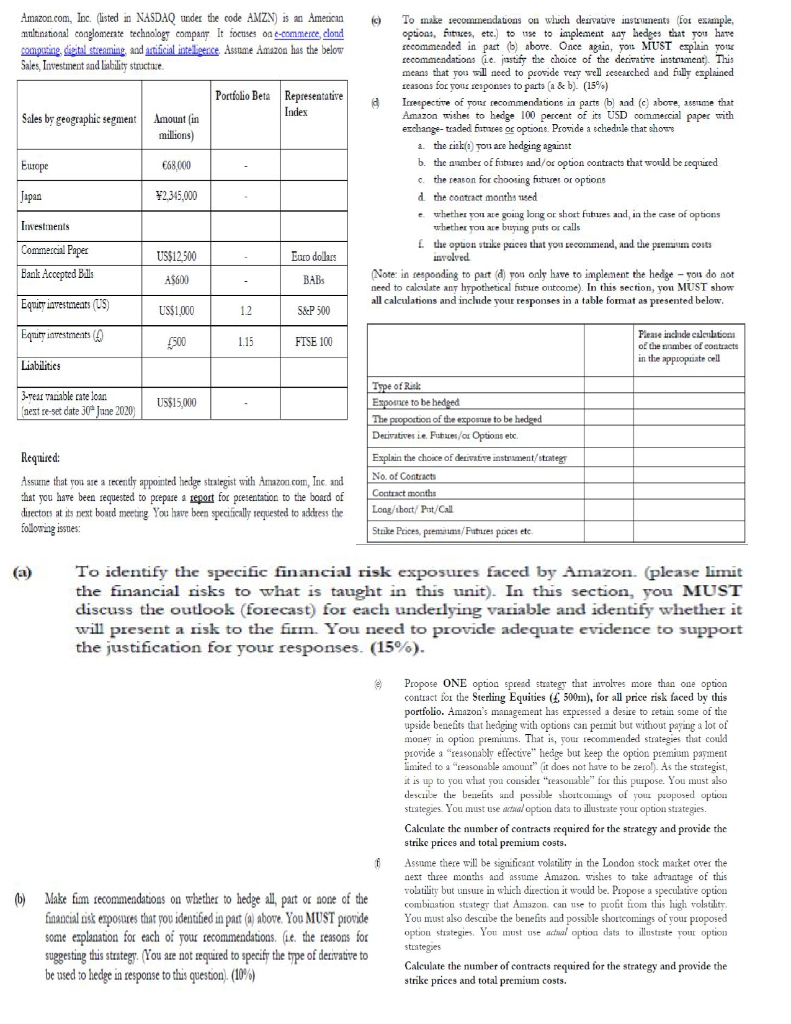

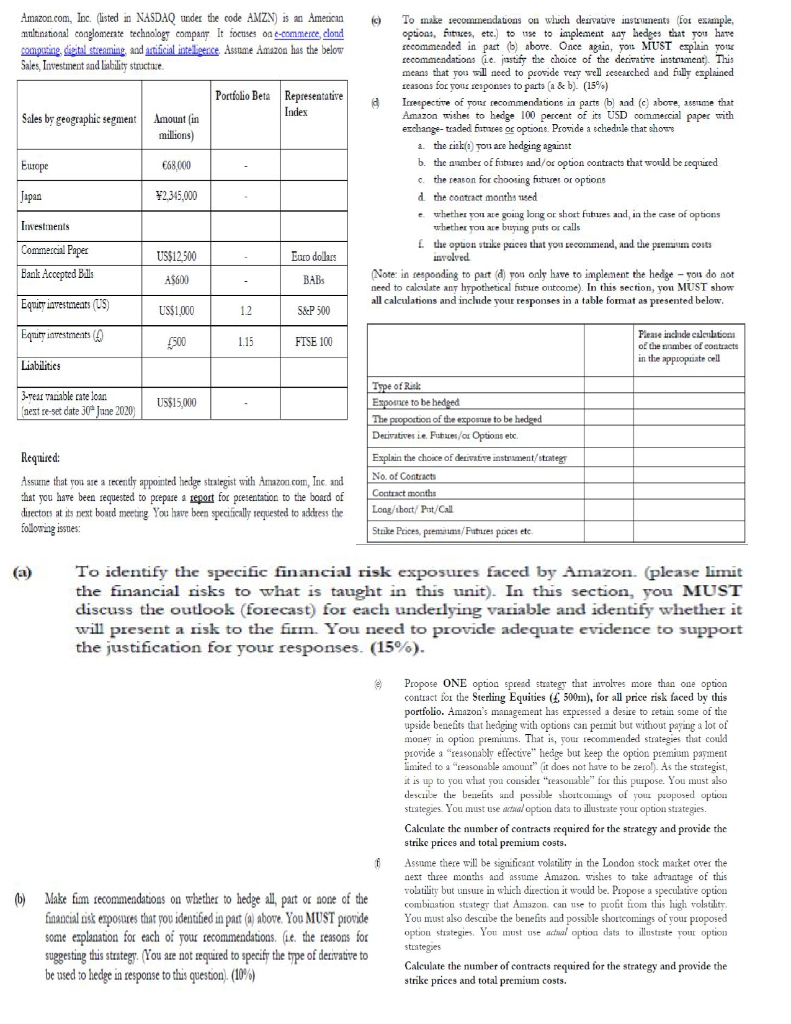

(c) Amazon.com, Inc. (listed in NASDAQ under the code AMZN) is an American multinational conglomerate technology company. It focuses on e-commerce, clond computing digital streaming and artificial intelligence Assume Amazon has the below Sales, Investment and lability stractice Portfolio Beta Representative Index Sales by geographic segment Amount (in millions) To make recommendations on which desvative instruments (for example, options, fitnes, etc.) to to implement any hedges that you have cecommended in part ) above. Once again, you MUST explain you Lecommendations (ie. jiastify the choice of the derivative instrument). This means that you will need to provide rey well researched and fully explained Leasons for your sesponses to parts (a & b]. (15%) Irrespective of your recommendations in parte (b) and above, as me that Amazon wishes to hedge 100 percent of its USD commercial paper with exchange-traded States or optione. Provide a schedule that shows 2. the risk(t) you are hedging against b. the aumber of fitues and/or option contracts that would be required c. the reason for choosing futures or options d. the contract months wed e whether you are going long or short fistures and in the case of options whether you are buying prits or calls 1. the option strike puces that you recommend, and the premium costs Europe 68.000 Japan 12.345.000 Investments Commercial Paper Bank Accepted Balls Euro dollars US$12.500 A$600 involved BABS (Note: in responding to part (d) you only have to implement the hedge - you do not need to calculate any hypothetical face outcome). In this section, you MUST show all calculations and include your responses in a table format as presented below. Equity investmeats (US) US$1,000 12 S&P 500 Equity investments $500 1.15 FTSE 100 Please inchide calculations of the member of contracts in the appropriate cell Liabilities 3-Test vanable cate loan next re-set date 30 June 2020) US$15,000 Type of Rick Esposice to be hedged The proportion of the expome to be hedged Derivatives Le Foced/or Options etc Explain the choice of desitie instrument/states No. of Contracts Contract months Long/thort/ Pat/Call Required: Assume that you are a recently appointed hedge strategist with Amazon.com, Inc. and that you have been requested to prepare a report for presentation to the board of directors at its next board meeting You have been specifically requested to aktress the following issues: Strike Prices, poemi / Faties prices etc To identify the specific financial risk exposures faced by Amazon. please limit the financial risks to what is taught in this unit). In this section, you MUST discuss the outlook (forecast) for each underlying variable and identify whether it will present a risk to the firm. You need to provide adequate evidence to support the justification for your responses. (15%). Propose ONE option spread strategy that involves more than one option contact for the Sterling Equities (4500m), for all price risk faced by this portfolio. Amazon's management has expressed a desire to retain some of