Question

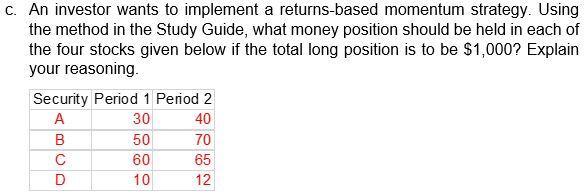

c. An investor wants to implement a returns-based momentum strategy. Using the method in the Study Guide, what money position should be held in

c. An investor wants to implement a returns-based momentum strategy. Using the method in the Study Guide, what money position should be held in each of the four stocks given below if the total long position is to be $1,000? Explain your reasoning. Security Period 1 Period 2 A 30 40 70 65 12 B C D 50 60 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To implement a returnsbased momentum strategy we allocate funds to stocks based on their rela...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Management Science Quantitative Approaches To Decision Making

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam

13th Edition

9781111532246, 1111532222, 1111532249, 978-1111532222

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App