours 3 5. Time Budget (After Year End) Specifically for U. Student (you): Preliminary Procedures Tests of controls of Revenue/Rec Substantive Tests of Acct Receivable Substantive Tests of Cash Tests of controls of Purchases/Payables Substantive tests of Acct Payable 4 4 4 2. Risk Assessment 1) Inherent Risk Most of the client staff and management are well educated, trained, and experienced they enjoy a fair compensation package and are well motivated. The only exception is the accounting technician performing the Sales Journal function who has less than one year experience. Overall IRIS ii) Control Risk (Initial Lead Sheet AdC) Internal Controls should be assessed based on: (1) Cash WP ADD-1 (2) Revenue/Receivables WP AdC-1 (3) Purchases/Payable WP AC-2 Based on these initial descriptions CR appears Low/High (circle choice). Recommend that tests of controls be performed/omitted (circle choice). I) Detection Risk Should be set at a high/low (circle choice) level and more/less (circle choice) substantive testing is done in the following areas: (To be determined after Control Testing is performed.) .) 3 NOTE: It is STRONGLY suggested that before starting the audit of each section you review the related text and content