Answered step by step

Verified Expert Solution

Question

1 Approved Answer

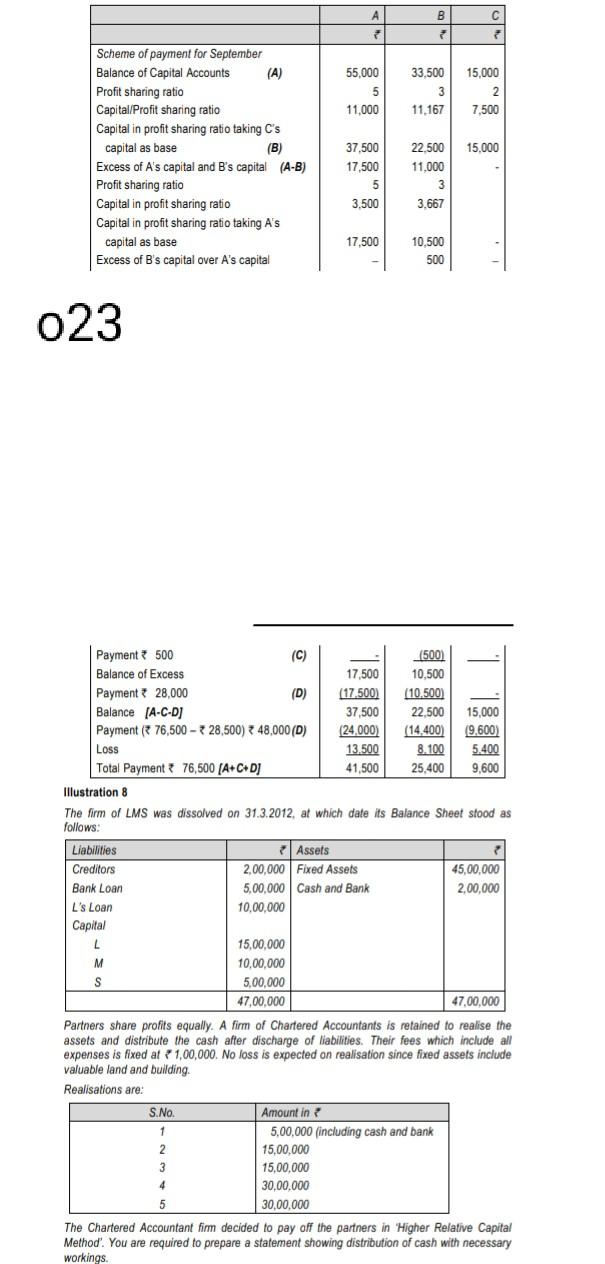

C B 7 55,000 5 11,000 33.500 3 11.167 15,000 2 7.500 15,000 Scheme of payment for September Balance of Capital Accounts (A) Profit sharing

C B 7 55,000 5 11,000 33.500 3 11.167 15,000 2 7.500 15,000 Scheme of payment for September Balance of Capital Accounts (A) Profit sharing ratio Capital/Profit sharing ratio Capital in profit sharing ratio taking C's capital as base (B) Excess of A's capital and B's capital (A-B) Profit sharing ratio Capital in profit sharing ratio Capital in profit sharing ratio taking A's capital as base Excess of B's capital over A's capital 37,500 17,500 5 3.500 22.500 11.000 3 3.667 17,500 10.500 500 023 Payment 500 (C) (500) Balance of Excess 17,500 10,500 Payment 28,000 (D) (17.500) (10.500) Balance (A-C-DJ 37,500 22,500 15,000 Payment ( 76,500 - 28,500) 48,000(D) (24,000) (14,400) 9.600) Loss 13,500 8.100 5.400 Total Payment 76,500 (A+C+D] 41,500 25,400 9,600 Illustration 8 The firm of LMS was dissolved on 31.3.2012, at which date its Balance Sheet stood as follows: Liabilities Assets Creditors 2,00,000 Fixed Assets 45,00,000 Bank Loan 5,00,000 Cash and Bank 2,00,000 L's Loan 10.00.000 Capital 15,00,000 M 10,00,000 S 5,00,000 47,00.000 47,00,000 Partners share profits equally. A firm of Chartered Accountants is retained to realise the assets and distribute the cash after discharge of liabilities. Their fees which include all expenses is fixed at 1,00,000. No loss is expected on realisation since fixed assets include valuable land and building. Realisations are: S.No. Amount in 1 5,00.000 (including cash and bank 2 15,00.000 3 15,00.000 4 30,00.000 5 30,00.000 The Chartered Accountant firm decided to pay off the partners in Higher Relative Capital Method'. You are required to prepare a statement showing distribution of cash with necessary workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started