Answered step by step

Verified Expert Solution

Question

1 Approved Answer

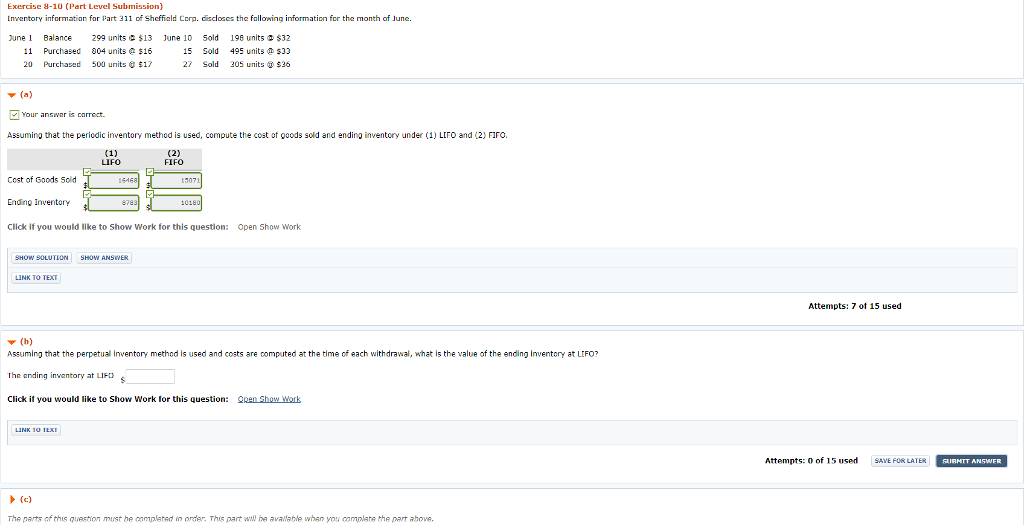

C) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if

C) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if the inventory is valued at? $____________

Need help with (b) and (c)!

Exercise 9-10 (Part Level Submission) Inventory information for Part 311 of Shcffield Corp. discloacs the fallowing information for the month of June. June 1 Balance 299 units $13 June 10 501d 198 units $32 11 Purchased 304 units$16 20 Purchased 500 uriits $1 15 sold 495 units@3 27 Sold 205 units$36 (a) Your answar is correct. Assuming that the periedic inventory methed is used, compute the cost ot goods sold and ending inventory under (1) LIFO and (2) FIFO LIFO FIFO Cost of Goods Sold Ending Inventory Click if you would like to Show Work for this question: Open Show Work SOLUTION SHOW ANSIWER Attempts: 7 ot 15 used (h) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the ending inventory at LIFO? The anding inventory at LIFO Click if you would like to Show Work for this question: Attempts: of 15 used SAVE FOR LATER The parts of this question must be completed in order. This part ww ba avalable whan you complete the part ahoveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started