the upside benefits that lediging with options can permit but without paying a lot of money in option premiums. That is, your recommended strategies that could provide a "reasonably effective hedge but keep the option premium payment Limited to a reasonable amount" (it does not have to be zerol) As the strategist, it is up to you what you consider "reasonable" for this purpose. You must also describe the benefits and possibile sloutcomings of your proposed option strategies. You must use actual option data to illustrate your option strategies. Calculate the number of contracts required for the strategy and provide the strike prices and total premium costs. Assume there will be significant volatility in the London stock market over the next three months and assume Amazon Wishes to take advantage of this volatility but unsure in which direction it would be. Propose a speculative option combination strategy thuat Amazon can use to profit from this high volatility You must also describe the benefits and possible shortcomings of your proposed option strategies. You must use actual option data to illustrate your option strategies Calculate the number of contracts required for the strategy and provide the strike prices and total premium costs. 6) Make fim recommendations on whether to hedge all, part of none of the financial tisk exposuces that you identified in pact () above. You MUST provide some explanation for each of your recommendations. (.e. the reasons for suggesting this strategy. (You are not required to specify the type of derivative to be used to hedge in response to this question) (10%) (c) Amazon.com, Inc. (listed in NASDAQ under the code AMZN) is an American multinational conglomerate technology company. It focuses on e-commerce, clond computing digital streaming and artificial intelligence Assume Amazon has the below Sales, Investment and lability stractice Portfolio Beta Representative Index Sales by geographic segment Amount (in millions) To make recommendations on which desvative instruments (for example, options, fitnes, etc.) to to implement any hedges that you have cecommended in part ) above. Once again, you MUST explain you Lecommendations (ie. jiastify the choice of the derivative instrument). This means that you will need to provide rey well researched and fully explained Leasons for your sesponses to parts (a & b]. (15%) Irrespective of your recommendations in parte (b) and above, as me that Amazon wishes to hedge 100 percent of its USD commercial paper with exchange-traded States or optione. Provide a schedule that shows 2. the risk(t) you are hedging against b. the aumber of fitues and/or option contracts that would be required c. the reason for choosing futures or options d. the contract months wed e whether you are going long or short fistures and in the case of options whether you are buying prits or calls 1. the option strike puces that you recommend, and the premium costs Europe 68.000 Japan 12.345.000 Investments Commercial Paper Bank Accepted Balls Euro dollars US$12.500 A$600 involved BABS (Note: in responding to part (d) you only have to implement the hedge - you do