Question

(c) At expiration, HSBC stock price goes up to $60, what will you do? Explain. (2 marks) Calculate the profits you can make if you

(c) At expiration, HSBC stock price goes up to $60, what will you do? Explain. (2 marks) Calculate the profits you can make if you act according to (b). (2 marks)

(d) If you think that HSBC stock price will move in narrow price range around $50 in coming 3 months, what will you do? Explain. (2 marks) Calculate the maximum profit you can make if your expectation is correct. (2 marks)

(e) A 6-month all option on TZB with an exercise price of $65 is selling at $1.30. A 6-month put option on TZB with an exercise price of $65 is selling at $0.80. If the risk-free rate is 2% per year, calculate the TZB stock price. (4 marks)

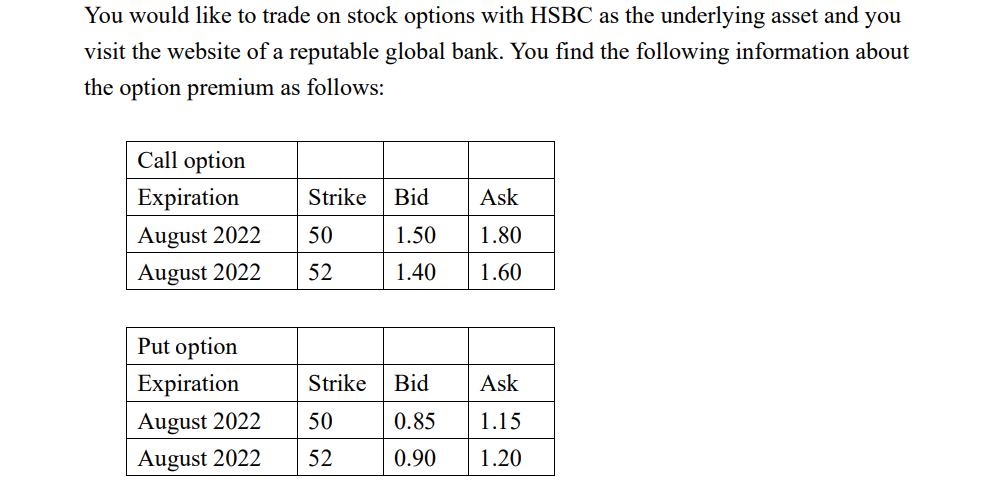

You would like to trade on stock options with HSBC as the underlying asset and you visit the website of a reputable global bank. You find the following information about the option premium as follows: Strike Bid Ask Call option Expiration August 2022 August 2022 50 1.50 1.80 52 1.40 1.60 Strike Bid Ask Put option Expiration August 2022 August 2022 50 0.85 1.15 52 0.90 1.20 You would like to trade on stock options with HSBC as the underlying asset and you visit the website of a reputable global bank. You find the following information about the option premium as follows: Strike Bid Ask Call option Expiration August 2022 August 2022 50 1.50 1.80 52 1.40 1.60 Strike Bid Ask Put option Expiration August 2022 August 2022 50 0.85 1.15 52 0.90 1.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started