not need to calculate any hypothetical face outcome). In this section, you MUST show all calculations and include your responses in a table format as presented below. Equity investmeats (US) US$1,000 12 S&P 500 Equity investments $500 1.15 FTSE 100 Please inchide calculations of the member of contracts in the appropriate cell Liabilities 3-Test vanable cate loan next re-set date 30 June 2020) US$15,000 Type of Rick Esposice to be hedged The proportion of the expome to be hedged Derivatives Le Foced/or Options etc Explain the choice of desitie instrument/states No. of Contracts Contract months Long/thort/ Pat/Call Required: Assume that you are a recently appointed hedge strategist with Amazon.com, Inc. and that you have been requested to prepare a report for presentation to the board of directors at its next board meeting You have been specifically requested to aktress the following issues: Strike Prices, poemi / Faties prices etc To identify the specific financial risk exposures faced by Amazon. please limit the financial risks to what is taught in this unit). In this section, you MUST discuss the outlook (forecast) for each underlying variable and identify whether it will present a risk to the firm. You need to provide adequate evidence to support the justification for your responses. (15%). Propose ONE option spread strategy that involves more than one option contact for the Sterling Equities (4500m), for all price risk faced by this portfolio. Amazon's management has expressed a desire to retain some of the upside benefits that lediging with options can permit but without paying a lot of money in option premiums. That is, your recommended strategies that could provide a "reasonably effective hedge but keep the option premium payment Limited to a reasonable amount" (it does not have to be zerol) As the strategist, it is up to you what you consider "reasonable" for this purpose. You must also describe the benefits and possibile sloutcomings of your proposed option strategies. You must use actual option data to illustrate your option strategies. Calculate the number of contracts required for the strategy and provide the strike prices and total premium costs. Assume there will be significant volatility in the London stock market over the next three months and assume Amazon Wishes to take advantage of this volatility but unsure in which direction it would be. Propose a speculative option combination strategy thuat Amazon can use to profit from this high volatility You must also describe the benefits and possible shortcomings of your proposed option strategies. You must use actual option data to illustrate your option strategies Calculate the number of contracts required for the strategy and provide the strike prices and total premium costs. 6) Make fim recommendations on whether to hedge all, part of none of the financial tisk exposuces that you identified in pact () above. You MUST provide some explanation for each of your recommendations. (.e. the reasons for suggesting this strategy. (You are not required to specify the type of derivative to be used to hedge in response to this question) (10%)